Insight Focus

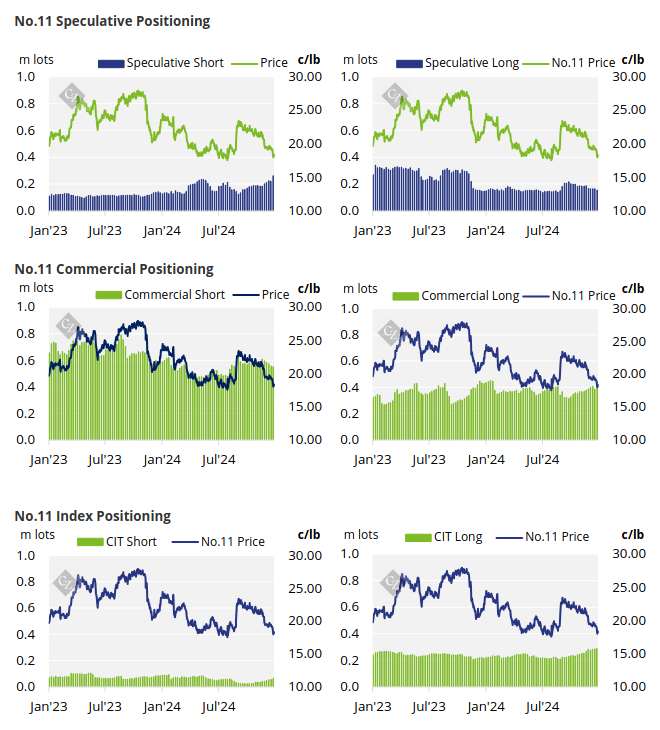

Raw sugar futures traded below 19c/lb over the past week. End-users took advantage of the lower prices. Speculators have added to their shorts heavily.

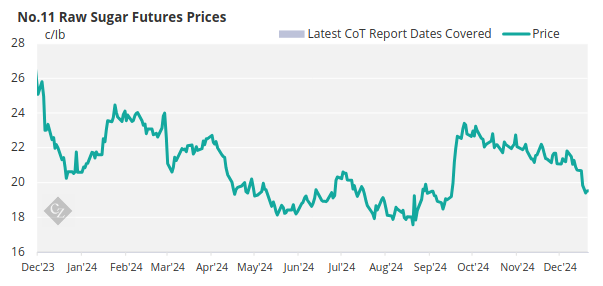

New York No.11 Raw Sugar Futures

Raw sugar futures traded between 18-18.9c/lb over the past week.

End-users have clearly benefitted from the further price drop as they added 41.2k lots of long positions. This is the first time prices have hit 18c/lb since September. By contrast, producers have closed out just under 6.5k lots of short positions.

No.11 Commitment of Traders Report (14 January 2025)

| Commercial | Speculative | Index | ||||

|---|---|---|---|---|---|---|

|

Position |

Change | Position | Change | Position | Change | |

| Long |

430,557 |

41,209 |

156,098 |

-9,144 |

291,329 |

5,286 |

| Short |

551,777 |

-6,450 |

262,143 |

37,861 |

64,064 |

5,940 |

| Net |

-121,220 |

47,659 |

-106,045 |

-47,005 |

227,265 |

-654 |

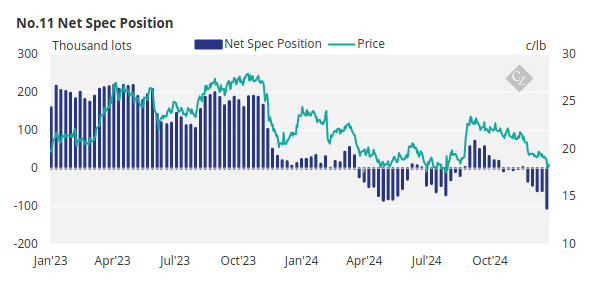

After weeks of minimal interest from speculators, they have opened a significant number of short positions, adding 37.9k lots of shorts. They have further reduced their speculative long position by 9.1k lots of longs.

The net speculative position now stands at -106k lots. This is the largest net short position they have held since reversing their position back in September.

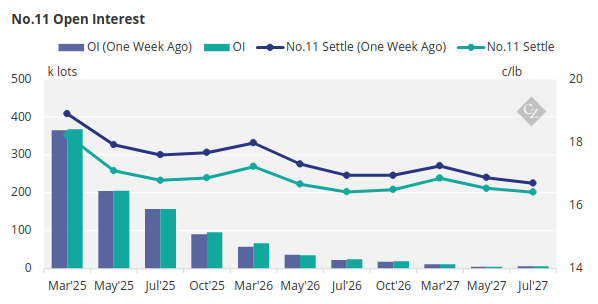

The No. 11 forward curve has weakened across the board.

London No.5 Refined Sugar Futures

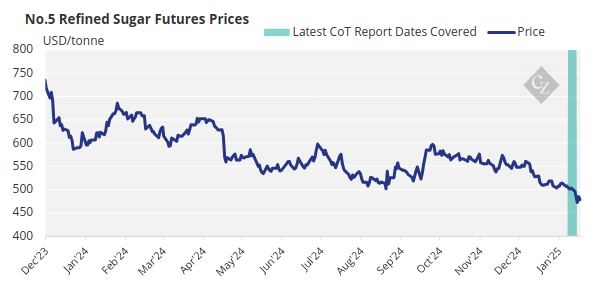

The No. 5 refined sugar futures traded lower over the past week between USD 472-497/tonne.

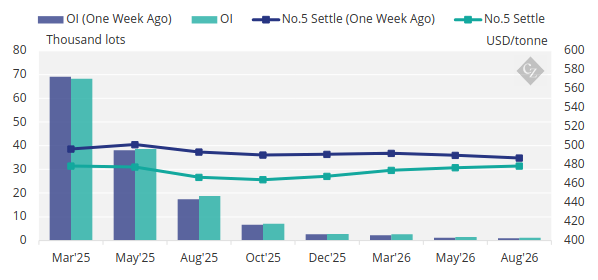

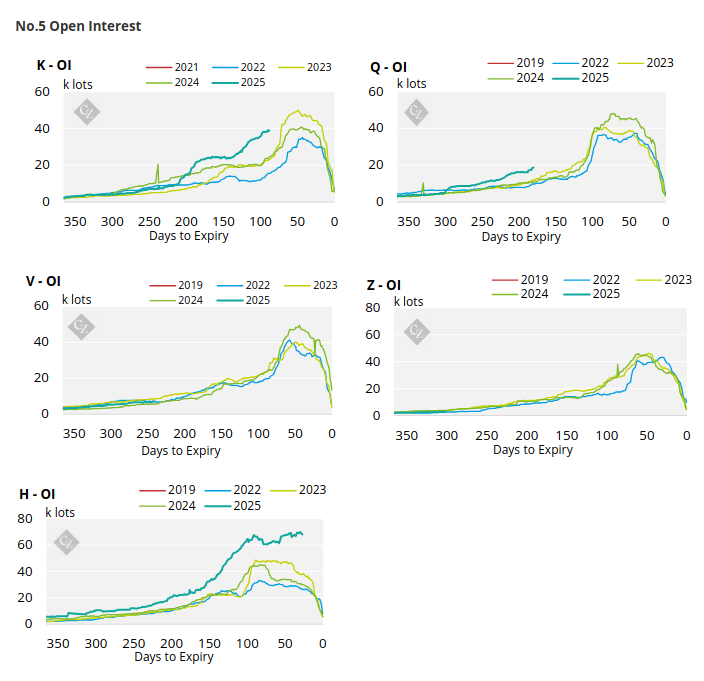

No.5 Open Interest

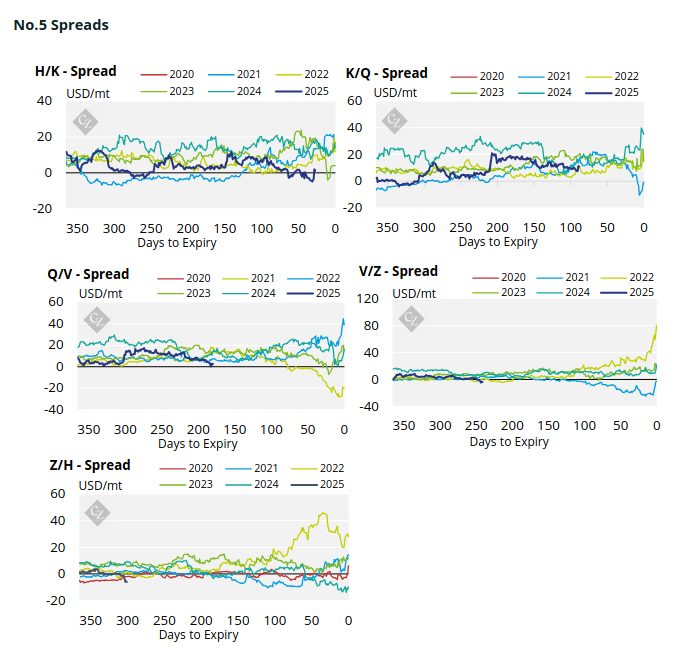

Following a similar trajectory to the No.11 raw sugar futures curve, the No.5 refined sugar futures curve has also weakened across the board.

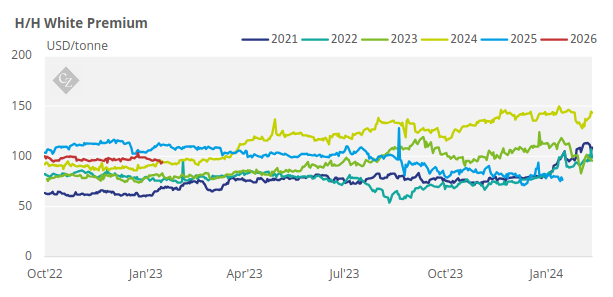

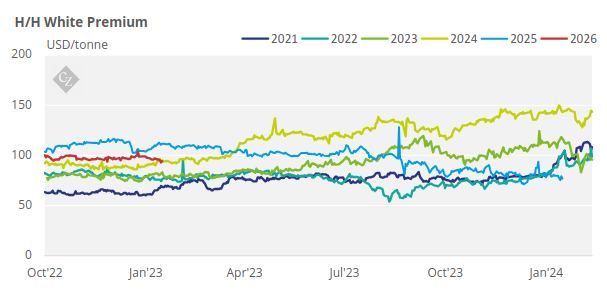

White Premium (Arbitrage)

The H/H white premium traded lower between USD 76-80/tonne.

This is below the level at which many of the world’s re-export refiners can operate profitably.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

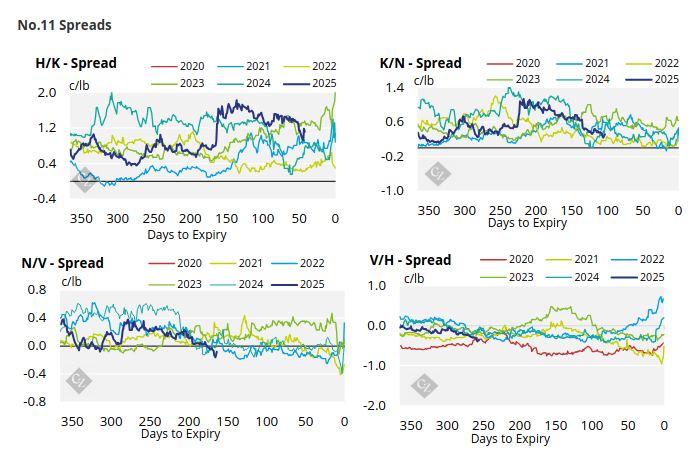

No.11 (Raw Sugar) Appendix

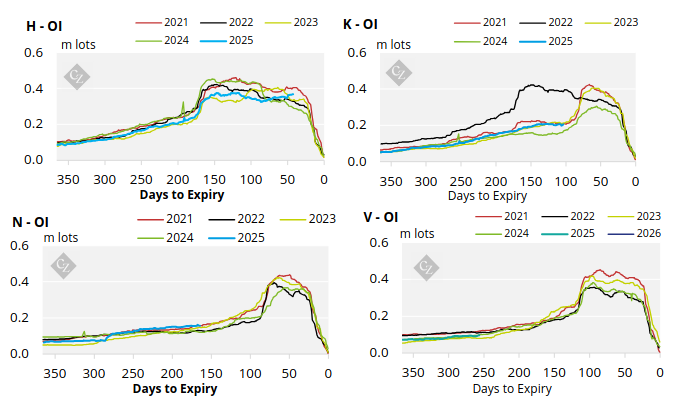

No. 11 Open Interest

No.5 (White Sugar) Appendix

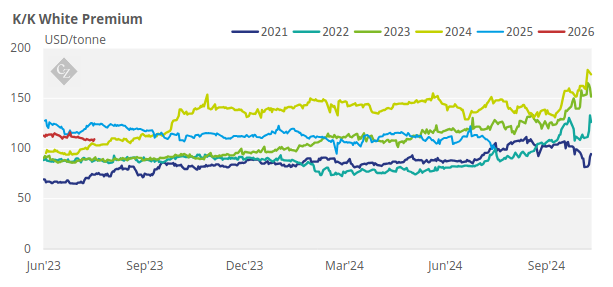

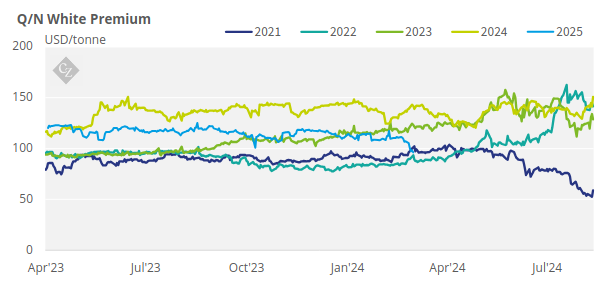

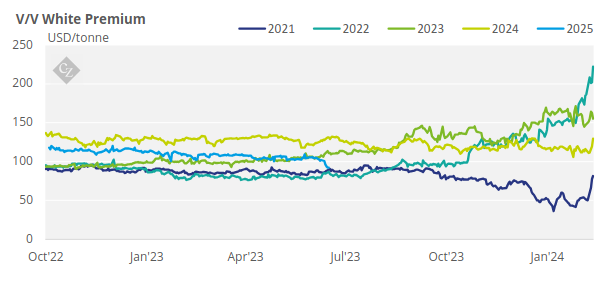

White Premium Appendix