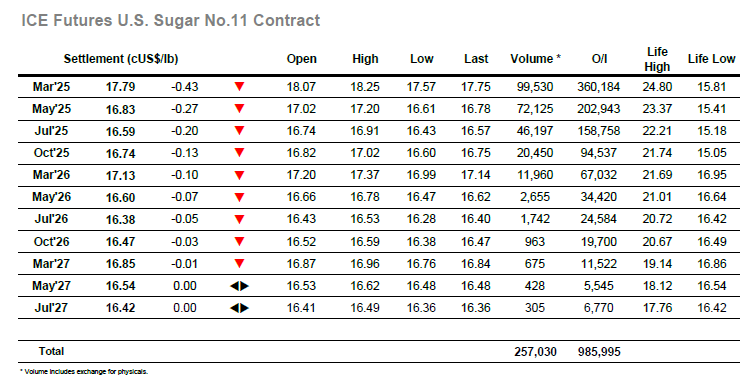

March’25 tumbled to 17.95 on the opening as traders reacted to the weaker showing from white sugar yesterday, but buying quickly emerged and within 15 minutes the price had recovered to sit at unchanged levels. For a couple of hours, the market was able to consolidate this are but without ever pushing beyond 18.25, and while it created a stable appearance briefly the sentiment remains negative and so there were few traders looking to take on the long side. The negativity has been enhanced by the long-expected news filtering out regarding 1m tons of Indian exports alongside a significant change in the spec short holding. Here the week to last Tuesday saw an additional 47,000 lots of net selling which brings the reported short to -106.045 lots, a larger that expected rise which shows a strong determination by specs/funds to continue pursuing the short side. By the end of the morning some weight was being lent to the short side and sent the price below 18c to trade at new daily lows, bringing a more familiar look back to the market and enabling the shorts to continue probing lower. Through the afternoon there were further waves of heavier selling which sent the price down to 17.57, the lowest March’25 price for almost two tears and lowest front month value since trading at 17.52 on 20th August last year. Bounces were proving to be limited and consisted mostly of day trader covering, while spreads were offering more encouragement to the shorts with March/May’25 dropping beneath 1.00 points again and recording daily lows at 0.93 points. The final couple of hours proved far calmer than the rest of the day with the market away from the lows and tracking within the range to reach a close at 17.79, with March/May’25 at 0.96 points. This leaves the overall picture weak with meaningful buyers still proving tough to find.

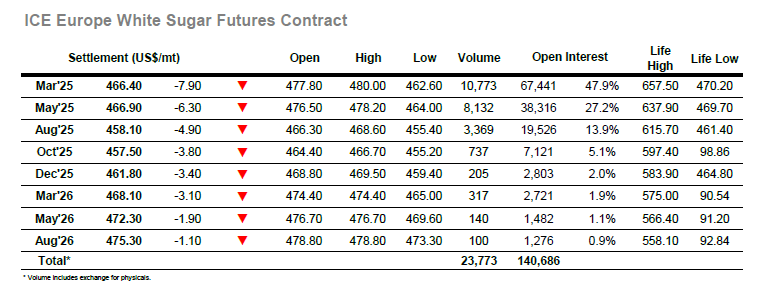

Having traded lower in No.11’s absence the market jumped upward when we opened today as unchanged No.11 levels drew buying. This took March’25 as high as $480.00 during the opening minutes before easing back by a few dollars, although there was sufficient buying from consumers to hold prices in the $477.00 are as we moved through the morning. Approaching noon, the picture changed notably as heavier selling appeared, and suddenly the vulnerability of the market was apparent again with the value tumbling to $467.20. This was not the end of the fall with the afternoon selling a continuation of spec pressure and additional lows made along the way, culminating at $462.60 midway through the afternoon, the lowest level seen from front month whites since August 2021. Such flat price struggles never seem to come without some collateral damage to the nearby white premium which today fell back to the $73 area, while for the March’25 spreads there was a weakening with March/May’25 slipping back to a -$1.50 discount during the afternoon. Having nudged back towards $470.00 during the final hour the appearance of pre-close selling left March’25 facing yet another weak settlement at $466.40 with no sign as yet that the market has reached a bottom.