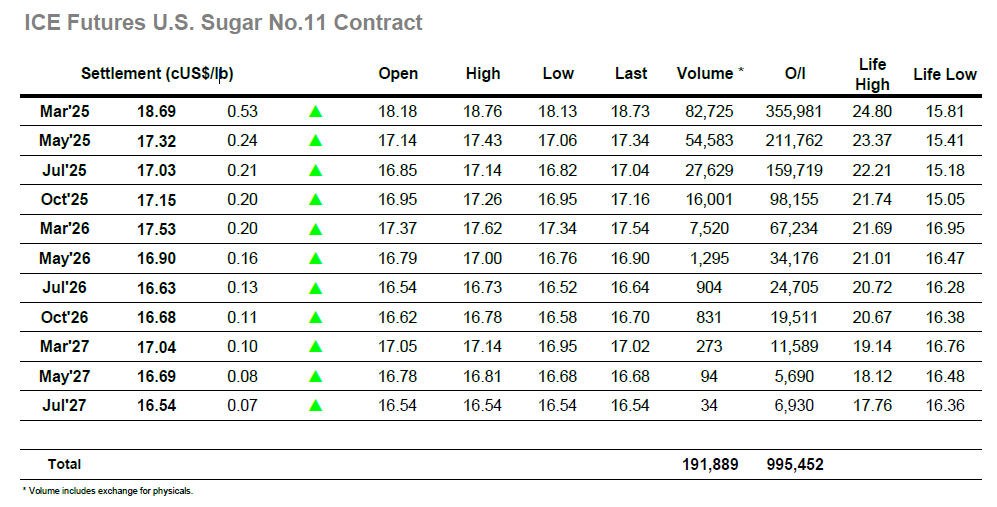

March’25 saw another solid start to a day with early trading seeing the price move up through yesterday’s highs and reach 18.39 before looking to consolidate. Much of the buying at the front of the board has emanated from the spec sector as some newer positions within the considerable short holding are closed back out, though across the other 2025 positions this movement has been ably supported by trade buying interest. With Indian export news now officially in the market there are no more bearish triggers expected that are not already known, and so this provides opportunity for some additional recovery which may develop yesterday’s start into something more than the recent dead cat affairs. Through the morning this was proving to be the case with March’25 steadily building in the 18.40’s before pushing ahead to 18.62 around noon. There was no immediate continuation from the Americas as their day got underway and so day trader liquidation generated a small retreat, though this was gathered up with the selling done and prices were then able to progress to more session highs. The outright strength was helping to pull the March’25 spreads back upward, and with a decent volume coming into the spread directly March/May’25 was able to reach 2-week highs at 1.36 points. These came in conjunction with an outright high at 18.76, and while the market then cooled a little as some profit taking kicked back in it merely sent the price back to the 18.60 area. With the firmer levels holding there was a late push up which saw the 18.76 high matched ahead of the close and ensured a strong settlement level at 18.69. With 2025 prompts having attracted some grower pricing at the higher levels a continuation of the rally may prove to be more challenging, though having posted by far the strongest two performances of the year back-to-back continuing gains cannot be discounted.

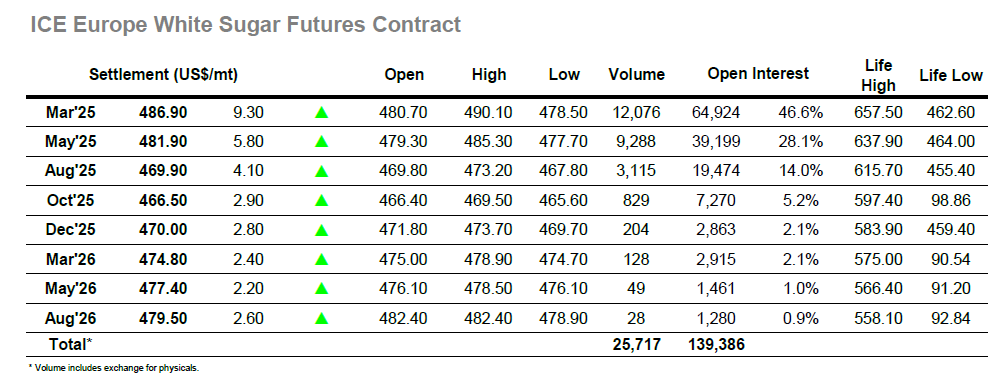

March’25 started the day trading a dollar higher and immediately pushed ahead to $481.40 as it looked to catch up with the already higher No.11 levels. This provided a solid basis for the recovery to extend further and it slow but steady trading through the morning the price reached beyond $487.00, some $25 above Tuesdays lows. The buying while not generated by a single sector certainly found its greatest volume from the spec sector, with bits and pieces of consumer buying helping the move but lacking the same degree of size that was seen earlier in the week at the lower levels. The price retreated by a few dollars during early afternoon but was soon picked up and worked back to reach new daily highs at $490.10, though this seemed to be enough progress with buyers reducing at the upper levels. Spread values were again firmer and March/May’25 touched to $5.60 intra-day, its highest level since November, and this will provide additional encouragement to longs given that the scale of its recovery outstrips that of the flat price. The market remained shy of the highs through the rest of the afternoon, though holding on to most of the gain it was still providing another strong performance which further unwinds previously oversold technical indicators. March’25 settled solidly at $486.90, though the later afternoon did see March/March’25 dropping back to the mid $70’s with a closing value recorded at $74.90.