Insight Focus

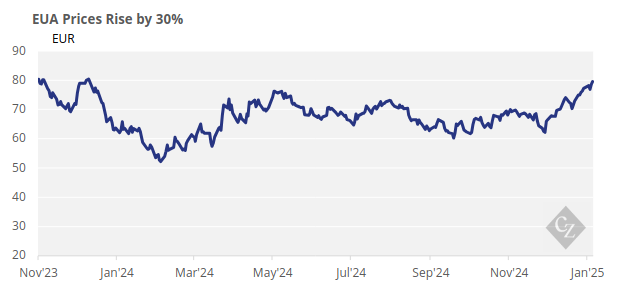

European carbon prices have surged over 30% in six weeks. This has been driven by speculative buying and a shift from net short to net long positions. Investment funds now hold a bullish position of 79 million tonnes, the largest in nearly three years. Expectations of future supply shortages are prompting investors to bet on higher prices from 2026 onward.

Speculative Surge Drives EU Carbon Rally

European carbon prices have soared by more than 30% in the last six weeks as a rush of speculative money has flowed into the market, though many traders are saying the rally has been overdone and prices are due for a correction.

The near EUR 20 jump in EUA prices since December 16 reflects a sharp flip in positioning by investment funds, who had unwound a more than 15-month long net short position in EUA futures in November.

Funds switched from a net short position of as much as 24 million EUAs in October, to a net long position of 42 million EUAs last week — the most in nearly three years.

The weekly Commitments of Traders data for January 17 also showed funds held long positions of more than 79 million tonnes, the biggest bullish position in more than three years.

EU Carbon Market Tightens

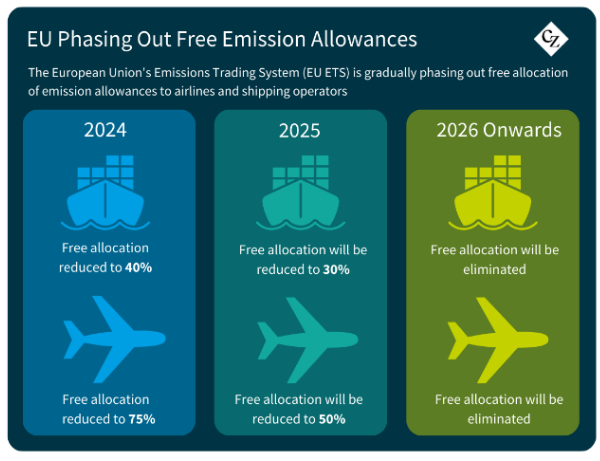

Part of the rationale stems from expectations that the market will move into annual shortfalls from 2026. As the allocation to industry declines, the cap will be adjusted lower by 27 million allowances in a one-off “rebasing” and sales of additional EUAs for the REPowerEU initiative will come to an end.

The shipping sector also makes its debut in the EU ETS this year. Maritime operators must surrender EUAs covering 40% of their emissions in 2025, but this obligation rises to 70% in 2026 and 100% in 2027. Additionally, the aviation sector will continue to receive fewer free EUAs in 2025 – 50% fewer than in 2024.

These adjustments to the EU ETS cap signal a market becoming net short on an annual basis, with most sources expecting significant price increases from 2027, if not sooner.

Investment funds may therefore be positioning themselves for the expected upturn in the market. While it may seem early for such bullish accumulation, speculative traders behaved similarly when the European Commission was preparing to introduce the Market Stability Reserve.

Funds Turn Bullish?

While the MSR was first agreed by Commission as early as 2015, the parameters of the reserve were not fleshed out until 2018, and it went into operation in 2020. Nevertheless, in the period between January 2018 and December 2020 prices quadrupled from EUR 8.05 to as high as EUR 33.50.

Investment funds built a net long position of around 50 million EUAs by late 2020, and this bullish bet went on to total more than 100 million EUAs in Q2 2021 as the full implications of the MSR were understood and more funds piled into the market.

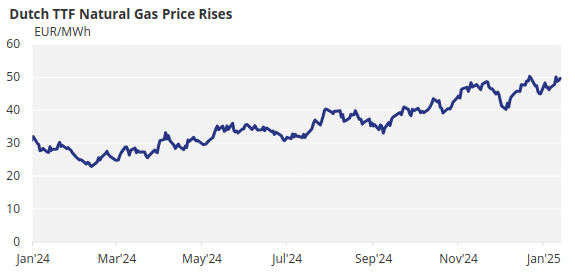

The flip in fund positioning comes after speculators held a net short position in EUAs for a total of 15 consecutive months. As high-priced natural gas dampened industrial output and forced numerous plants to close – both temporarily and permanently – demand for EUAs fell.

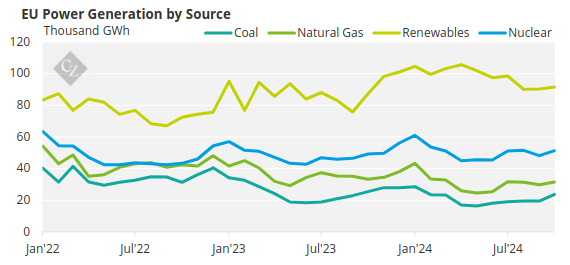

Verified emissions in 2023 fell by at least 15% year-on-year, reflecting a 24% drop in power sector emissions, when hard coal-fired production dropped nearly 28% and gas generation declined by 16.5%. The 2023 data was published in April 2024, when funds had already been net short for eight months.

This 24% drop in power industry emissions equated to less demand for EUAs of around 176 million tonnes, according to Commission data. But while funds have now flipped to net long, the downward trend in power sector demand is expected to be extended when data for 2024 is published in April this year.

Data from the European grid agency show that electricity generation from hard coal fuelled plants dropped by more than 23% last year, while gas-fired output dropped 6.8% year-on-year.

Source: Eurostat

The drop in EUA demand from the power sector is therefore not expected to be quite as great in 2024 as it was in 2023, and industrial output is seen stabilising if not increasing in certain sectors as gas prices have eased from their record highs of 2020-23.

With the numerous adjustments to EUA supply taking place over the next two years, the market may be seeing a slow turn from oversupply towards balance, and it’s this prospect that could be turning investment funds into medium-term bulls.