Insight Focus

Chicago corn prices are steady, with gains in Chicago grains and declines in Europe. Market dynamics are influenced by weather concerns and Argentina’s export tax changes, while South America’s crop progress lags.

Corn and wheat in Chicago are up again, while European grains have fallen. Argentinian corn production has been revised lower, and export taxes have been reduced.

Corn in Chicago has continued to rally, and it appeared to be trying to reach USD 5/bushel last week. However, the market is overbought, the uptrend is intact and the net spec long is significant, leaving the market vulnerable to a correction. The reduction in Argentinian export taxes might be the trigger for specs to sell the market and book some profits. However, the tax reduction is not that significant. Expect some profit-taking this week but also some consolidation.

There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August) to average USD 4.55/bushel. The average price since September 1 is running at USD 4.3/bushel.

Corn Vulnerable to Correction

Last week was short in Chicago as Monday was a holiday, but corn opened positively last Tuesday, consolidating the gains of the previous week. It traded all the way up to USD 4.94/bushel. However, a negative Friday prevented it from reaching USD 5/bushel, with the week closing positive but below USD 4.90/bushel. Euronext corn closed the week slightly negative but essentially unchanged.

US export inspections were again above expectations, with 1.54 million tonnes inspected compared with 1.15 million tonnes expected, up 7% week on week. Incoming US President Trump said he would hold off on imposing tariffs on China in his first day in office, helping positive sentiment. Prior to this, he also said he would impose 10% tariffs. The market reacted seems to suggest it does not believe tariffs will be imposed on China.

Argentina announced late last Thursday a reduction in its export tax to 26% compared with the previous rate of 33%, boosting competitiveness, which was likely the reason for a negative Friday in Chicago. BAGE reduced its corn production forecast to 49 million tonnes from 50 million tonnes previously. This compares to 48 million tonnes projected by BCR and 51 million tonnes in the latest WASDE report. Corn planting is 98.3% complete, virtually finished.

In Brazil, Safrinha (second corn crop) planting has started and is 0.5% planted, behind the 5% recorded last year. The harvest of the first corn crop is 4.4% complete, compared with 8.6% last year.

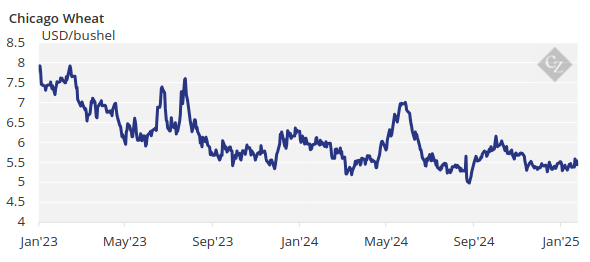

Weather Concerns and Tax Changes Impact Wheat

Wheat received a push in Chicago as freezing temperatures in the US raised fears of potential damage, with expectations of some winter killing. Similar concerns are also expected for Russian wheat. Euronext wheat had a slightly negative week. The reduction in Argentina’s export tax is also applicable to wheat.

The negative week in Euronext occurred despite Russia exporting much lower volumes, as published last week, with 2.4 million tonnes expected to be exported during January – much lower than the 4 million tonnes exported in January last year.

On the weather front, cold weather is again expected in the US, which could cause some winter killing in wheat. Brazil and Argentina are forecast to receive much-needed rains, especially in Argentina. Cold and rainy weather is also expected in northwest Europe and the Black Sea region.