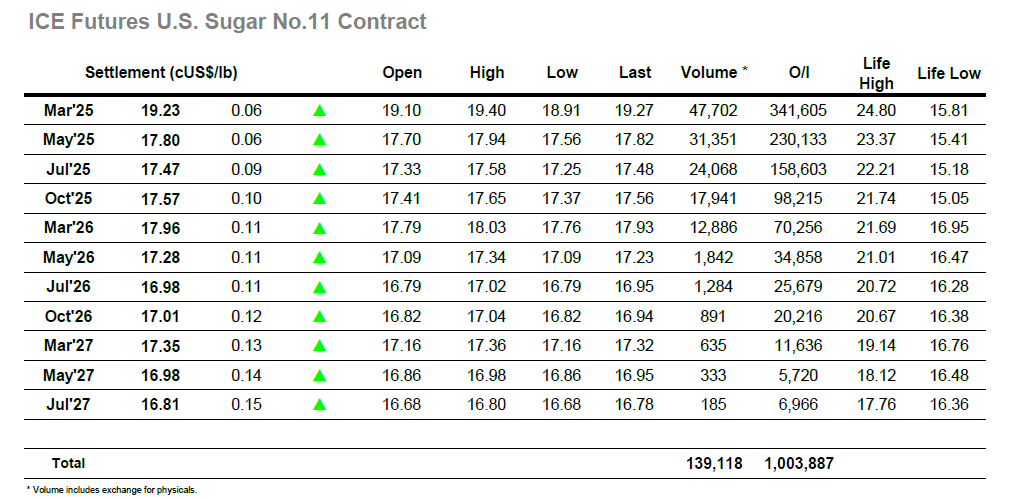

It was a far calmer start to trading than seen over previous days as March’25 traded either side of unchanged in the opening minutes before nudging higher to sit in the upper 19.20’s. Volume was considerably lower as the market continued to tick along broadly sideways with a brief move below 19.17 gathered up and the price generally holding in the 19.20 area. Moving into the afternoon a little more supportive interest started to emerge, and the upside resumed at a moderate pace with the price rising as far as 19.40, still below yesterday’s highs but maintaining a positive bias. This may have been due to the UNICA numbers which showed cane at 0.399 mmt / Sugar 0.009 mmt / Mix 20.85% / ATR 118.51 kg/t / Ethanol 0.379 mlt, though with the sugar number generally nominal at this time of year its impact cannot be too significant. Having eased back from the highs as things settled back down there was a sudden, unexpected spike lower against liquidation to a session low at 18.91, before recovering back to the 19.20 area in equally rapid fashion to again drift sideways. Spreads were once more seeing some movement as March/May’25 ranged between 1.35 and 1.49 points though by late afternoon both the flat price and the spread were showing minimal change against last night’s values. Supportive action through the final hour led March’25 to close with a small net gain at 19.23, bringing a calmer inside day to a conclusion without damaging the recent strong progress as traders assess the next move.

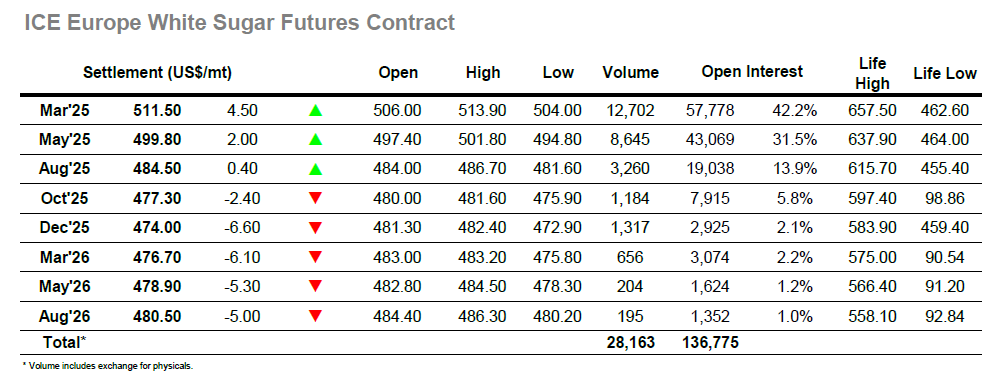

There was mixed trading through the first part of today’s session with March’25 ranging a couple of dollars either side of last nights $507.00 mark, and it was clear that many smaller traders were talking stock of the recent recovery with outright volumes far lower than seen recently. The early range held until the afternoon when a little more buying started to appear in a bid to work back to yesterdays highs, though here also the necessary volume was lacking and the move topped out in the $511.00 area. This was placing some light pressure onto the March/March’25 white premium with trades a couple of dollars lower at $82.00, and when the flat price dropped back to $504.00 on day trader liquidation in conjunction with No.11 the market was looking wobbly for the first time in a week. This picture took a sharp about turn in the final two hours however as from nowhere there was a surge of supportive interest for both flat price and spread which took values to new daily highs, March’25 trading to $513.90 while the March/May’25 spread reached $12.10. Alongside this the March/March’25 arb moved up through $88.00, leaving the picture once again looking constructive as the close approached. Some end of day position squaring left March’25 closing at $511.50, concluding the fifth successive day of gains and maintaining the positive momentum.