Insight Focus

The wheat market is facing concerns over 2025 harvests in key regions. These include weather challenges and trade uncertainties. President Trump’s policies add further volatility to global commodity markets. With unpredictable production and rising trade tensions, wheat prices face an uncertain future.

The wheat markets have begun to shift focus. No longer are the abundant sellers of large quantities of cheap wheat from the Black Sea and the US the main focus. Attention has turned to concerns for the 2025 harvests in the Black Sea, India, the US and to a lesser degree Western Europe. All this while the funds have large short positions in both the US and European wheat markets.

The timing of these concerns coincides with the arrival President Trump on January 20, with his determination to ‘put America first’, threatening tariffs and trade wars with all the major economies of the world, which will inevitably impact commodity trade flow and values.

Volatility and Uncertainty Prevail in the Market

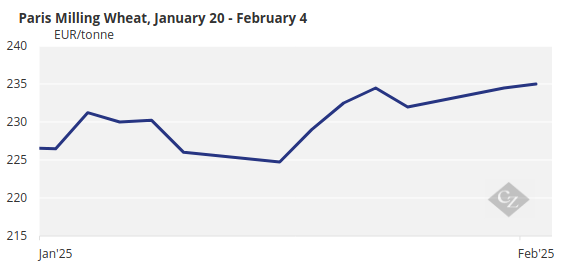

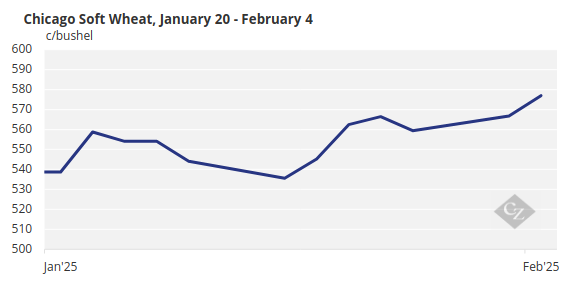

Looking at the price charts below, we can see how the markets have fluctuated since January 20, with participants unsure of the next headline that will swing the market one way or the other.

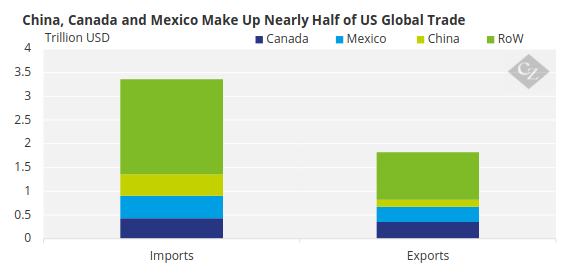

The arrival of Trump in the White House on January 20 sparked real concern about trade wars and tariffs. Since then, there has been much uncertainty until finally tariffs were announced on imports from Canada, Mexico and China, while Columbian dialogue prevented them being on the list for more than a brief moment.

Source: UN Comtrade

This has been followed by a pause for 30 days on the Canadian and Mexican tariffs while differences are sought to be resolved. Meanwhile, Beijing announced retaliation in the form of energy and rare earth metals. The EU is next in line for Trump’s tariff focus, while the UK seems to be less in the Trump bad books, despite his ‘out of line’ comments.

Winterkill Concerns Market

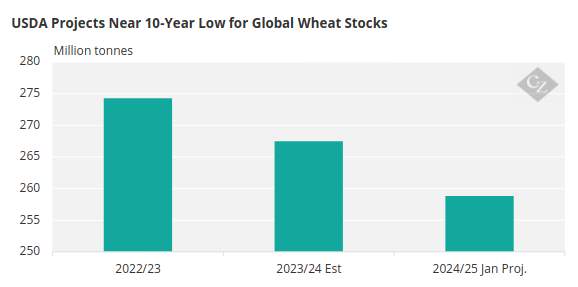

We have discussed many times the dwindling year end global wheat stocks, which are currently at a near 10-year low of 258.82 million tonnes, according to the USDA’s latest WASDE report.

Source: USDA

Russia, the world’s largest wheat exporter, has reported concerning cold weather spells. With its 2025 wheat crop in the poorest condition for many years as it headed into the harsh winter months the limited snow cover has left the already struggling plants at the mercy of freezing cold spells and the associated risk of winterkill.

Recent reports forecast the 2025 harvest at approximately 78-79 million tonnes compared to 81-82 million tonnes in 2024 and a much higher 91-92 million tonnes in the previous two years. This will result in another year of falling exports.

The US has equally seen cold spells with limited snow cover, which has focused thoughts more on the 2025 harvest to come. Winterkill could, as with Russia, have the potential to kill off large acreages of wheat.

India has seen less than ideal weather over recent months, leading to potential 2025 crop reductions. With limited stocks and the need for control over domestic prices to ensure food security for its enormous population, imports are on the radar as a possibility down the line.

Western Europe has fared very poorly in 2024, with high hopes of a return to a more normal size harvest in 2025. Nonetheless weather issues have and continue to plague parts with previous 2025 production optimism far from assured.

Looking Ahead

- Wheat, as with other commodities and the financial markets, awaits the next Trump headline to swing it one way or another.

- China and Mexico are big buyers of US agricultural commodities, with any rise in the trade war stakes having a potentially negative impact on US wheat markets.

- On a global scale, trade wars could be bad news for economies and therefore overall wheat demand, pressuring prices longer term. Equally, they may just change the dynamics and trade flows between buyers and sellers.

- The weather and crop ratings are an ongoing saga that will continue to play a role across the world until crops are much closer to harvest in several months. Any harsh winterkill weather in the US and Black Sea will most certainly spark anxiety for some.

- The funds are short of wheat and appear to be reluctant to exit in great volume, despite the many uncertainties currently swirling around the market. This could change at any moment if a story appears to attract the market bulls.

- The wheat market continues to experience uncertainty around the world in the form of weather, politics and sentiment. The weeks and months ahead look to be potentially volatile and captivating as the future values remain hard to predict!