Insight Focus

Trump’s tariffs are set to reshape global trade. While levies against Canadian and Mexican goods have been delayed, Chinese tariffs have gone into force, prompting retaliation. But in Brazil, agribusinesses may have access to new opportunities.

New US Trade Policy Could Bring Opportunities

US President Trump has announced 10% tariffs on Chinese imports, which marks a resumption of the trade war that began during his first term. The US president also threatened 25% tariffs on Mexican and Canadian products but has since paused the move. The EU has also come into his crosshairs.

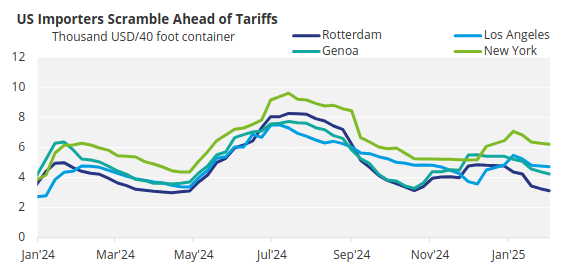

It is undeniable that global trade will be reshaped by the measures – whether they come into force or not. In the aftermath of the election last year, freight rates for the key Shanghai-New York and Shanghai-Los Angeles routes spiked, reflecting US importers pulling forward cargoes in anticipation of the tariffs.

Source: Drewry

But although the move comes with huge uncertainty, there could be opportunities for other countries, such as Brazil. For instance, Brazil competes largely with the US to satisfy huge Chinese soybean demand, and the scales are now likely to sway in favour of the South American country.

In addition to soybeans, Brazil’s beef and orange juice producers could also benefit from the moves.

1. Brazil’s Soybean Advantage

Amid an escalating trade war between Washington and Beijing, the initial expectation is that Chinese importers will source more soybeans from Brazil over the US.

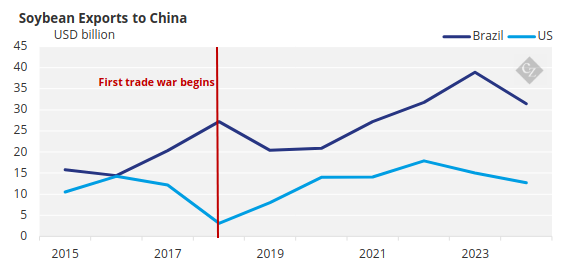

Over the last decade, Brazilian soybean exports to China have doubled — a growth attributed not only to the natural increase in demand in China but also to the effects of the trade war during President Trump’s first term.

Source: Comex and USDA

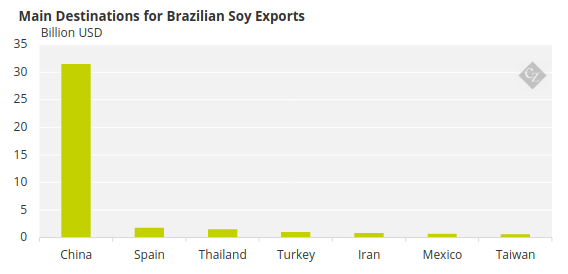

In general, shipments to China tend to decrease only in special contexts, such as crop failures in Brazil and price reductions, as was observed in 2024. Today, 70% of soybeans exported by Brazil go to China.

Source: Comex

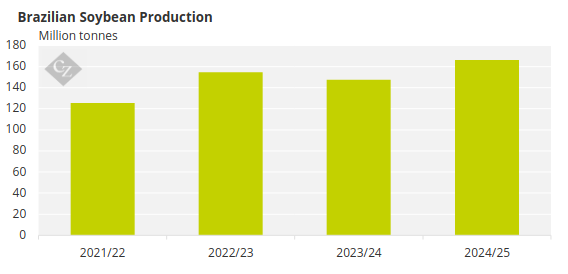

A record soybean harvest in Brazil is expected for this year, when CONAB estimates 166.3 million tonnes will be produced (an increase of 15.4% compared to 2024). China’s greater appetite for Brazilian grains could lead to a new increase in exports.

Source: CONAB

The producers, however, emphasise that it is still too early to make any kind of conclusion. After all, there is no guarantee that the US and China will not negotiate.

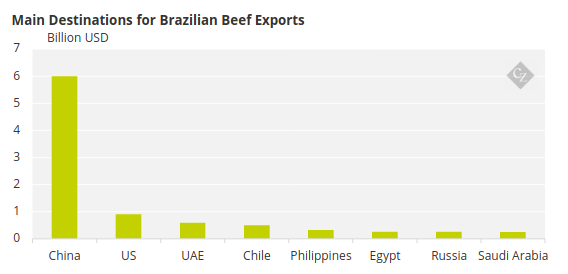

2. Brazilian Beef Could Win

Any potential movement on US-Canada or US-Mexico tariffs could prove favourable for Brazil’s beef industry. “There seems to be a desire by the US to renegotiate the free trade agreement with Mexico and Canada, in which case there may be higher import taxes for some products,” said Celso Figueiredo, professor of international relations at Fundação Getúlio Vargas and partner at Barral Parente Pinheiro Advogados. Under the US-Mexico-Canada agreement, there are currently no tariffs on imports of bovine meat from either Canada or Mexico.

Canada accounts for almost 30% of beef imports made by the US, so there may be an opportunity for Brazil to boost shipments if there is any imbalance in commercial relations between the North American countries.

Today, the US represents the second largest destination for Brazilian beef exports. Last year alone, sales to the country generated USD 943 million, 103% more than in 2023.

Source: Comex

Under the current circumstances, Brazil, for now, does not feel uncomfortable – something that large companies in the meat sector have been emphasising.

Brazilian beef exporters already pay a tariff of around 25% for their product to enter the US. Furthermore, the country faces a challenging livestock cycle, with reduced meat stocks. According to the Brazilian Association of Meat Exporting Industries (ABIEC), the US needs a reliable commercial partner in the sector. This means that if there is a disintegration of relations with Canada, Brazil could step in.

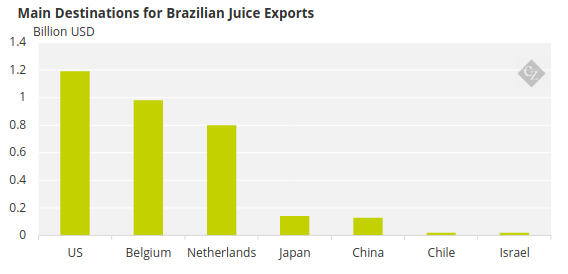

3. Fruit Juice Demand Soars

Brazil usually competes with Mexico for the position of largest supplier of fruit juice to the US. Last year alone, Brazil sold USD 1.19 billion of fruit juice to the US, 22% more than in 2023.

Source: Comex

Demand continues to rise. Last year, the fruit juice market in the US generated USD 23.8 billion, an increase of 16% compared to 2020, according to Mintel. The forecast is that in 2033, the sector will generate USD 32 billion, 34% more than today.

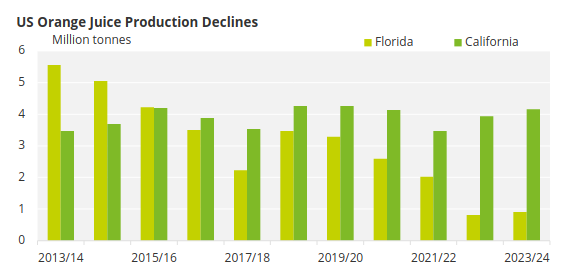

Meanwhile, supply in the US is falling. While the US is one of the biggest orange juice producers globally, last year, it faced setbacks including weather events and pest in key growing regions such as Florida, which have decimated the crop over the years.

Source: USDA

The market in Brazil is trying to assess whether the recent setbacks in trade relations between Mexico and the US could represent a greater opportunity for product exports. Until then, agribusiness and other sectors of the economy remain attentive to any signs from the US government about new tax increases and the relationship with Brazil.