This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Spot beet sugar prices weakened amid slow sales. Processors struggled to sell excess sugar, with many holding offers for the 2025 crop. Sugar markets showed little reaction to the February 3 tariff announcement, with minimal impact expected.

Spot Beet Sugar Prices Weaken as Sales Slow

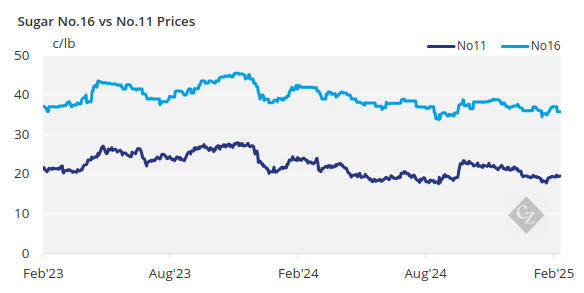

Spot beet sugar prices were weaker during the week ending February 7, amid slow sales of 2024-crop supplies, following the prior week’s decline in refined cane sugar prices.

Beet sugar prices for 2025 were lowered by 2c/lb, reflecting indications that processors were struggling to sell excess supplies of 2024-crop sugar in a market already well supplied or to users who viewed lower values as buying opportunities. Northeast, West Coast, Gulf, and Southeast refined cane sugar offers for the 2025 calendar were 2c/lb lower compared to a week earlier.

Adding to the weakness in the spot market were slower-than-expected deliveries of contracted sugar in some cases. While some processors reported “as-expected” shipments, others still saw movement lagging expectations.

For next year, most beet sellers appear to be holding offers for the 2025-26 crop around 45c/lb, FOB, Midwest, with the upper end around 48c/lb depending on location. This was well above buyers’ bids, which were mostly in the lower 40c/lb range, with some seeking prices in the upper 30s. Beet processors indicated that these lower prices would put sugar below the cost of production.

“We’re not ready to lock in at a loss,” one processor stated.

Inquiries for the 2025-26 crop continued, but most traders expected few actual sales before the International Sweetener Colloquium, held from February 23-26 in Palm Springs, California, if any sales occur then. Instead, most anticipate a prolonged selling season, possibly extending into early summer, unless something drastic (such as tariffs on sugar imports from Mexico) impacts the market.

Beet processors would at least prefer to have the 2025 planted area confirmed, with decisions expected in the next few weeks if not already made. Early indications suggest that acreage may be steady to slightly lower compared to 2024.

Sugar Markets Stable Despite Tariffs

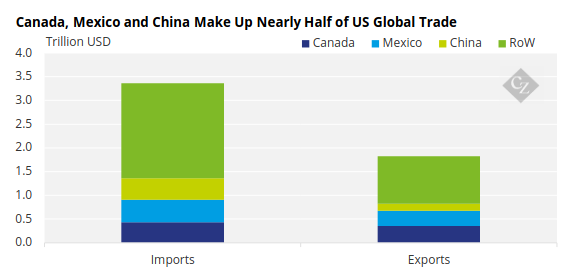

Sugar markets had a minimal reaction to the February 3 announcement of 25% tariffs on all products imported from Canada and Mexico, which were set tAn argument could be made that tariffs on US sugar imports from Mexico (and Canada) would have minimal impact, even if enacted. Ample domestic sugar supplies in the US, along with the option of high-tier imports, should ensure adequate supplies, albeit at a higher price, despite any disruption.o take effect just after midnight on February 4.

An almost immediate delay of at least a month was announced on tariffs for Mexican goods after it was reported that Mexico would deploy 10,000 troops to help secure its border with the US. Canada also announced retaliatory tariffs on USD 30 billion worth of US imports.

On February 3, it was confirmed that tariffs on Canadian goods (including sugar and molasses) would also be suspended for a month, pending negotiations. While sugar trade with Canada is minimal, sweetener trade with Mexico (sugar moving north and corn sweeteners moving south) is significant.

An argument could be made that tariffs on US sugar imports from Mexico (and Canada) would have minimal impact, even if enacted. Ample domestic sugar supplies in the US, along with the option of high-tier imports, should ensure adequate supplies, albeit at a higher price, despite any disruption.

Corn sweetener markets remained quiet.