Insight Focus

Urea prices are climbing toward USD 500/tonne FOB in Egypt. Middle East is likely to follow, due to strong US demand and an imminent Indian tender. Processed phosphate prices remain stable amid weak demand and delayed Chinese exports. Potash prices are rising on strong US demand and a potential 25% tariff on Canadian imports, while ammonia prices are expected to fall due to oversupply.

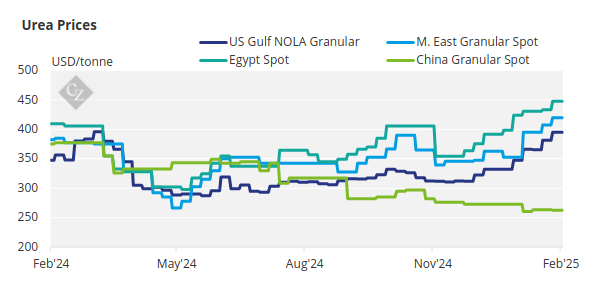

Urea Prices Surge

The trajectory of urea prices is slowly edging towards USD 500/tonne FOB Egypt and will thereafter follow in other origins. The latest Egypt price is now reported by major Egypt urea producer MOPCO at USD 459/tonne FOB for March shipment. This is an increase of USD 60/tonne since the beginning of the year.

Middle East urea is now reported to be closer to USD 450/tonne FOB with a part cargo reportedly sold at USD 445/tonne FOB, which nets back to above USD 460/tonne CFR US Gulf/NOLA. The latest Middle East pricing is up USD 80/tonne since the beginning of the year.

Adding to the upward pressure on urea prices is the expectation that India will once again seek to purchase over 1 million tonnes, with a tender rumoured to be announced in the coming weeks, if not days. Currently, all but one vessel has been nominated for the January 23 urea tender, which saw India secure a disappointing 558,900 tonnes versus the desired 1.5 million tonnes.

Production issues still prevent meaningful urea exports from Iran but there has been a substantial drawdown on inventories with exports in January exceeding 400,000 tonnes.

Chinese producers are still not expected to come into the export market anytime soon, leaving Southeast Asian producers Petronas, BFI and Pupuk Indonesia carrying the urea exports. According to sources, BFI is expected to issue a tender for two shipments of 6,000 tonnes each (a total of 12,000 tonnes) of granular urea. A significant price increase is anticipated, likely in line or above most recent Indonesia tenders, which had results of USD 440/tonne FOB or above.

Major buying seasons in Australia and Thailand are approaching with about 80% of annual imports taking place between April-September.

In the last full calendar year, Australia imported a record 3.8 million tonnes of urea. However, weather conditions to date may see this year’s import below last year. Further underpinning the strength in the urea price is expected strong demand from US/NOLA. For comparison, April 2024 imports saw 1.4 million tonnes arriving.

The European producers are battling high gas prices, with the one month forward trading close to EUR 60/kWh vs EUR 40/kWh on December 16. As a result, producers are raising prices weekly. This trend is likely to intensify when restrictions on Russian imports take effect on July 1.

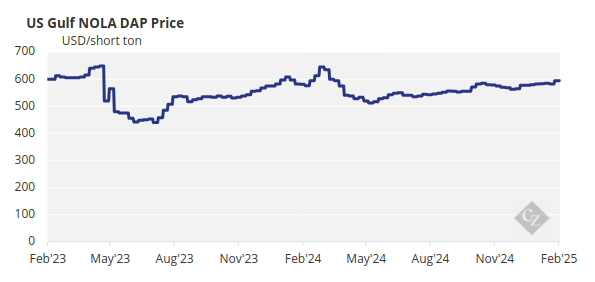

Phosphate Market Stalls

The processed phosphate situation this week mirrors the one of last week. India remains largely absent from imports, with only one cargo of DAP reported from Ma’aden this week at USD 633/tonne CFR. As of January 2025, India’s DAP inventory stands at a critically low level of less than 1 million tonnes, down 45% year over year.

Inventories in May are expected toWith most market players well covered for the spring application season, prices only increased USD 10/short ton this week to USD 330-350/short ton FOB in the Midwest. remain at 1 million tonnes, down substantially on the 2 million tonnes in April 2024, 3 million tonnes in April 2023 and 4.4 million tonnes in April 2019.

At the time of writing, the big issue in India is that the current subsidy price level of MRP/NBS leaves importers with a loss of between USD 120-125/tonne. Losses are also incurred on domestic DAP producers, via the import of phosphoric acid.

Pakistan imports are also muted due to weather, as well as agricultural and retail prices being too low to warrant a margin for importers. The nominal DAP price in Pakistan is around USD 645/tonne CFR.

On the opposite side of the world in Argentina, the government has decided not to extend the 7.5% PAIS tax on imported fertilizers, resulting in an immediate drop of around USD 50/tonne on MAP. Argentina MAP prices still carry a premium to Brazil of around USD 13-14/tonne. The last reported MAP price in Brazil is in the low USD 630s/tonne CFR.

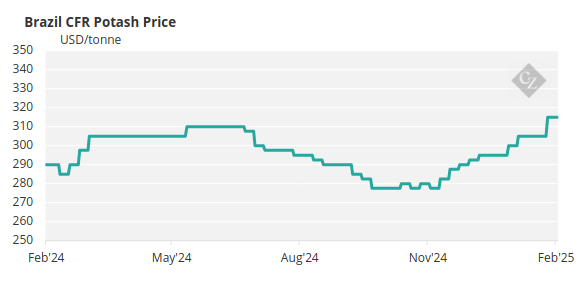

Potash Prices Show Marginal Rise in China and US

The bullish sentiment in the MOP market persists, despite the slowdown in price movement, with only prices in China, Southeast Asia and the US showing a slight increase.

Nutrien surprised the market this week by raising its potash prices by USD 20/short ton (USD 22.04/tonne) in the US and CAD 30/tonne in Canada, prompting Mosaic to follow suit. Despite the price hike, which would bring the Midwest terminal pricing to USD 360/short ton FOB, prices are operating well below those levels.

With most market players well covered for the spring application season, prices only increased USD 10/short ton this week to USD 330-350/short ton FOB in the Midwest.

The Southeast Asian MOP market saw an increase in demand despite the lack of a fresh benchmark from the latest 350,000-tonne tender from Pupuk Indonesia. The importer was forced to scrap the tender as suppliers rejected the new price formula methodology.

Market players look ahead to the end of February and the start of March, when Pupuk Indonesia is expected to retender. Meanwhile, the latest GTT trade data shows that Malaysia imported 1.6 million tonnes of MOP in 2024, marking a 20% increase, while Indonesia imported 3.4 million tonnes, reflecting a 44% rise.

Brazilian potash prices were assessed as unchanged at USD 315-320/tonne CFR for the second consecutive week, with limited spot sales to note. March shipment availability has become limited, with most focusing on April onwards. Producers are still aiming for higher offers, despite the slowdown in demand.

For the first time, sanctioned potash producer Belaruskali shipped more than 1 million tonnes by rail from its factories in January. The major export hub is Bronka, Poland, which received in excess of 550,000 tonnes, with St. Petersburg receiving just above 150,000 tonnes. BPC started using the Baltic port of Ust- Luga, same as Eurochem and Uralkali, and the volume reached 176,000 tonnes.

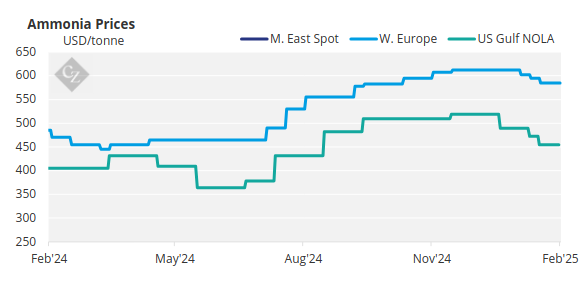

Ammonia Prices Slide as Supply Outpaces Demand

Ammonia prices east of Suez continued to weaken this week amid substantial supply and limited demand across the region. In the West, sentiment remains oriented towards the downside owing to similar factors, though natural gas market instability appears to be putting fresh business on the backburner. This is rendering price discovery increasingly difficult.

Prices in the Middle East and Asia should continue to soften through February due to comfortable availability, with benchmarks west of Suez also likely to decline, albeit at a much steadier trajectory.