Insight Focus

Trade wars, tariffs and rising prices. The past few weeks in the agricultural supply chain have been characterised by US President Trump’s flurry of executive orders that have impacted everything from tractors to eggs. Here are the main agricultural trade and logistics headlines for this month.

UK PM Revisits Brexit Trade Deal

The UK government is aiming to renegotiate aspects of the Brexit trade agreement with the EU since the EU/UK post-Brexit Trade and Cooperation Agreement provides for review of its trade provisions in 2025. Prime Minister Sir Keir Starmer called the prior deal “botched.”

One aspect that may be up for review is the elimination of sanitary and phytosanitary (SPS) checks on food products – but the UK should expect insistence from Brussels that standards must align with the EU and be overseen by EU judges. Since the deal was made, it is estimated that the UK has lost out on about GBP 3 billion in annual food sales to the EU. More areas for review are access to fisheries and animal welfare standards. The first post-Brexit summit has been scheduled to take place in the UK on May 19.

US Begins New Trade Wars

However, there are fears these efforts might put the UK in the crossfires of the US after President Trump threatened to impose tariffs on the EU, China, Canada and Mexico.

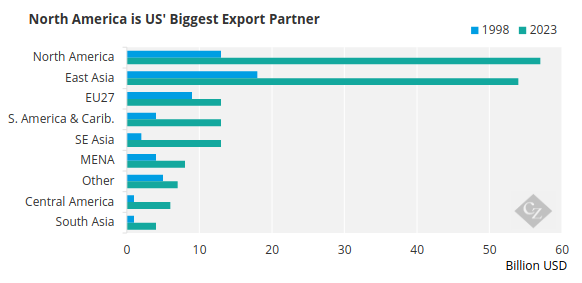

The US is proposing a 25% tariff on imports from Mexico and Canada, as well as 10% duties on China. He has now pressed pause on his North American tariffs but those on China went ahead, with swift retaliation from Beijing. China announced tighter export controls on coal, LNG and rare earth metals – vital for the clean energy transition. China has also imposed tariffs on agricultural machinery and initiated a WTO complaint against the US. If tariffs on Mexico and Canada do go ahead, the agricultural exports sector, valued at USD 190 billion, is particularly vulnerable.

Source: USDA

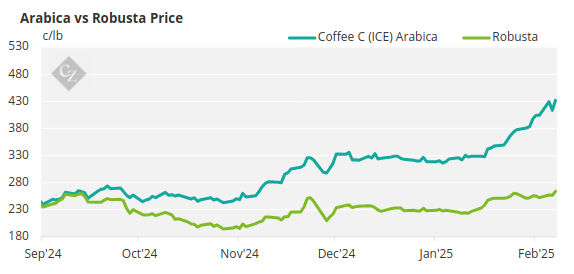

Another briefly imposed tariff was levied by President Trump on Colombia after a diplomatic spat at the end of January. Although the tariff was rescinded after the issue surrounding deportation flights was resolved, the threat still looms over the South American country. Colombia is the world’s third largest coffee producer, and coffee prices have already skyrocketed this year due to supply issues.

Tariff Impact to Extend to Machinery, Freight

Coffee is just one item that could be caught in the crosshairs of tariffs. In its first-quarter earnings report released on Thursday, US tractor manufacturer Deere & Company projected a 30% decrease in large-equipment sales for 2025 and expects net income between USD 5 billion and USD 5.5 billion, down from USD 7.1 billion in 2024. The company downplayed impacts of potential tariffs, stressing that “75% of all products that we sell in the US are assembled here in the US.” However, John Deere has four plants in Mexico that manufacture key components for its tractors, and these could be caught in the crossfire of a potential 25% tariff on Mexican steel and aluminium products.

Another impact from the US’ tariffs could be felt in the logistics and freight sectors, according to freight company DSV. According to Clarksons, the US accounts for 5% of global seaborne imports, while bilateral US-China trade accounts for 1.4% of global seaborne goods transport. Trade patterns are likely to shift in 2025 as China moves away from the US and sells more goods to South America and Southeast Asia (just as it did in Trump’s first term), while the EU may benefit from greater access to the US market (tariffs pending).

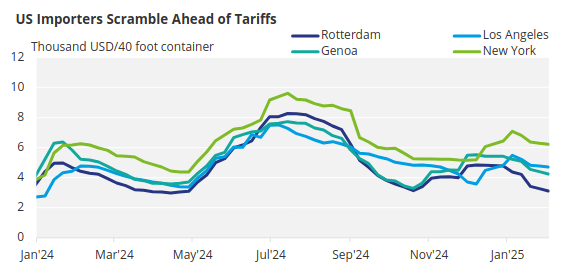

A Lloyds List analysis highlighted that some US importers pulled forward cargoes in 2024 in anticipation of tariffs, which is reflected by a surge in Drewry’s Shanghai to New York index in the wake of the election.

Source: Drewry

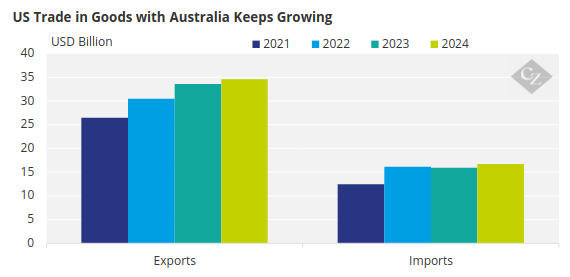

Tariffs Down Under?

Australian farmers are also concerned about the possibility of trade tariffs under President Trump as he threatened protectionist measures during his first term. According to the Australian Embassy, the US is “Australia’s largest economic partner” with USD 77 billion in two-way trade and investments of USD 1.6 trillion. The US International Trade Administration says Australian agricultural exports to the US were worth USD 4 billion in 2022.

Source: US Census

Australia has already faced trade barriers from tensions in the Red Sea, which have disrupted Australian canola exports to the EU and increased costs for imported goods such as fertilizers and machinery parts. Although the ceasefire seems to be holding, the WSJ reported that big shipping liners won’t send vessels back to the Red Sea.

More increases in Australian shipping costs have come from a 25% rise in landslide fees imposed by stevedoring companies. An investigation by the Australian Competition and Consumer Commission found that the revenue per lift has increased by AUD 72.16 between 2016 and 2024, despite real costs only having risen by about AUD 24.22 per container. In 2022-23, Australia’s top export was wheat, valued at AUD 16.7 billion.

Meanwhile, Russia Experiences Grains Export Boom

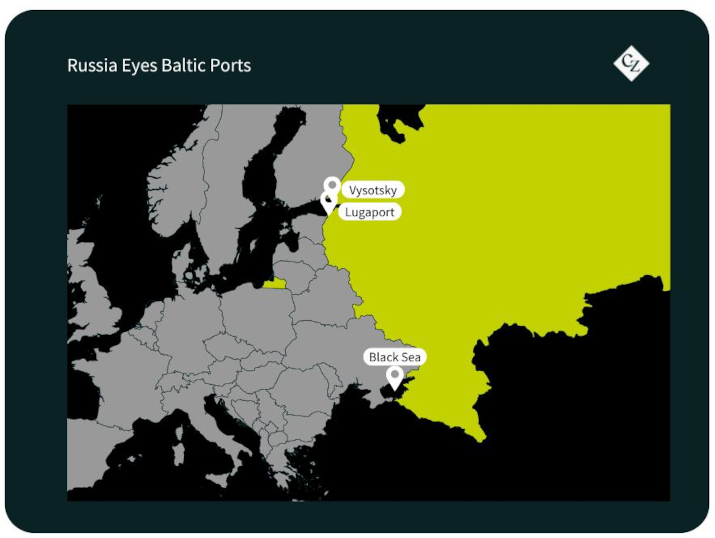

Despite ongoing conflict in Ukraine, Russia, the world’s leading wheat exporter, announced it is expanding its Baltic Sea ports to enhance agricultural exports by 50% by 2030. It wants to diversify away from traditional Black Sea routes, which have become risky due to the conflict with Ukraine.

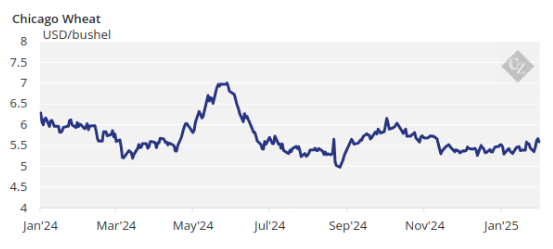

With target markets of Latin America and Africa, Russia has recently launched the Vysotsky and Lugaport ports in the Gulf of Finland, which can handle up to 15 million tonnes annually. Despite the war, Russian grains exports have remained resilient, keeping prices stable.

EUDR Exemptions on Horizon

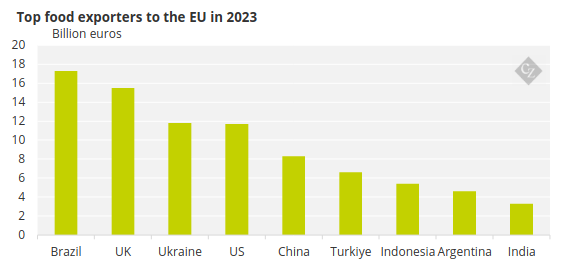

EU lawmakers have voted to exempt most member states from the controversial and complex law that bans commodities grown on deforested land from being sold within the bloc. The amendment has sparked criticism, particularly from Brazil – Europe’s main supplier of agricultural commodities.

There has been long-running pressure on the EU authorities from EU farmers, who complain that the administrative burden of the Common Agricultural Policy reduces their competitiveness against imports from low-cost countries. The latest blow to the farmers has been dealt by the signing of the EU-Mercosur agreement, which is expected to intensify trade between the EU and Mercosur countries (Argentina, Brazil, Paraguay, Uruguay and Bolivia). In support of French farmer protests, supermarket chain Carrefour has even halted buying Mercosur-origin beef.

EU Makes Trade Changes

Amid uncertainty over US tariffs, the EU is making an extra effort to diversify trade. As well as its Mercosur agreement, the EU has concluded negotiations with Mexico that will modernise the Global Agreement between the countries.

This is good news for EU farmers as the agreement removes tariffs as high as 100% on important EU export products, such as cheese, poultry, pork, pasta, apples, jams and marmalades as well as chocolate and wine. It also simplifies processes to make agri-food exports quicker and cheaper, the EC said in a statement.

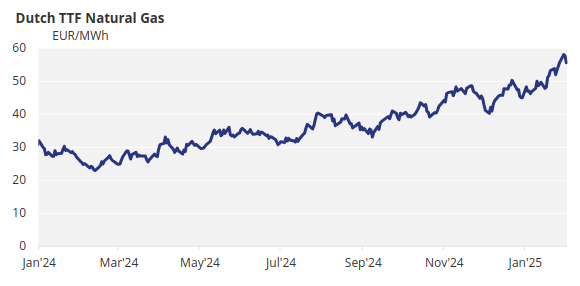

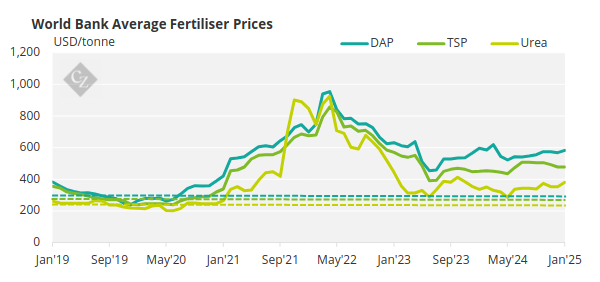

But the EU has gone the other way in its frosty relationship with Russia. At the end of January, it adopted a proposal to impose tariffs on a number of agricultural products from Russia and Belarus, as well as on certain nitrogen-based fertilisers. The European Commission said in a statement that the measure would support the EU fertiliser industry, which has struggled amid higher energy prices.

It is also the next step in the EU’s strategy to reduce dependency on Russia. However, the EU has stopped short of blocking the products entirely – the Russian goods affected are still allowed to be stored in EU customs warehouses and transported in EU vessels to third countries.

Dotted line = 2019 average price

Source: World Bank