Insight Focus

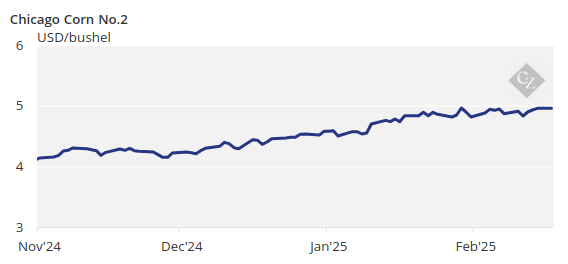

Chicago corn tested USD 5/bushel last week while US wheat rallies. Market remains sceptical of disappointing WASDE report, with March futures reaching USD 5/bushel last Friday. We expect the WASDE to adjust for higher ethanol demand, exports and lower production in Argentina and Brazil, possibly in March or April.

Our forecast for Chicago corn for the 2024/25 crop (September-August) remains unchanged at an average of USD 4.55/bushel. Since September 1, the average price has been running at USD 4.38/bushel.

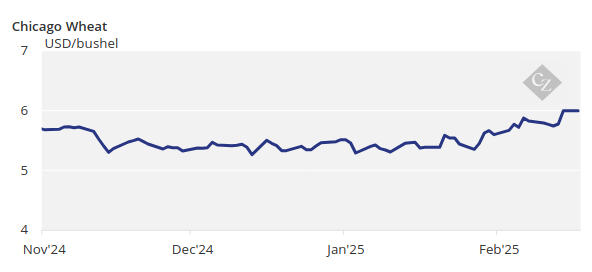

The February WASDE report came in below expectations, but Chicago corn continues to attempt breaking the USD 5/bushel mark, though it falls short. Meanwhile, US wheat has seen a rally, while European grain prices are slightly weaker.

We anticipate that the WASDE will need to adjust for increased demand in ethanol and higher export expectations, possibly in the March or April updates. Additionally, lower production forecasts for Argentina and Brazil may drive further adjustments. We may see some profit-taking in the short term, but we think we will see 5 USD/bushel in the front month within the next month.

February WASDE Disappoints

Corn in Chicago started positively last Monday, anticipating a supportive-to-bullish WASDE on Tuesday. However, the report fell short of expectations, leading to a sell-off in corn prices on Tuesday. Despite the disappointing WASDE report, the market remained sceptical and traded higher through Friday, reaching a high of USD 4.99/bushel, though it still fell short of breaking the USD 5/bushel mark.

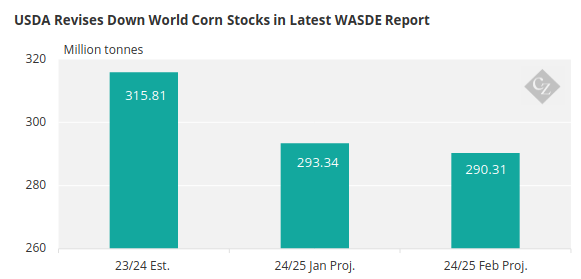

The February WASDE was somehow a non-event as the USDA left the US corn supply and demand unchanged, despite expectations for lower stocks. World stocks were reduced by 3 million tonnes.

Source: USDA

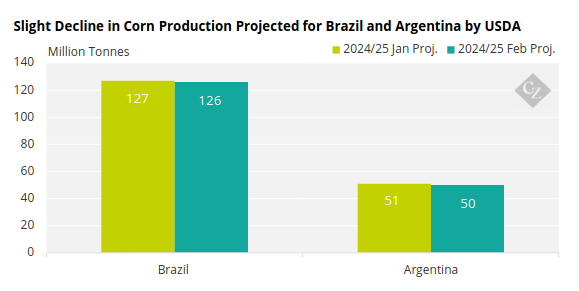

The USDA did reduce Argentinian and Brazilian production, with Argentine production cut by 1 million tonnes to 50 million tonnes (we believe it should be closer to 48-49 million tonnes) and Brazilian production lowered by 1 million tonnes to 126 million tonnes (we think it should be in the 120 million range). These were the only production changes, representing a somewhat muted downgrade, which leaves room for further revisions in upcoming reports.

Source: USDA

The US corn carry was left unchanged at 1.54 billion bushels, not yet recognizing what we think is a notable increase in corn demand for ethanol. We also believe there is room for a higher export number.

The only change made was a 10 cent/bushel increase to the farm price forecast, raising it to USD 4.35/bushel, possibly anticipating a downward revision to the carry in the March report.

Corn planting in Argentina is now complete. BCR in Argentina has reduced its production forecast again, cutting it by 2 million tonnes from its previous estimate to 46 million tonnes, while BAGE has kept its forecast unchanged at 49 million tonnes. Meanwhile, CONAB in Brazil increased its forecast to 122 million tonnes, up from 119.6 million tonnes previously and compared to the 126 million tonnes in the WASDE.

US corn inspections last week were in the upper part of the expected range, supporting the market.

French Wheat Planting Up 10%

On the wheat front, the French agriculture ministry said that winter wheat area planted for the 2025 harvest is up 10% year on year up from its December estimate. This should lead to higher production next year. The French wheat condition was 73% good or excellent versus 68% last year.

The February WASDE report reduced US wheat ending stocks by 4 million bushels, all coming from higher food demand.

Global stocks were reduced by 1.26 million tonnes, with the only change in production for Brazil, which was downgraded by an immaterial 210,000 tonnes.

Dry weather is expected in Argentina this week. The same is expected in Brazil although with some light and beneficial rains also anticipated.

Cold weather is expected again in the US together with snow in the corn belt and the northern plains, which will keep wheat dormant. Rains and cold weather are also expected in northwestern Europe, while the Black Sea region is expected to be dry.