Insight Focus

Record M&A volume is expected in Brazil this year. This is due to strong assets currently for sale and energy auctions forecasted later this year. The expansion of renewable energy and attractive transmission line deals should drive this growth.

Economic Uncertainty Boosts Energy M&A

The year kicked off with excitement for the energy market. USB bank has just launched a survey in which it predicts a record in M&A investments in the sector. Around BRL 50 million should be invested in electric energy generation, transmission and distribution, 10% more than in 2024, according to the bank.

In the bank’s assessment, especially in the hydroelectric energy sector there are good assets that have been attracting the attention of large companies. A recent example was the purchase, by the French EDF, of 70% of the Baixo Xingu hydroelectric plant, in Paraná, for BRL 1.43 billion.

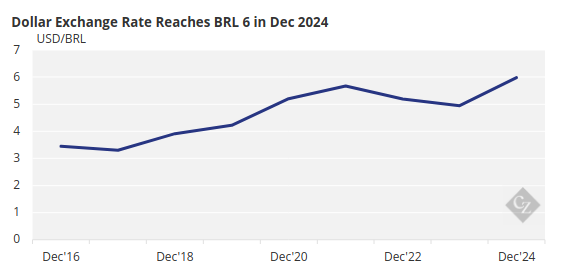

The movement towards market consolidation is largely explained by the search by large investors for stable assets with predictable growth at a time of economic uncertainty in Brazil, with concerns about inflation and fiscal policy. At the same time, the strong dollar makes Brazilian assets more attractive.

Source: Brazilian Central Bank

Brazil Needs Energy

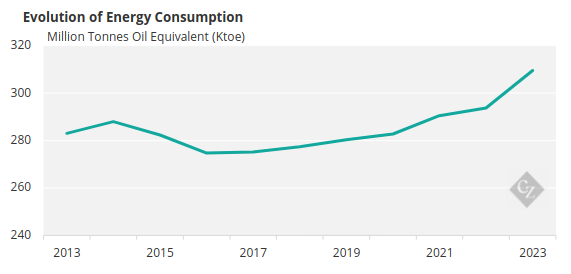

The expansion of energy consumption in Brazil and the need to increase installed capacity have been also motivating large companies to more carefully analyse offers for acquiring assets in the sector.

“There are good assets in a high demand sector, which has awakened the market’s appetite,” says Alexandre Viana, CEO of consultancy Envol. Energy consumption grew by 10% between 2019 and 2023 alone, according to EPE (Energy Research Company). Electricity consumption is expected to grow by an average of 2.1% per year until 2034, EPE estimates.

Source: EPE

But there are infrastructure bottlenecks, mainly in the energy transmission network, to be overcome. Many deficiencies are related to regulatory issues and delays in new transmission line projects. However, M&A can help resolve some of these issues through increased investment in infrastructure modernisation.

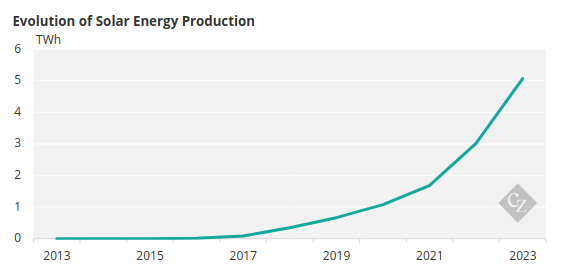

The expansion of the sector, driven by consolidation, should also help to more efficiently distribute the growing volume of renewable energy produced. Solar energy production increased by 657% between 2019 and 2023 alone, according to EPE.

Source: EPE

Renewable Energy Also Attracts Capital

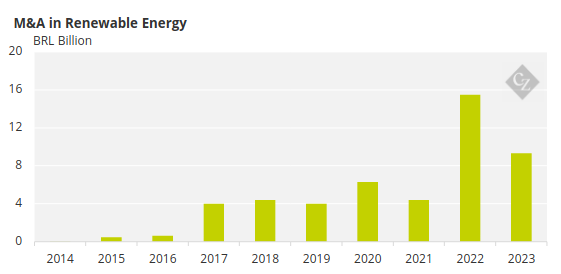

Unsurprisingly, the renewable energy sector has also been undergoing consolidation, in a movement that is expected to continue in the future. Over the past decade, M&A in the segment reached almost BRL 50 billion, according to consultancy Cela (Clean Energy Latin America), and should continue to grow, although at a slower pace than the generation, transmission and distribution of electrical energy.

Source: Clean

Legal changes in remuneration rules for distributed generation and small-scale electricity production contributed to a drop in investment in 2023. However, there should be a resumption in investments this year after more time has passed to adapt to the changes. Projects related to distributed generation and new fuels, such as green hydrogen, favoured by the Future of the Fuel bill, have returned to the radar. Approved in September last year, the legislation offers incentives for producing hydrogen and other biofuels.

“We must start to feel more strongly the positive impact of the Future of the Fuel bill and the need for greater energy demand,” says Camila Ramos, CEO of Cela.