Insight Focus

PTA Futures edged higher on a strengthening PX market and crude oil price volatility. PET resin export prices pushed marginally higher, produce margins remain compressed. Futures forward curves continue to show minimal forward premiums to May’25.

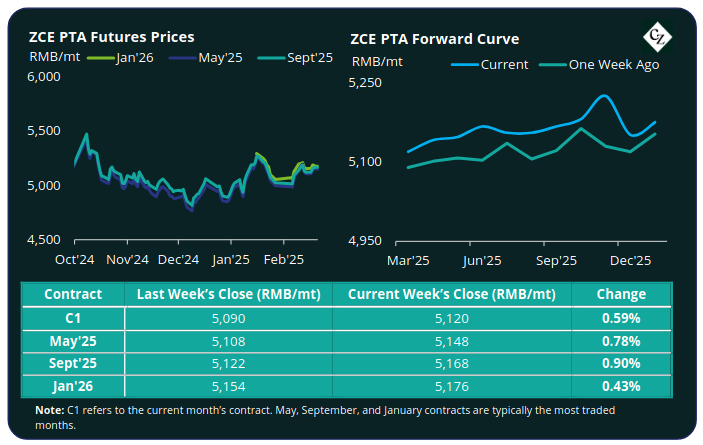

PTA Futures and Forward Curve

PTA Futures edged higher last week, with main contracts months adding close to 1% versus the previous week’s close.

Crude oil prices were rising through much of last week, before turning bearish late on Friday, with Brent oil prices dropping from nearly USD 77/bbl on Thursday back into the USD 74/bbl range by Friday close.

Recent US inventory build and potential US-Russia negotiations over Ukraine that could also lead to sanction relief are seen as bearish for the crude markets, although prices will likely remain rangebound in the near-term.

The PX-N CFR average weekly spread continued to strengthen to around USD 198/tonne. The PTA-PX CFR spread also receded, decreasing back to an average of USD 76/tonne last week, down USD 4/tonne on the previous week.

Whilst further PTA plant maintenance supports the supply and demand balance, the market remains subdued with higher spot inventory levels and downstream destocking. Average PTA operating rates have dropped to just 78%.

The PTA forward curve remained in slight contango over the next 12 months, with the May’25 contract holding a RMB 28/tonne premium over the current month’s contract. The Sept’25 has a RMB 48/tonne premium.

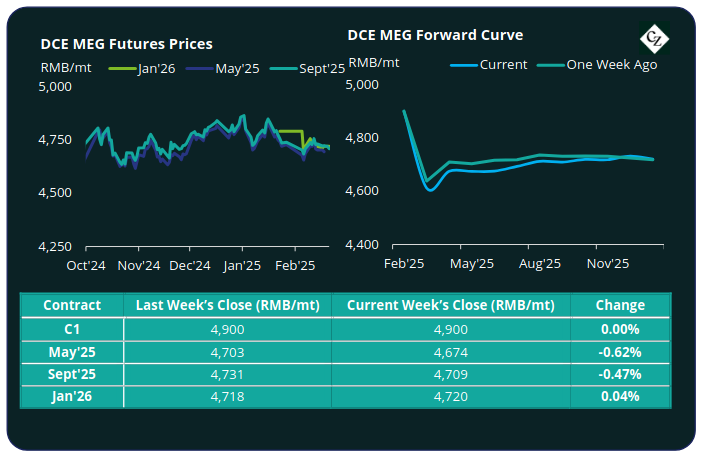

MEG Futures and Forward Curve

MEG Futures weakened, reversing out the previous week’s gains. Main month contracts of May’25 and Sept’25 lost around 0.5%.

East China main port inventories increased by just 0.7% to around 730,000 tonnes as both import arrivals and offtake slowed. Import arrivals are expected to intensify in the coming week, potentially weakening MEG prices further.

Whilst polyester operating rates increased to around 88%, MEG trading was slow as downstream orders remained weak, with concerns around the strength of the polyester market into March.

Beyond the current month’s contract that is ending, the MEG Futures forward remains flat with the Sept’25 contract at just a RMB 35/tonne premium over the next main month contract of May’25.

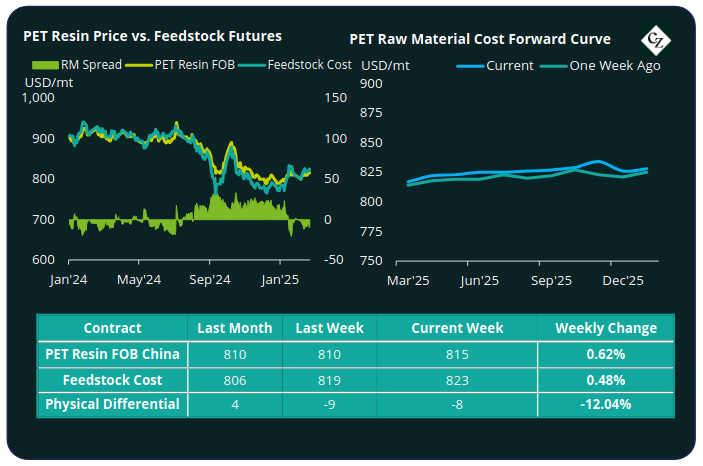

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices firmed modestly last week increasing a further USD 5/tonne to average USD 815/tonne by Friday.

The average weekly PET resin physical differential against raw material future costs improved very slightly to a weekly average of negative USD 8/tonne last week, up by USD 2/tonne. By Friday, the daily differential was negative USD 8/tonne.

The raw material cost forward curve remained relatively flat, with May’25 holding just a USD 6/tonne premium over Mar’25, and Sept’25 holding a USD 10/tonne premium.

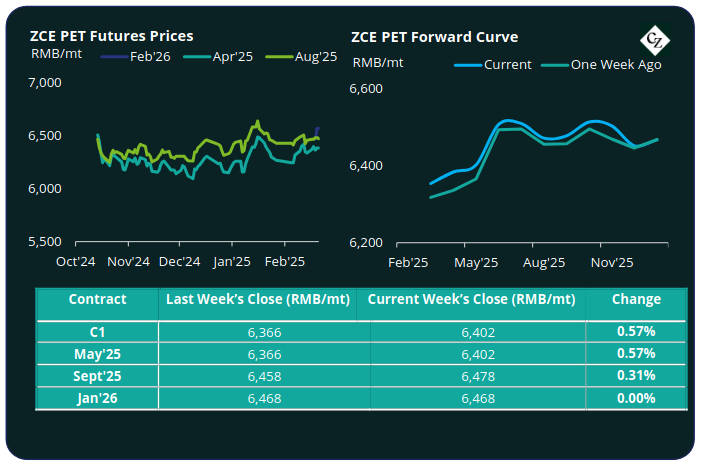

PET Resin Futures and Forward Curve

PET Resin Futures saw near-term contracts further gains of around 0.6% last week, supported by increases in raw material costs.

The Mar’25 contract, the first contract month of these new futures, increased to RMB 6,402/tonne (USD 883/tonne), equating to an FX adjusted increase of USD 5/tonne versus last week.

The average weekly premium of the Mar’25 PET Futures over Mar’25 Raw Material Futures increased to USD 19/tonne, up USD 2/tonne. By Friday, the daily premium was USD 19/tonne.

The PET Resin Futures forward curve kept relatively unchanged across the main contract months. May’25 held just a RMB 48/tonne (USD 7/tonne) premium over the main Mar’25 contract and Sept’25 held a RMB 124/tonne (USD 17/tonne) premium.

Concluding Thoughts

Overall, the Chinese PET resin export market remains weak, with increasing factory stock levels (now over 20 days average) despite the low operating rates.

In the short-term, prices are expected to keep rangebound supported by supply constraint, with over 2.5 million tonnes of PET resin capacity currently under maintenance.

However, from mid-March onwards improved seasonal demand is likely to be counter-balanced by returning production keeping processing margins compressed.

This outlook is also reflected in both the Raw Material and PET Futures forward curves, with forward premiums to May’25 at just USD 6-7/tonne.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.