This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Sugar remained slow ahead of the International Sweetener Colloquium. Prices were unchanged, with limited bookings for 2025-26. The USDA forecasts ample sugar supplies for 2024-25, but tight global raw sugar markets and lower domestic beet acreage could drive prices up.

Spot and forward cash sugar trading was slow during the week ending February 21, with prices unchanged. Most traders were looking forward to sideline meetings during the International Sweetener Colloquium (February 23-26) in Palm Springs, California.

To date, only a limited amount of sugar has been booked for 2025-26, with some small volumes booked at prices said to be “in line” with 2025 values. Sellers have been holding out for steady to firmer prices in 2026, while buyers, noting slow deliveries and adequate supplies this year, are holding out for lower offers.

Traders have scheduled meetings at the Colloquium, but neither buyers nor sellers expect a rush of sales. More contracts are anticipated in the weeks and months following the event, which follows a more traditional trading pattern. In contrast, two years ago, contract signings at the 2023 Colloquium were possibly the highest on record as buyers sought to lock in limited sugar supplies.

USDA Forecasts Ample Sugar Supplies

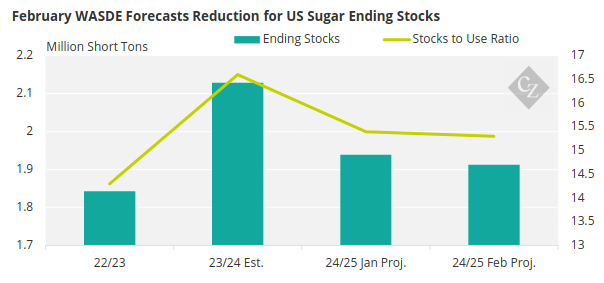

In its February WASDE Report, the USDA forecast a 15.3% ending stocks-to-use ratio in 2024-25, indicating ample supplies. A ratio as low as 13.5% is (arguably) considered adequate to meet domestic needs.

Source: USDA

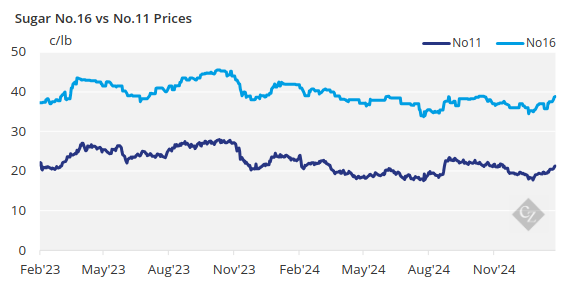

However, waiting too long to buy sugar for 2025-26 isn’t without risk. Recent strong gains in No. 11 (world) and No. 16 (domestic) raw sugar futures indicate a tightening supply situation globally and will provide support to US refined sugar prices, especially considering the large imports of high-tier sugar that are tied to raw sugar values.

Additionally, the prospect of lower sugar beet acreage in 2025 could reduce domestic production from the record-high levels forecast for this year.

Beet Planting Expected to Slow

Many in the trade expect 2025 sugar beet plantings to remain flat or decrease from 2024, as it appears several beet processors will carry stocks into 2025-26 following this year’s larger-than-expected production. Lower acreage may also reduce the number of early-harvested beets, resulting in less new crop sugar counted in the 2024-25 marketing year.

A key factor in determining the pace and price of 2025-26 sugar contracting may be deliveries. Beet processors have reported slower-than-expected deliveries of contracted sugar for 2024-25, with no indication that the pace is improving as the year progresses.

The USDA’s February Sweetener Market Data report showed that sugar deliveries in December were down 4.4% from December 2023, and October-December deliveries were down 4.9% compared to the same period the previous year.

Corn sweetener markets were quiet due to ongoing logistical challenges from wintry weather across the Midwest.