Insight Focus

PTA and MEG Futures retreated this week. This was attributed to a substantial shift in crude oil prices and bearish outlook. PET resin export prices also responded by falling back below the USD 800/tonne level. The futures forward curves remain flat through to peak season, with prices continuing to closely track upstream costs.

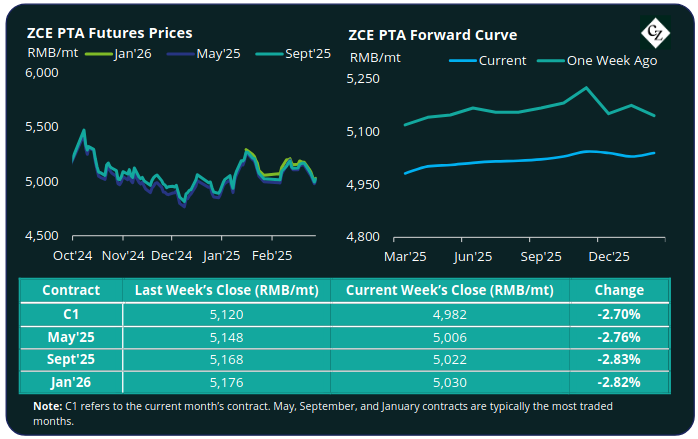

PTA Futures and Forward Curve

PTA Futures retreated on falling upstream values last week, with main contract months dropping around 2.75%.

Crude oil prices experienced their first weekly loss in a month driven lower by concern about the US economy, tariffs and the prospect of peace in the Ukraine. OPEC+ is also expected go ahead with its production cut unwinding scheduled for April.

At the time of writing, Brent crude was trading at USD 72.70/bbl, down from over USD 75/bbl on Monday.

The PX-N CFR average weekly spread narrowed by around USD 8/tonne as some plants returned from maintenance, while the PTA-PX CFR spread improved modestly, increasing back to an average of USD 79/tonne last week, up USD 3/tonne on the previous week.

PTA plant operating rate remained stable, with the recent ramp up in polyester operating rates also slowing, keeping fundamentals relatively balanced.

The PTA forward curve continued to slowly flatten, although still in slight contango over the next 12 months, with the May’25 contract holding a RMB 24/tonne premium over the current month’s contract. Sept’25 held a RMB 40/tonne premium.

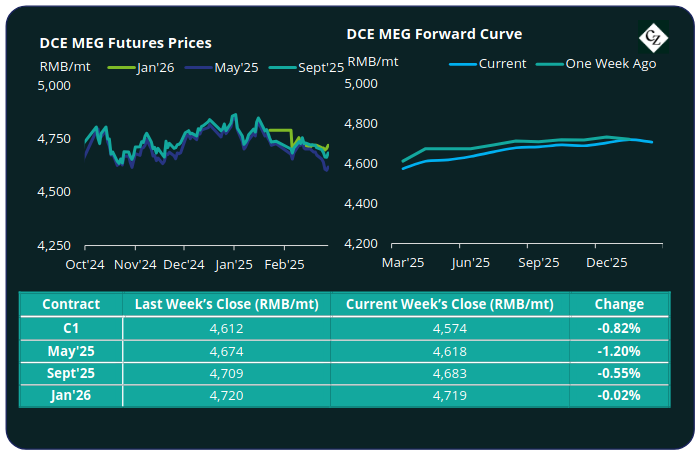

MEG Futures and Forward Curve

MEG Futures also continued to weaken, losing around a further 1% on the previous week, adding to the consecutive weekly downward pressure on prices.

East China main port inventories decreased by 4.3% to around 699,000 tonnes as import arrivals and offtake improved.

However, sustained inventory reduction through the next month will be challenged due to ample downstream polyester stock and continued flow of deep-sea arrivals.

As a result, MEG supply and demand fundamentals are expected to remain in tight balance in March, with near-term prices tracking crude oil price trend and supply planning.

MEG Futures forward curve remains flat with the May’25 contract holding RMB 44/tonne premium over current month. Sept’25 contract is at a RMB 109/tonne premium.

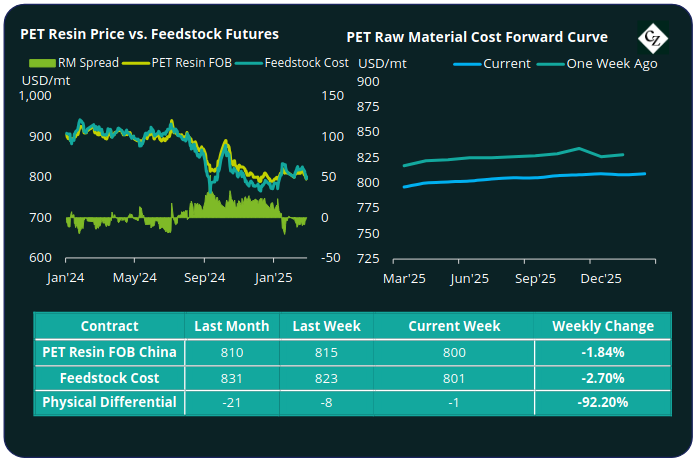

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices fell considerably on weaker raw materials last week, decreasing USD 15/tonne to average USD 800/tonne by Friday.

The average weekly PET resin physical differential against raw material future costs improved to a weekly average of negative USD 4/tonne last week, up by USD 6/tonne. By Friday, the daily differential was negative USD 1/tonne.

The raw material cost forward curve remains flat, with May’25 holding just a USD 5/tonne premium over Mar’25, and Sept’25 holding a USD 9/tonne premium.

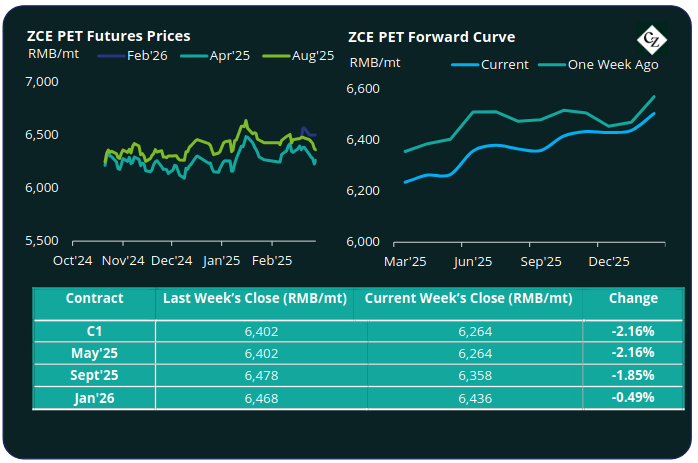

PET Resin Futures and Forward Curve

PET Resin Futures followed raw materials lower, giving up around 2% on average versus the previous week’s close.

The Mar’25 contract, the first contract month of these new futures, fell to RMB 6,264/tonne (USD 860/tonne), equating to a substantial FX adjusted decrease of USD 23/tonne versus last week.

The average weekly premium of the Mar’25 PET Futures over Mar’25 Raw Material Futures increased to USD 24/tonne, up USD 5/tonne. By Friday, the daily premium was USD 23/tonne.

The PET Resin Futures forward curve kept relatively unchanged across the main contract months. May’25 held just a RMB 30/tonne (USD 4/tonne) premium over the main Mar’25 contract. Sept’25 kept at a RMB 124/tonne (USD 17/tonne) premium.

Concluding Thoughts

Chinese PET resin supply and demand fundamentals remain relatively unchanged with factory stock level adding to price pressure.

While the physical differential has improved, it remains constrained due to oversupply. In general, PET resin export prices are likely to keep stable to soft.

Raw material and PET futures forward curves continue to both show very minimal upside into peak season, meaning pricing is expected to closely track raw material costs in the near term.

Looking at crude’s prospects, according to the EIA’s latest projection, “gradual increases in production combined with relatively weak global oil demand growth will increase global oil inventories in the second half of 2025.”

The current EIA outlook is for Brent crude oil price to average USD 74/bbl in 2025 before falling to USD 66/bbl in 2026. As a result, PET resin export prices are expected to face continued headwinds through 2025.