Insight Focus

The government has announced it will allow for 1 million tonnes of exports in the 2024/25 season. Domestic sugar prices have been strengthening throughout February. Export margins are positive for both raw sugar and refined sugar.

Maharashtra Sugar Imports/Exports

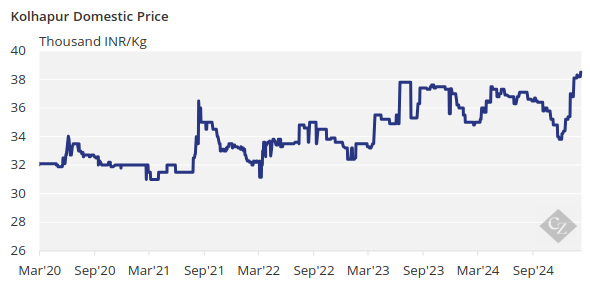

Domestic sugar prices have been climbing up throughout February, hitting a 6-year high at INR 38,500/tonne this week.

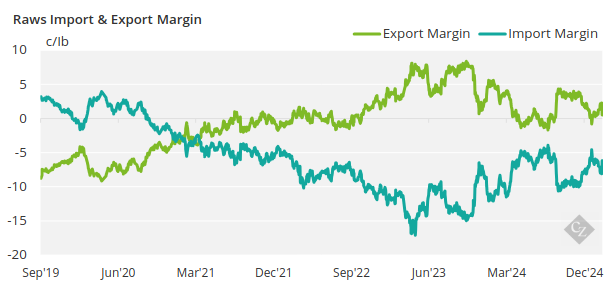

The raw sugar export margins are positive today, as mills would earn around 0.5c/lb over the domestic market. Export margins have been workable so far due to the recent strength in the world market prices in combination with a weakening INR. However, at today’s prices exports become unviable if the domestic price reaches around INR 39,500/tonne.

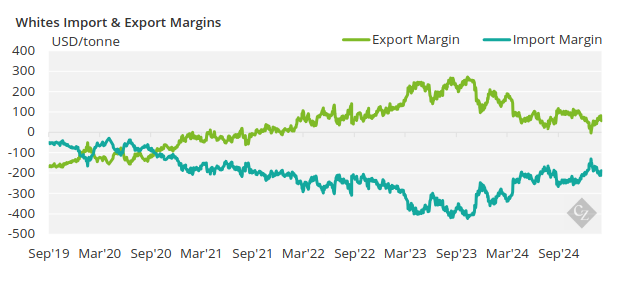

White sugar export margins today are also positive as mills would earn around USD 28/tonne.

Ethanol vs Sugar

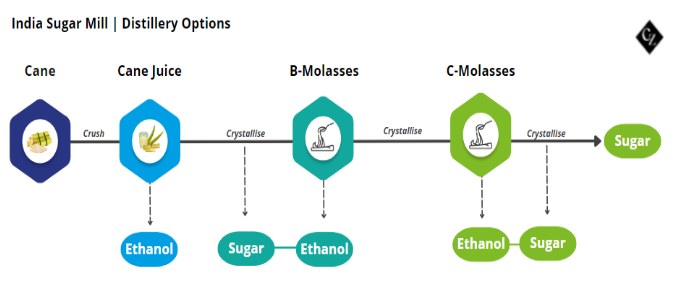

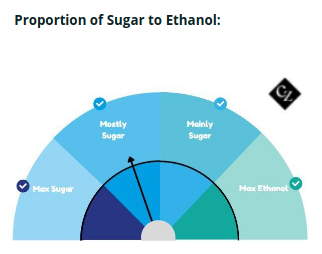

Many mills/distilleries have a choice over which feedstocks they use to make sugar or ethanol based on the relative prices of ethanol paid by the oil marketing companies.

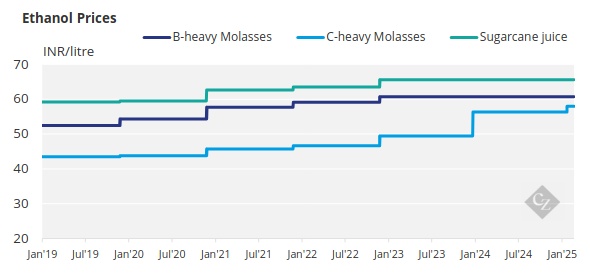

The Indian government has raised prices for C-molasses by 3% for the 2024/25 season to ensure that there is enough ethanol for the Ethanol Blending Program (EBP), as the 20% ethanol blending target is due this year.

Like the current season, the government had incentivised C-molasses production in the previous season to ensure that there was enough sugar supply for domestic consumption as food security was a priority for the government at the time.

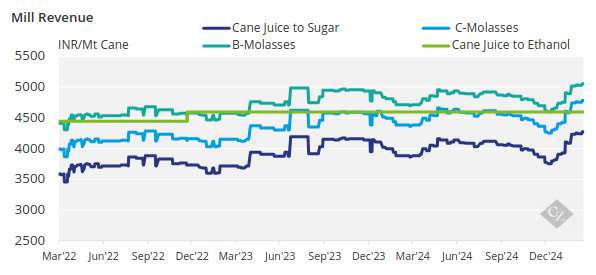

The revenue generated by the mills based on the type of feedstock used can be seen in the chart below:

Here are the current prices paid for ethanol by feedstock:

Appendix