Insight Focus

The Mar’25 raw sugar futures contract expired on Friday. Both raw and refined sugar futures curves have weakened over the past week. Speculators reduced their short position by 48.4k lots.

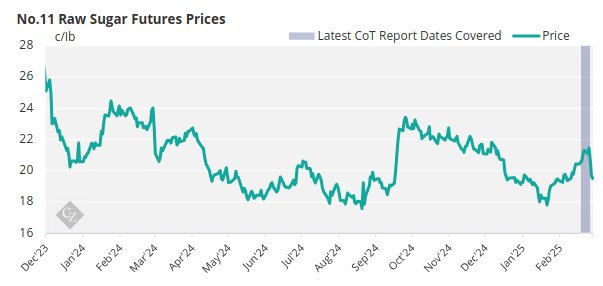

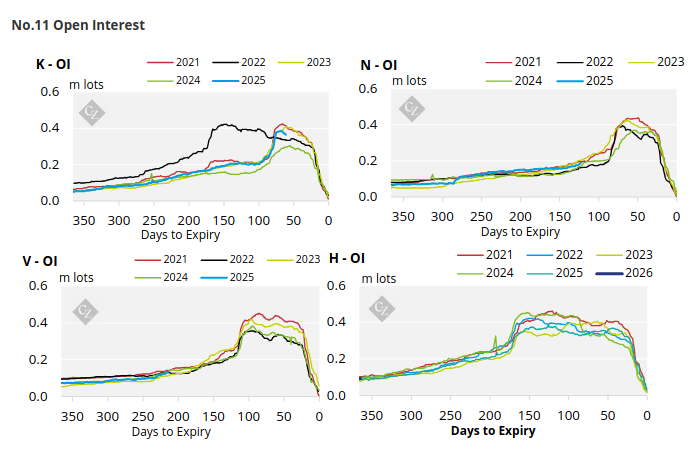

New York No.11 Raw Sugar Futures

During the week of the Mar’25 expiry, raw sugar futures traded between 20-21.5c/lb before trading lower on Thursday. The Mar’25 contract settled at 19.51c/lb, with the market now trading in the 18-19c/lb range.

The Mar’25 raw sugar futures contract expired on Friday. Both raw and refined sugar futures curves have weakened over the past week. Speculators reduced their short position by 48.4k lots.

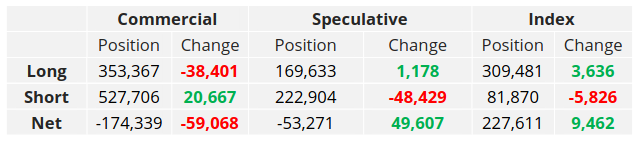

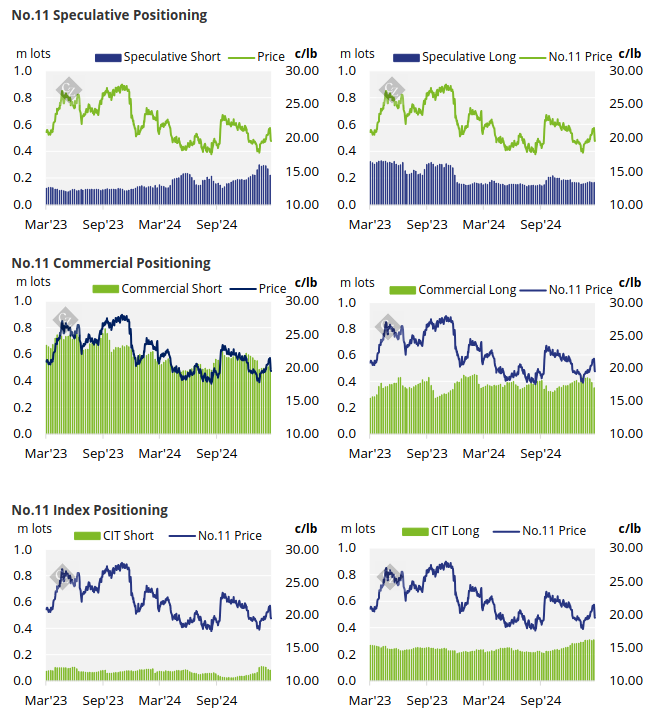

No.11 Commitment of Traders Report (25 February 2025)

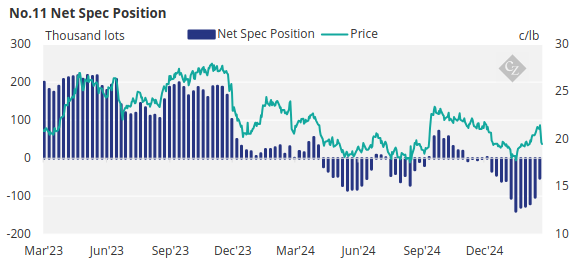

Speculators have closed out 48.4k lots of short positions while adding minimally to their long position. The net-short position now stands at -53.3k lots.

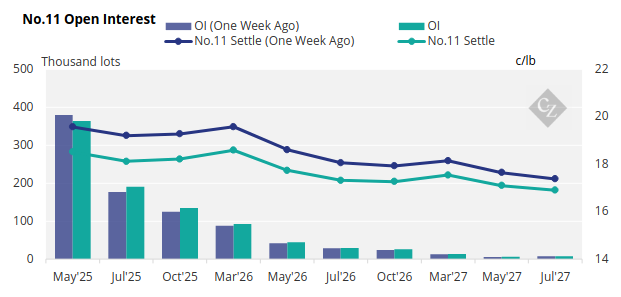

The No. 11 forward curve has weakened across the board.

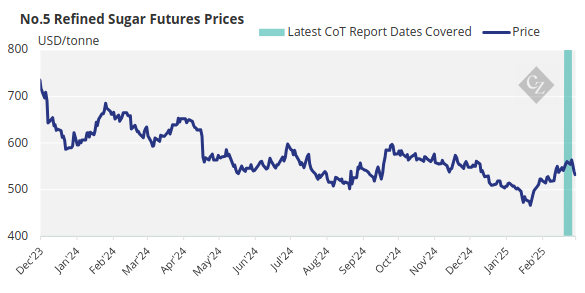

London No.5 Refined Sugar Futures

Looking at the No. 5 refined sugar futures, prices have moved lower over the past week and hit USD 532.6/tonne by Friday’s close.

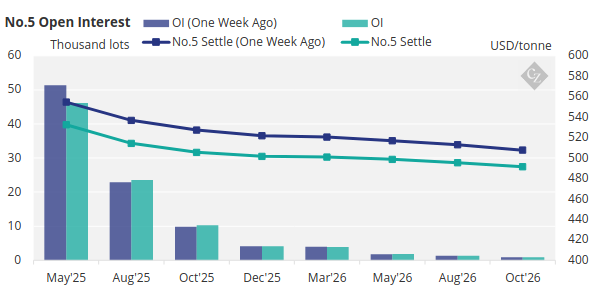

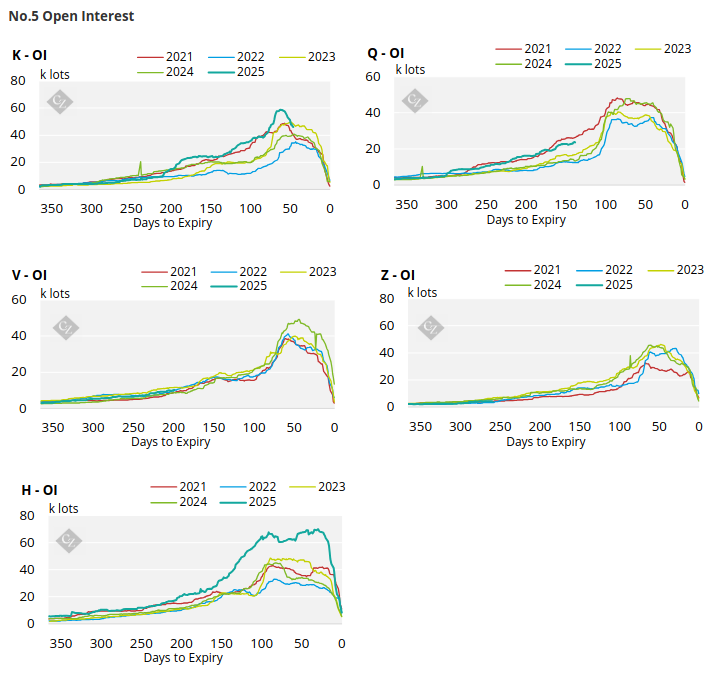

No.5 Open Interest

Following a similar trajectory to the No.11 raw sugar futures, the No.5 refined sugar futures curve has also weakened across the board.

White Premium (Arbitrage)

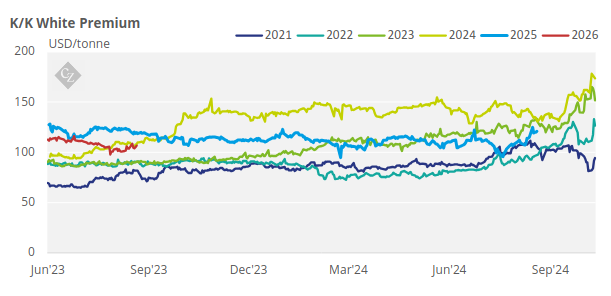

The K/K white premium traded between USD 122-124.3/tonne in the past week.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

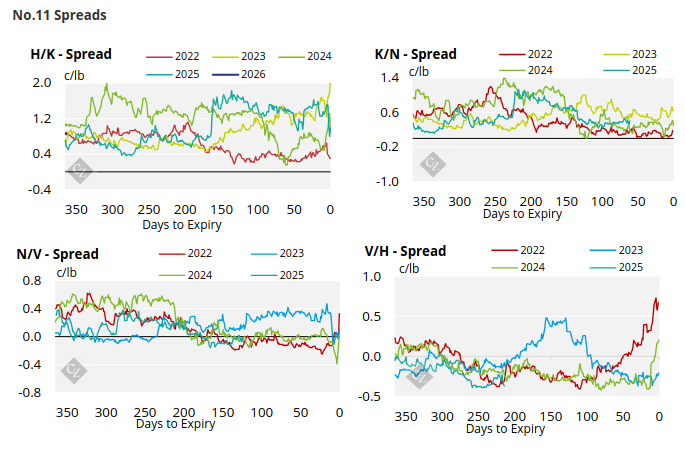

No.11 (Raw Sugar) Appendix

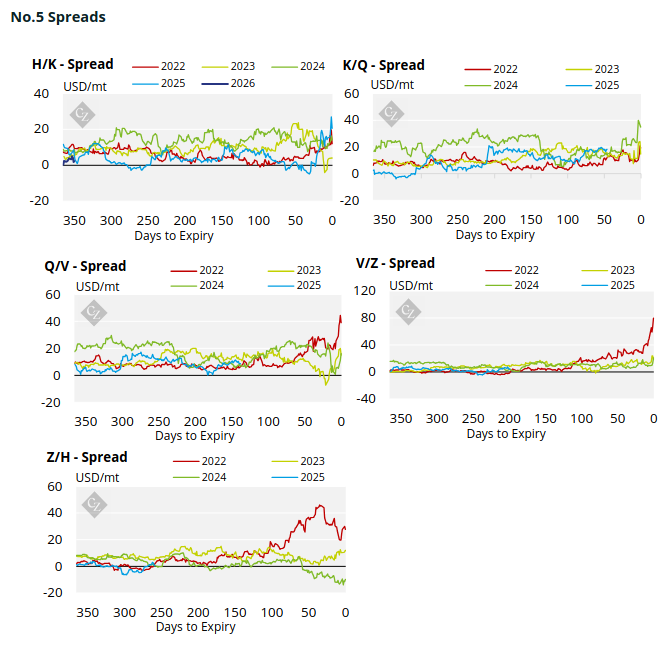

No.5 (White Sugar) Appendix

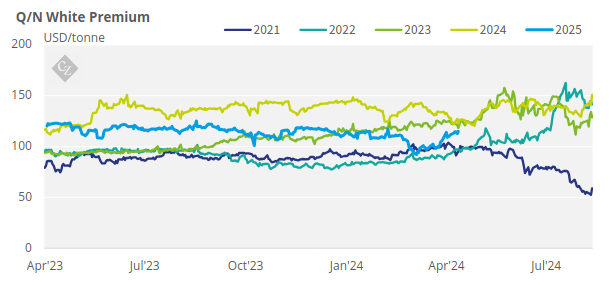

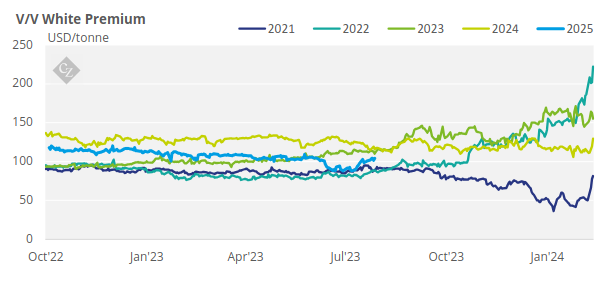

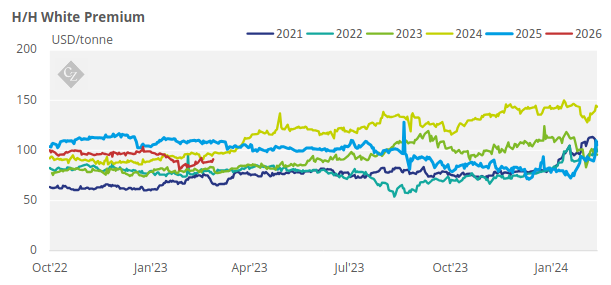

White Premium Appendix