Insight Focus

Urea prices decline due to India’s tender delay and weak demand. Processed phosphate prices remain steady due to limited supply. Potash prices are set to rise with curbed production and strong demand. Ammonia prices are under pressure from high production outpacing demand.

Urea Prices Slide as India Delays Tender

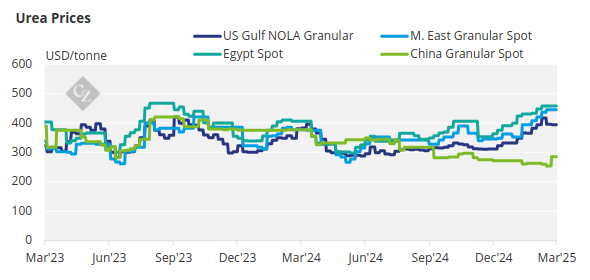

The international urea market price continues to decline across the board, primarily due to the lack of any announcement of a urea purchase tender by India. However, it is expected that a tender could soon be announced by the government agency IPL. The question remains: for how much quantity and which shipment period? According to data, India’s current inventory stands at around 5 million tonnes, which is considered low.

Underscoring the continued weakness in the market, spot trading has been slow. Qatar Energy’s tender for a 45,000 tonne April shipment attracted bids at USD 415/tonne FOB, down USD 22/tonne from the February 2025 tender. Pupuk Indonesia caved in and sold 90,000 tonnes at USD 399/tonne, compared to their expected price of USD 427/tonne FOB. Just a week ago, they rejected USD 411/tonne FOB. US/NOLA April barge prices are at an equivalent USD 411-413/tonne CFR. Adding to this, the Trump administration introduced 25% tariffs on all products coming from Canada and Mexico.

However, this tariff has now been suspended until April 2, with a 10% tariff expected to be the new level. On net border trade between Canada and the US, Canada is up by approximately 3% versus the US on exports. However, in terms of UAN solutions, the US imported 386,000 tonnes from Canada in 2024 versus exporting only 35,000 tonnes to Canada. Total US imports of UAN Solution from all countries in 2024 amounted to 2.4 million tonnes, while exports stood at 1.8 million tonnes. The impact of the 25% tariffs imposed on Canada remains to be seen.

Egypt has remained quiet on the export front for the past few weeks, with previous sales committed through the middle of March. Current indications are at around USD 430-435/tonne FOB, albeit with no buying interest.

The outlook for urea prices remains bearish until India announces a tender, given the absence of support from major markets like Brazil, the US, and Europe.

Phosphate Trade Shifts Amid US Tariffs

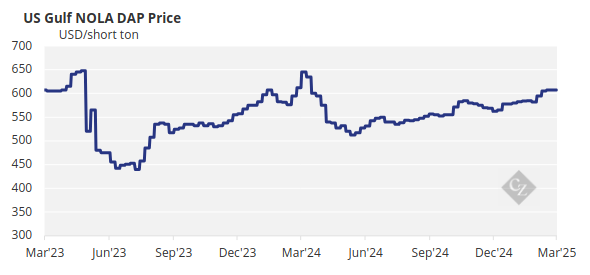

The impact on US farmers from a 25% tariff on Mexico would be significant, particularly on DAP/MAP products. Since Morocco, China, and Russia are excluded from the US market due to anti-dumping measures, Mexico’s exports to the US surged in 2024 to 518,000 tonnes, compared to 200,000 tonnes in 2023 and just 108,000 tonnes in 2022. MAP imports to the US from Mexico now account for around 25% of the total. Furthermore, the US exports over 1.5 million tonnes of MAP/NPS/NPK to Canada, which will have an impact with the Canadian government’s reciprocal tariffs.

In other news, the Brazilian market is quiet due to its annual Carnival. EABC of Ethiopia rejected the revised DAP offers on March 4 from its February 20 tender for 540,390 tonnes, as the targeted price of USD 625/tonne FOB could not be met. To date, it is estimated that EABC has secured only around 700,000 tonnes of DAP versus the target of 1.27 million tonnes. Another purchase tender is expected to be announced soon.

India has gone quiet over the past few weeks, although Ma’aden appears to be active, rumoured to be discussing a 60,000 tonne sale at a price in or around their past sale at USD 636/tonne CFR. India is in critical need of DAP for the Kharif season starting on April 1, with an inventory of only 1.1 million tonnes versus 2 million in 2024 and 3 million tonnes in 2023.

China may offer some relief with expectations that exports will resume at the end of April or early May. The flipside is that Chinese producers will likely demand much higher prices, as sulphur prices have reached USD 240/tonne CFR China. About 30% of the production cost of DAP is related to sulphur pricing, meaning DAP pricing in China is expected to reflect the increased sulphur price.

OCP of Morocco exported 3.94 million tonnes of DAP in 2024, up from 3.84 million tonnes the year before. MAP exports reached 3.74 million tonnes, up 9% from 3.45 million tonnes. Although MAP exports to Brazil fell significantly, Australia picked up the slack, importing 746,080 tonnes versus 323,279 tonnes the year before. OCP’s capacity for processed phosphates in 2025 is expected to be 16.5 million tonnes, with exports around 14.5 million tonnes.

Potash Prices Rise Amid Trade Barriers

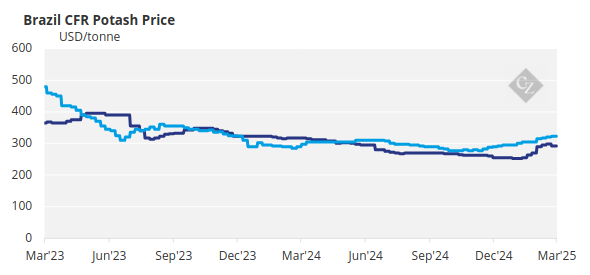

Potash prices are increasing due to production curtailments in both Belarus and Russia. Evidence of this was seen in the most recent Pupuk Indonesia tender, which resulted in offers of granular MOP at USD 352.25/tonne CFR from a Chinese participant with support from Laos. The standard MOP price was offered by Uralkali at USD 335/tonne CFR. The tender has yet to be finalised.

The impact of the 25% tariffs imposed on Canada could have serious long-term effects, as the USA imports up to 10 million tonnes of MOP annually from Canada, representing about 80% of total imports. Alternative sources are limited, with Belarus under sanctions and Russian MOP unavailable. Only about five to six countries produce MOP at a significant scale: Canada, Russia, Belarus, Germany, Israel, and Jordan, with Laos gradually increasing capacity with Chinese investment. The outlook for potash prices is bullish.

Ammonia Prices Continue Fall

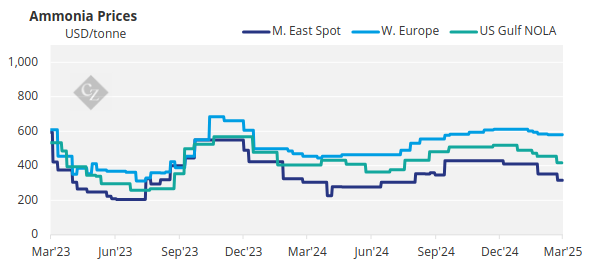

High operating rates of ammonia production have resulted in continued downward price movement. The March Tampa contract settlement between Mosaic and Yara dropped USD 40/tonne to USD 460/tonne CFR Tampa. However, there is optimism among producers that prices will rise in the US, with the spring season expected to be strong. Europe remains uncertain, with forward gas prices fluctuating significantly, causing premium prices to come under pressure. Producers in the Middle East and Southeast Asia are asking contract buyers to take advance shipments to alleviate inventory buildup.

The outlook for ammonia prices is bearish, with potential increases starting from September onwards.