Insight Focus

Tariff chaos and a plummeting dollar helped US grains recover last week. However, European grains have plummeted. It remains difficult to forecast market direction due to import tariffs on key US trade partners, currency volatility and the upcoming March WASDE.

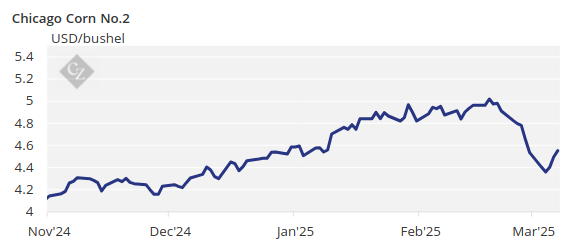

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 4.55/bushel. The average price since September 1 has been USD 4.40/bushel.

Tariff chaos and a plummeting dollar helped US grains recover, closing the week unchanged, while European grains plummeted.

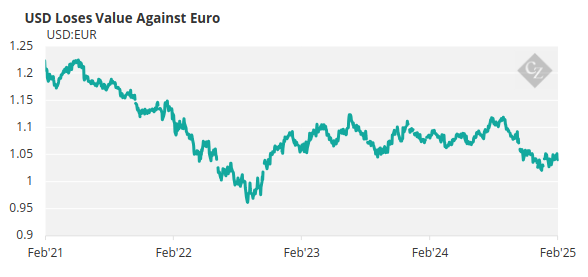

Besides the back-and-forth on import tariffs, the dollar dropped last week, with the dollar index falling 3.4% and the USD declining 4.4% against the EUR, both week on week, giving US grains an advantage over Europe. The expiry of the March contracts on both sides of the Atlantic also added to the volatility of the week.

Source: St Louis Fed

It is difficult to forecast market direction amid the chaos influencing the markets. Just some of the impacting factors are import tariffs on key US trade partners, currency volatility the March WASDE report this week and weather.

We anticipate a pause in tariff-related headlines this week, as last week seemed to cover everything. Therefore, the focus should be on the March WASDE, and if anything, we don’t think it will be bearish, as we don’t see the risk of an upward revision to US or world stocks.

Corn Recovers After Trump Delays Tariffs

At the start of last week, US tariffs on imports from China, Mexico and Canada went into effect, with 20% tariffs on Chinese products, up from the previous 10% and 25% tariffs on Mexican and Canadian products. China responded by imposing tariffs on US corn, wheat and other agricultural products.

March corn in Chicago opened negatively last week following the start of tariffs on Mexico, Canada and China, and the corresponding retaliatory tariffs announced by Canada and China. However, the market found a floor by midweek and rallied on Thursday after Trump delayed the implementation of tariffs on Mexico for another month, with a suggestion from the US Secretary of Commerce that this might apply to Canada as well, though nothing was officially confirmed.

A plummeting dollar also favoured the recovery of US grains.

Weekly export sales of US corn came in stronger than expected, but this had a neutral impact on the market, which was focused on the tariff soap opera.

Corn harvesting in Argentina is 6.7% complete, and conditions have improved. BAGE maintains its estimate at 49 million tonnes.

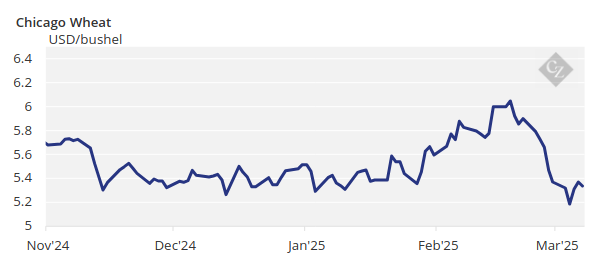

China Imposes Import Tariffs on US Wheat

Wheat also fell last week, driven by the same factors as corn, but also because ABARES in Australia published its forecast for 2024/25 wheat production, increasing it by 2.21 million tonnes to a total of 34.1 million tonnes.

China imposed 15% import tariffs on US wheat, which will have little impact due to historically low trade flows between the US and China for US wheat, but it added to the bearish sentiment last week.

The Russian weather service reported that 87% of wheat is in good or excellent condition, much better than the 63% published in December.

French wheat conditions are 74% good or excellent, up 1 percentage point from last week and six points higher than last year.

The US is expected to experience warmer-than-average temperatures and mostly dry conditions. Brazil is expected to receive rain after a heatwave last week, and Argentina is also expected to receive rain. Northwestern Europe is forecast to receive rain, while eastern Europe and the entire Black Sea region are expected to have warm temperatures, resulting in snow melting.

The March WASDE report will be released this Tuesday, and we expect lower US corn stocks due to higher demand for ethanol and increased exports. However, we could also see a reduction in world stocks due to lower production in Argentina and Brazil.