Insight Focus

President Trump has become a major disruptor in the wheat market. History shows that political events, like Russia’s 1972 grain deal and the 2022 Ukraine invasion, can drastically affect wheat prices. However, market fundamentals will ultimately prevail over political disruptions.

Anyone following the wheat market—or any other commodity market—typically examines weather reports, production forecasts, seasonal trends and supply-demand dynamics. Politics often ranks lower on the list, even though government subsidies, taxes and domestic prices are relevant.

In recent weeks, however, US President Donald Trump has embarked on a raft of trade tariffs on most of the world, which seems quite a radical approach.

In an extraordinary exchange, we have seen President Donald Trump and his second-in-command JD Vance attempting to strongarm another head of state, President Volodymyr Zelensky of Ukraine.

The current US President is definitively trying to make his mark, whether in relation to economic trade, conflicts, security alliances or simply upending the previously assumed world order.

The Present

US President Donald Trump is seemingly embarking on a trade war with virtually the whole world, as he follows his mantra of ‘Making America Great Again’.

He has upended security alliances with Europe, NATO, Ukraine and threatens to take over Canada, the Panama Canal and Greenland, by any means necessary. These actions, all within 50 days of his inauguration, are weighing heavily on the minds of many across the world.

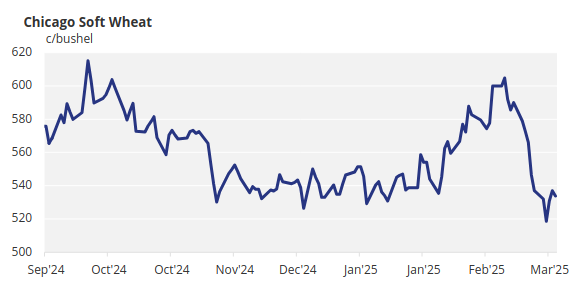

The recent drop in wheat prices has been due to a fear of significant economic turmoil being brought upon the world as a result of trade wars from the world’s largest economy, the US. The result is a damaging of confidence and thus potentially less demand for commodities. A reduction in wheat demand will ultimately have a negative impact on values, unless supply drops by more, which is possible.

The Past

History has some notable examples where politicians have had a radical impact on wheat prices.

The Great Russian Grain Robbery of 1972-1973

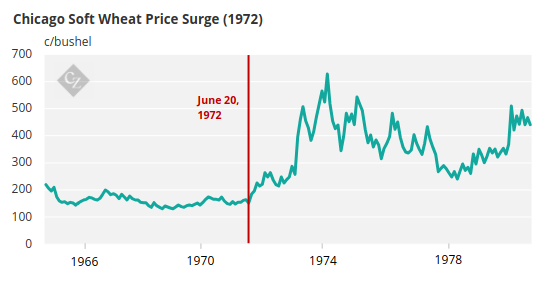

In 1972, Russian politicians knew that the country’s wheat crop was looking very poor for a second successive year and that it would need to buy wheat.

On June 20, 1972, the Russian minister of foreign trade, Nikolai Patolichev, led a team to negotiate a grain deal with the US, where the US government agreed to provide credit for Russian purchases.

The upshot was that by September 1972, the Russians had discreetly bought many times the amount originally indicated, with nearly 10 million tonnes of grains, mainly wheat, from the US, as well as France, Canada and Australia. To add insult to injury, the US government had subsidised these purchases with some USD 300 million.

The world lacked the sophisticated satellite imaging systems that we see today, providing constant updates on harvest prospects across the globe, so others were not aware of the Russian’s plight. However, only weeks following the deal the first Earth-observing ‘Landsat 1’ satellite was launched, analysts began to appreciate the scale of the Russian crop woes.

Once grain traders, who had sold the wheat, realised the scale of the Russian and indeed global stock shortage, prices spiked to levels never previously seen. They never returned to pre-June 1972 levels again.

Russia’s Invasion of Ukraine in 2022

On February 24, 2022, Russia’s President Vladimir Putin ordered the full-scale invasion of neighbouring Ukraine. The unimaginable human suffering continues three years on, while the immediate impact on wheat prices was extreme.

Russia is the world’s largest wheat exporting country, while Ukraine was the fourth largest. Few had believed that the invasion would actually occur and thus the market’s reaction was swift and radical. Prices rose to levels never seen before, even the 2007/08 year of critically low world stocks did not create such turmoil.

Concerns centred around whether wheat would continue to be adequately exported through the Black Sea, from where Ukrainian and Russian wheat is shipped to the world — primarily to the biggest importers in the poorest North African nations.

The Black Sea Grain Agreement, brokered by Turkey and the UN, served well to facilitate the continuation of shipments. However, Putin’s decision to withdraw from the agreement on July 17, 2023, saw another meaningful spike in wheat values.

The Future

- The future may be uncertain, but history does help us understand how the future may unfold.

- Major political moves, be that a global trade war, an invasion concerning pivotal wheat players or indeed a discreetly engineered buying of much of the world’s wheat reserves, logic and calm heads will always prevail….in time.

- The Great Russian Grain Robbery in 1972 was an extraordinary feat by the Russian government. Although prices never fell back to pre-1972 levels, stability eventually returned.

- Putin’s war of aggression continues, but as an age-old trading saying goes: ‘what goes up must come down’, and prices did, almost as radically as they rose.

- The US President Trump may play his part in being a major market disruptor, but it is likely to be short lived.

- Where wheat is concerned, ‘the market is always right’….it will revert to weather, stocks and what populations can afford to pay.

- Politicians will never be bigger than the market, for any prolonged period of time!