This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Sugar sales remained slow through March 7. Tariffs on US imports from Mexico are adding to uncertainty, potentially raising prices, though sales are expected to remain low. The USDA is expected to lower its 2024-25 beet sugar production forecast, while weak demand further dampens the market outlook.

Slow Sugar Sales Persist

Spot and forward bulk sugar sales progressed at a slow pace during the week ending March 7, extending the snail’s pace evident at the February 23-26 International Sweetener Colloquium.

Prices remained unchanged with a weak tone after being lowered a week earlier. Adding to the lack of activity were the on-again, off-again 25% tariffs on imports from Mexico, the US’ largest source of imported sugar.

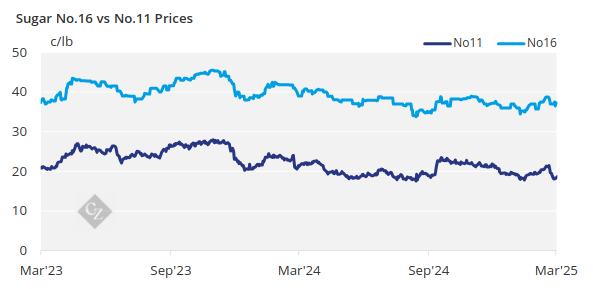

Traders arrived at the Colloquium with minimal sugar sold or bought for 2025-26, as sellers sought to hold offers at 2024-25 levels while buyers had lower prices in mind. A comment during the February 24 morning session from Frank Jenkins, president of JSG Commodities, stating that Midwest bulk refined beet sugar could trade “either side of 40c/lb”, set a tone of price weakness for the rest of the Colloquium and beyond.

Midwest beet sugar prices for 2025-26 were confirmed at 39c/lb FOB Midwest, with indications of some deals below that level, as one processor was said to be aggressive in its sales efforts. At the same time, other processors held firm at 40c/lb, which they claimed was the breakeven level (with reasonable profit) for their beet growers. Spot sugar sales remained slow, and prices were unchanged.

Users got the lower prices they had hoped for, but this has not resulted in an onslaught of buying. Sales have been completed, but activity has been light.

Tariffs Drive Uncertainty

There are mixed signals going forward. First, tariffs on all US imports from Canada and Mexico, which are currently a major area of uncertainty, could be seen as a bullish factor if imports from Mexico suddenly cost 25% more.

Even with the tariff, traders said sales would likely continue, but at a reduced level. The USDA was already expected to lower Mexico’s export limit in the March 11 World Agricultural Supply and Demand (WASDE) Report.

While the tariffs could open the door to more high-tier sugar imports, the fact that high-tier pricing currently “doesn’t work” may limit that option.

USDA Expected to Lower Beet Sugar Forecast

Also supportive of the market are expectations that 2024-25 beet sugar production, forecast by the USDA at a record-high 5.35 million tonnes raw value, will be lowered in an upcoming WASDE report. Traders cite warmer weather in some areas that may cause deterioration in outside beet piles.

A third bullish factor is the expectation of flat to lower planted sugar beet acreage in 2025, which may reduce the early harvest in August-September, resulting in less sugar counted in the current year.

Indications of weak demand provide an offsetting bearish influence on the market. The weak demand scenario was confirmed anecdotally at the Colloquium and was also reflected in earlier USDA data, which showed October-December deliveries down 4.9% from the same period a year earlier.

Corn sweetener markets remained quiet, with wintry weather again disrupting logistics across the Midwest.