Insight Focus

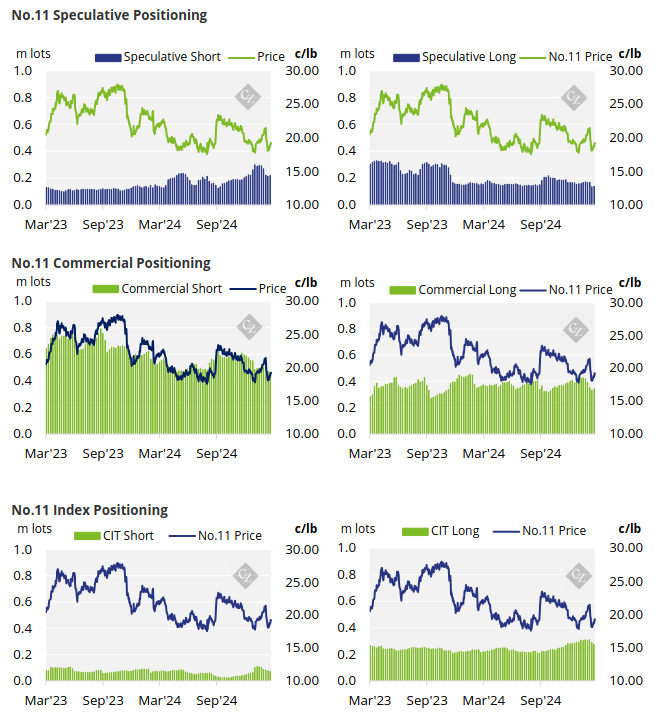

Both raw sugar futures and refined sugar futures traded higher over the past week. End-users were the more active participants on the commercial side. Speculators have added to both their long and short positions but remain net-short in the raw sugar market today.

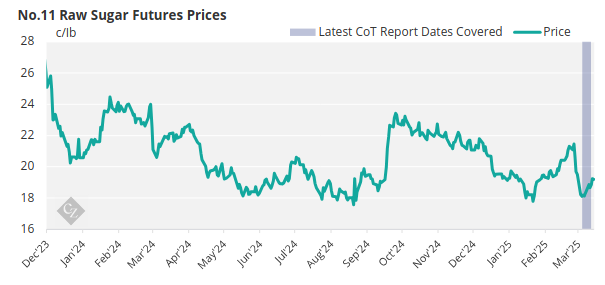

New York No.11 Raw Sugar Futures

The raw sugar futures strengthened last week, gradually rising towards 19c throughout the week before closing at 19.2c/lb on Friday.

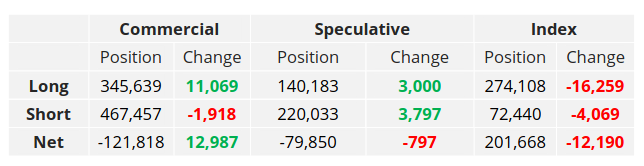

On the commercial side, end-users were the more active participants, adding 11.1k lots to their long positions. Whereas producers closed out under 2k lots of short positions.

No.11 Commitment of Traders Report (11 March 2025)

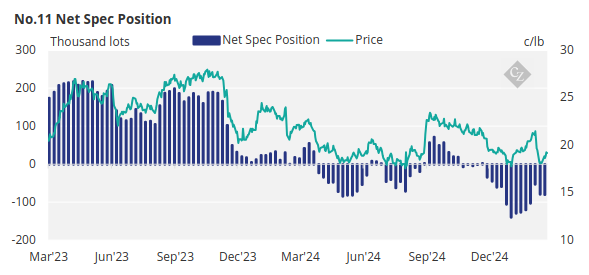

Speculators have opened both long and short positions over the past week increasing their long position by 3k lots while also adding to their short position by 3.8k lots.

Speculators are now net-short in the market by -79.9k lots.

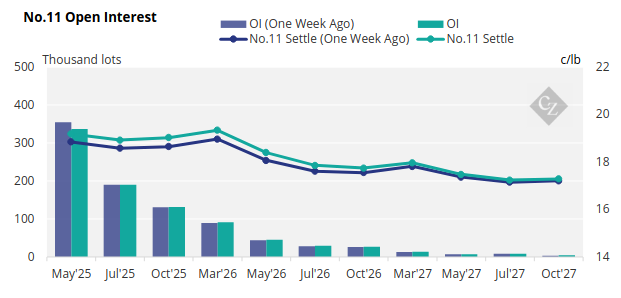

The No. 11 forward curve has strengthened across the board, particularly in the front months.

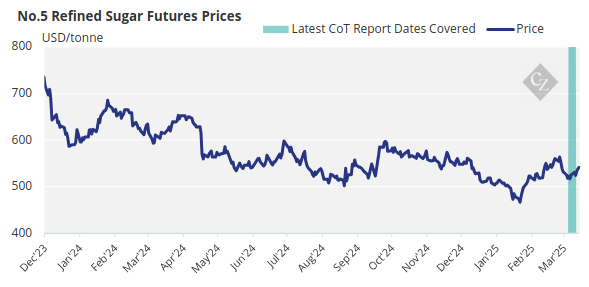

London No.5 Refined Sugar Futures

The no.5 refined sugar futures climbed up towards USD 540/tonne throughout the week, trading between USD 524.5-539/tonne, before closing at USD 541.5/tonne on Friday.

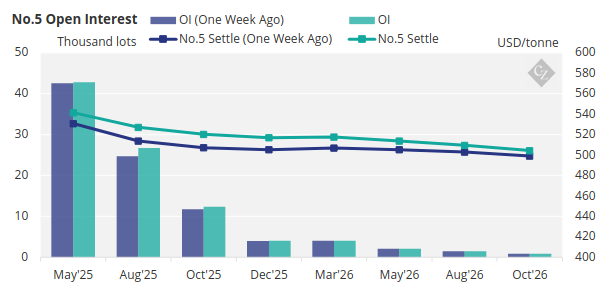

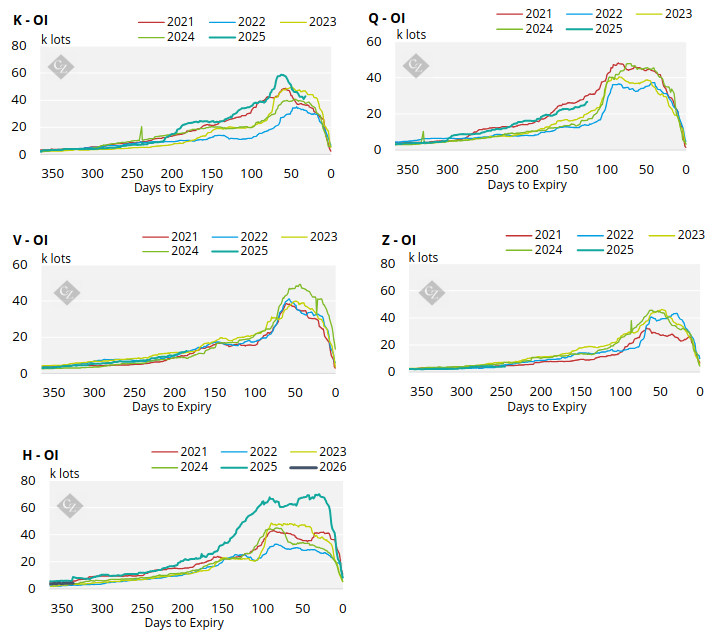

No.5 Open Interest

Like the no.11 raw sugar futures curve, the No.5 refined sugar futures curve has also strengthened across the board.

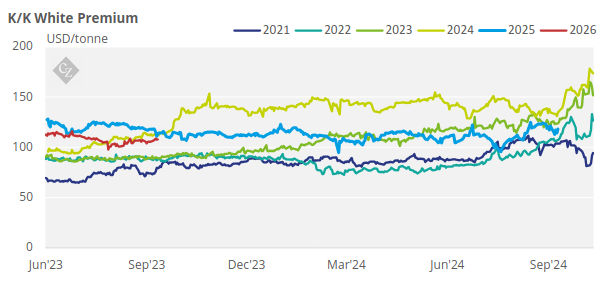

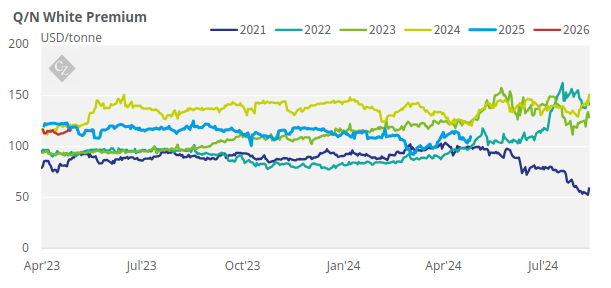

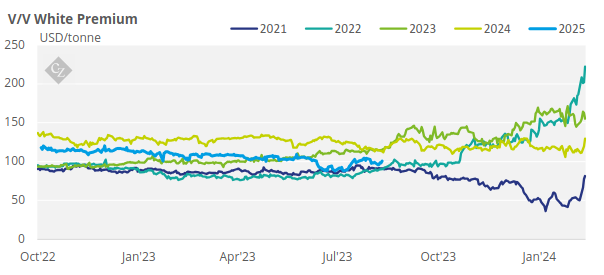

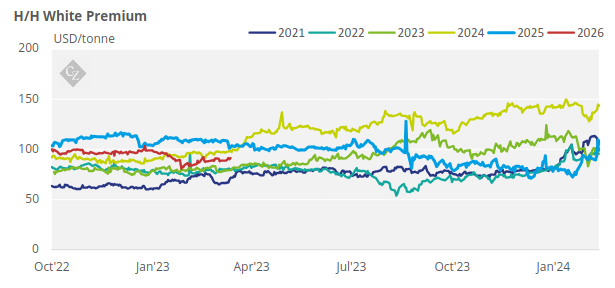

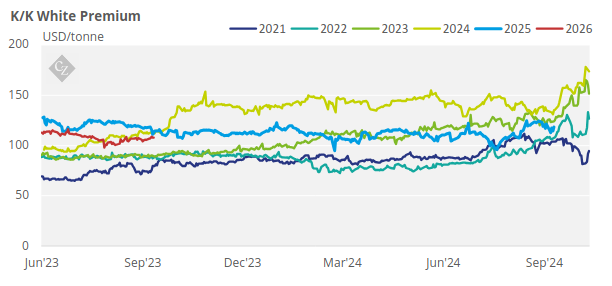

White Premium (Arbitrage)

The K/K white premium traded between USD 112.9-118.4/tonne over the past week.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

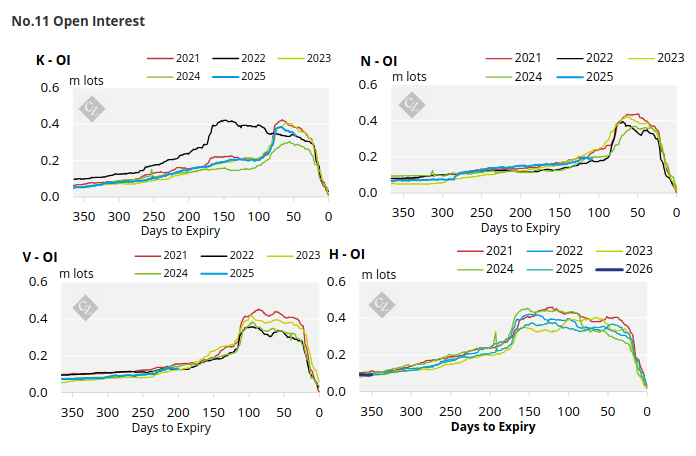

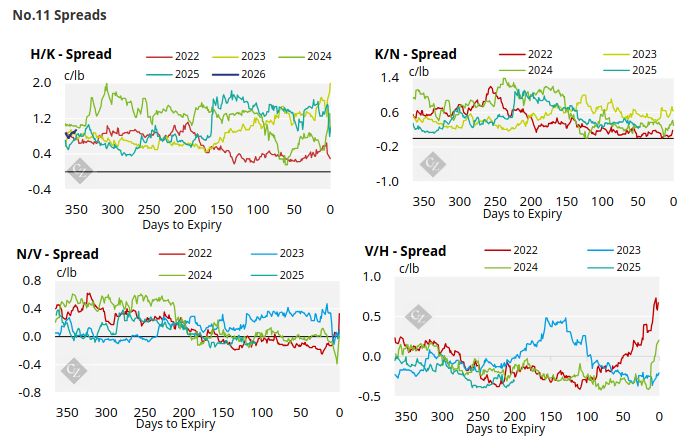

No.11 (Raw Sugar) Appendix

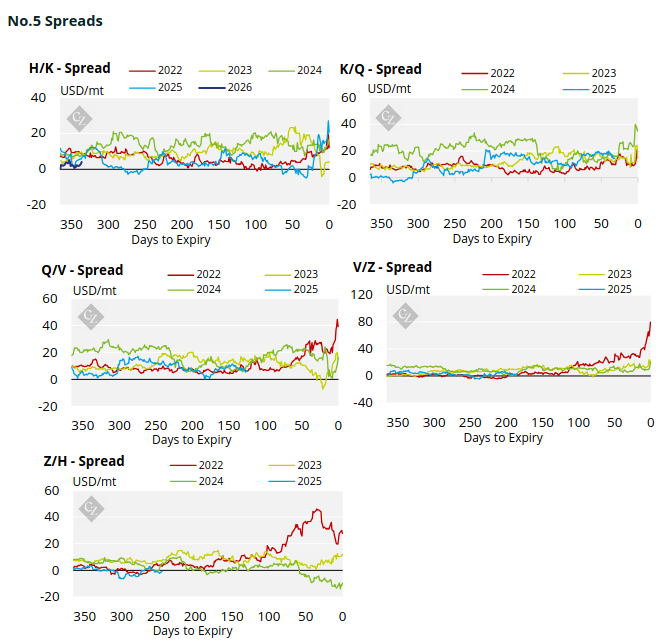

No.5 (White Sugar) Appendix

White Premium Appendix