Insight Focus

PET Futures continue to fall, driven by weakness in the PTA market, as inventories weigh on sentiment. PET resin export prices begun to firm slightly propped up by firmer crude pricing. Asian PET resin export prices are seeing a forward premium of just USD 5-10/tonne to May.

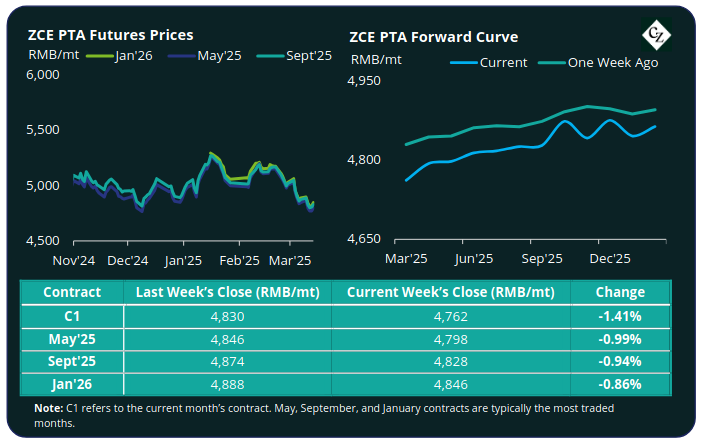

PTA Futures and Forward Curve

PTA futures were down between 1-1.5% across all main contract months, as PTA inventories continue to weigh on market sentiment.

Crude remained volatile, firming after a new round of sanctions targeting Iran’s oil industry and US attacks on the Yemeni Houthis, offset weakness in oil price fundamentals. Goldman Sach’s released outlook projected USD 71/bbl by Dec’25.

At the time of writing, Brent crude was trading at USD 71.20/bbl, up from the sub-70s price seen a week earlier.

The PX-N CFR average weekly spread dropped a further USD 15/tonne last week as upstream costs swung back and forth and Naphtha prices firmed. The PTA-PX CFR spread also softened to an average of USD 75/tonne last week, down USD 1/tonne on the previous week.

Overall, there was little change to PTA supply and demand fundamentals, as reflected in the PTA-PX spread. A modest increase in PTA operating rates was offset by strengthening demand from rising polyester production.

Nevertheless, inventories remained high, and warehouse receipts elevated, which will continue to constrain near-term pricing.

The PTA forward curve continued to hold a slight carry, with the May’25 contract holding a RMB 36/tonne premium over the current month’s contract. Sept’25 held a RMB 66/tonne premium.

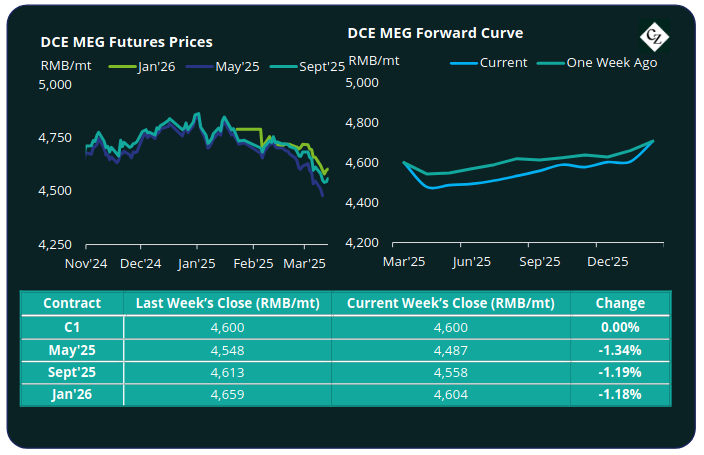

MEG Futures and Forward Curve

MEG Futures continued their downward trajectory, after topping out mid-January, with the main May’25 contract shedding a further 1.34% as stock levels rebound.

East China main port inventories increased by 4.3% to around 658,000 tonnes on the back of another wave of import arrivals and slow offtake.

Domestic MEG production remained stable, although more than ample supply countered any supply-demand benefit from increasing polyester operating rates.

The MEG futures forward curve remains flat, although forward contract prices fell below the current month, with the May’25 contract at a RMB 113/tonne discount over current month. The Sept’25 contract is at a RMB 42/tonne discount.

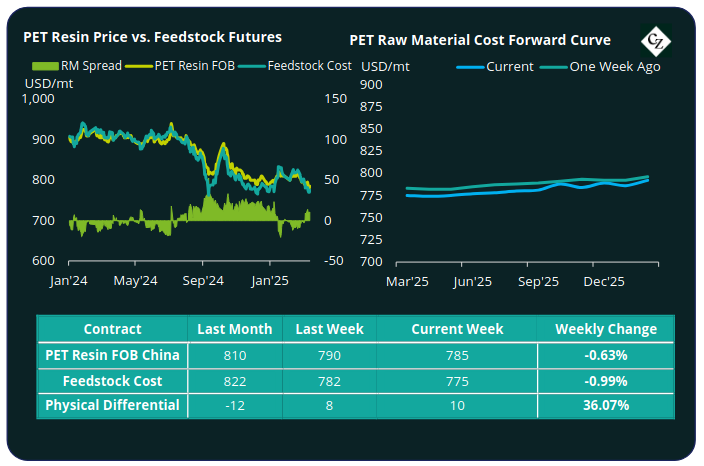

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices firmed very slightly towards the end of last week on rising upstream costs, increasing USD 5/tonne to average USD 785/tonne by Friday.

The average weekly PET resin physical differential against raw material future costs improved, swinging back positive, to a weekly average of positive USD11/tonne last week, up by USD 9/tonne. By Friday, the daily differential was positive USD 10/tonne.

The raw material cost forward curve remains flat, with May’25 at the same level as the current month, and Sept’25 holding just a USD 6/tonne premium.

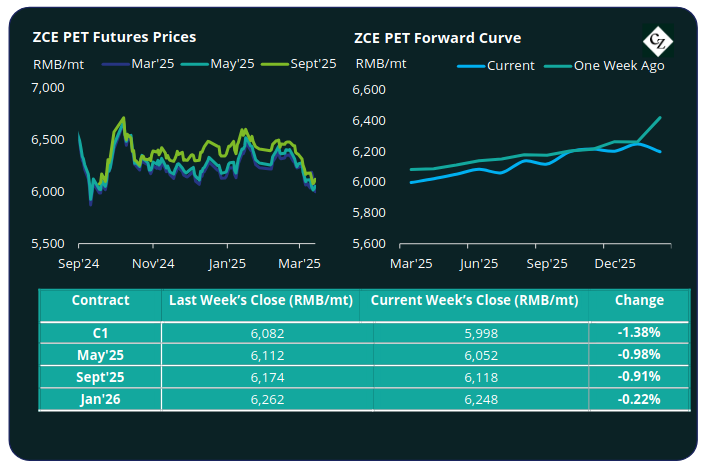

PET Resin Futures and Forward Curve

PET Resin Futures followed raw materials lower, giving up around 1% on average versus the previous week’s close.

The Mar’25 contract, the first contract month of these new futures, due to expire next Friday, fell to RMB 5,998/tonne (USD 829/tonne), equating to a substantial FX adjusted decrease of USD 11/tonne versus last week.

The average weekly premium of the Mar’25 PET Futures over Mar’25 Raw Material Futures increased to USD 29/tonne, up USD 5/tonne. By Friday, the daily premium was back down to USD 21/tonne.

The PET resin futures forward curve kept relatively unchanged across the main contract months. May’25 held a RMB 54/tonne (USD 7/tonne) premium over the main Mar’25 contract, while Sept’25 held just a RMB 120/tonne (USD 16/tonne) premium.

Concluding Thoughts

Chinese PET resin operating rates have been gradually rising over the last fortnight with lines returning from scheduled maintenance. However, further turnarounds at several other plants are due in March, which may slow the rate of further production increases.

Pricing has also stabilised and even looked to firm towards the back of last week, as low prices drove sales, reducing factory stock levels.

Any further improvement in the physical differential to raw material futures is likely to be constrained by the structural over-capacity, including Sanfame’s new 750,000 tonnes/year capacity, which remains shut down.

Expect Asian PET resin export prices to closely follow upstream costs though to April, with forward curves indicating just USD 5-10/tonne going into peak season.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.