Insight Focus

UKAs have experienced significant price volatility. Government consultations on potential reforms, including a Supply Adjustment Mechanism, and speculation about linking the UK ETS to the EU market have added to the market’s unpredictability. Despite these developments, UKAs continue to trade at a discount compared to their European counterparts.

UKA Continues Volatility

UK carbon allowances have endured some of their biggest price swings in the last year, with front-December future prices ranging from an all-time low of GBP 31.10/tonne earlier this year, to a shade over GBP 50/tonne last summer.

Source: ICE

The trend has largely been a decrease over time, giving UKA prices an average settlement price in the last twelve months of GBP 39.63/tonne, compared to GBP 46.69/tonne in the year between March 2023 and March 2024.

Prices have also experienced a fair amount of volatility over the last two years. UKAs jumped as much as 50% between September and October 2023 and have also swung by as much as 25% in one-month time frames since then.

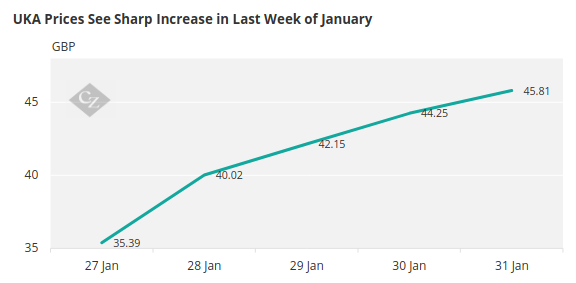

The most recent example took place in the week from January 27 to 31, when December 2025 UKA futures rose by more than 30%.

Source: ICE

This volatility is mostly due to continued uncertainty over the future shape of the market.

Government Consultations Impact UK ETS

Since mid-2023 the UK government has launched no less than 14 separate consultations on potential reforms to both the market, as well as to other areas of climate policy that could impact the UK ETS.

Already, some of the outcomes have led to changes. For example, a March 2022 consultation on “Developing the UK Emissions Trading Scheme” led to a decision to distribute 53.5 million additional UKAs to the market in an effort to smooth the transition to higher prices as the market supply tightened.

Some of these consultations are critically important to the future price direction. For example, a consultation on “Future Markets Policy” is widely viewed as the most important source of potential changes, as it contains a recommendation to implement a Supply Adjustment Mechanism (SAM).

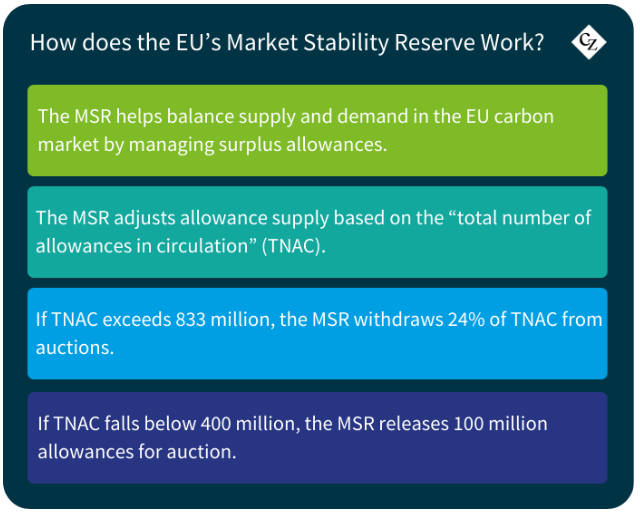

The SAM is viewed as likely to be very similar in its functions as the EU ETS’ Market Stability Reserve (MSR), which removes a pre-determined share of the calculated market surplus each year until total supply falls below an upper threshold, presently set at 833 million tonnes.

The MSR is also empowered to inject additional EU allowances into the market, should supply drop below a lower threshold (currently 400 million tonnes).

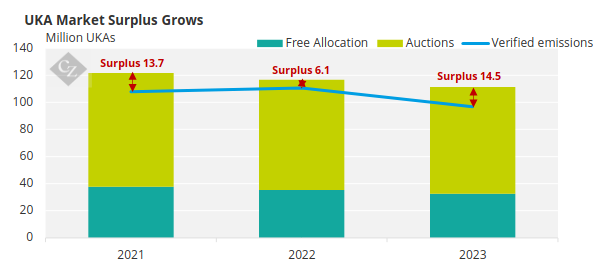

The UK ETS has shown a surplus of supply over demand in each of the years it has operated, from 18 million UKAs in 2021 to an aggregate 47.3 million by 2023. Data for 2024 will be published later this year.

Source: GOV.UK

Implementing a UK SAM would likely absorb some or most of the annual surplus to ensure that there is always a comparative tightness of supply that would drive a carbon price high enough to encourage investment in low-carbon alternatives.

The prospect of this mechanism being introduced has encouraged speculative investors to build long positions in anticipation of the same sort of price rise that accompanied the EU approval of the MSR. EUA prices nearly doubled to EUR 25/tonne in 2018 and jumped from EUR 33/tonne to more than EUR 80/tonne in 2021, when the mechanism went into operation.

Other government consultations cover issues including extending the UK ETS beyond 2030, changes to calculation of free allocation of UKAs, including maritime shipping in the system, extending the ETS to include the waste sector and integrating greenhouse gas removals into the UK ETS.

Each of these changes would likely bring additional demand into the market, which would in turn be addressed by a corresponding (or near) increase in supply. However, the delay in these consultations giving rise to concrete proposals or amendments to the market have worn away much of the market’s optimism.

UK-EU ETS Link Dominates Market

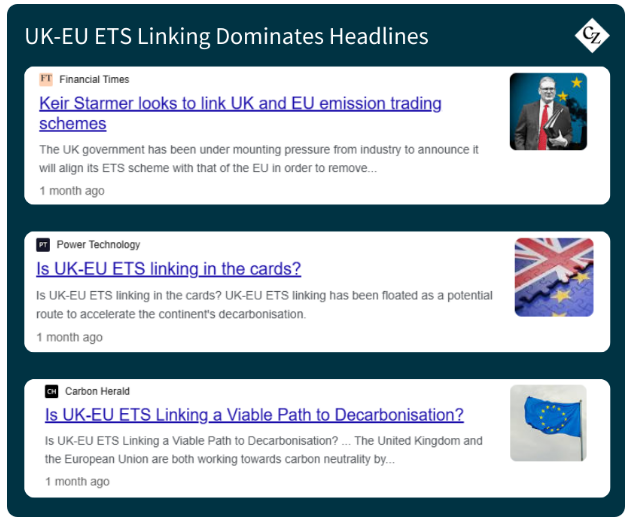

More recently, though, speculation over whether the UK will begin talks to link its ETS to the European market have come to dominate the market conversation. Twice already in 2025, news headlines have appeared suggesting that the UK is keen to schedule discussions on market linkage, leading to significant price jumps.

Market linking was contemplated as part of the Trade and Cooperation Agreement signed between the UK and EU as part of the Brexit negotiations, but discussions have yet to take place. In January, media reported that UK prime minister Sir Keir Starmer had asked to add the matter to the agenda of a leaders’ summit to be held in the spring, and prices soared from GBP 35/tonne to GBP 45/tonne in a week.

Whether these discussions take place in the near future remains open to question, but the technical requirements of bringing the UK market into line with the EU system may not be particularly onerous, since the UK’s standalone system was born out of its membership of the EU ETS.

Furthermore, the UK trades both gas and electricity on a daily basis with the EU, and there is a great logical advantage to bringing carbon trading into a similar structure. However, the political challenges of linking the UK system to Europe’s may be harder to overcome. The EU ETS is under the jurisdiction of the European Court of Justice, and having UK emissions trading exposed to a non-UK court may be difficult for the government to accept.

But until there is concrete progress, either in domestic regulation or in discussions over market linking, most experts agree that UK carbon allowances will continue to trade at a significant discount to their European counterpart.