Insight Focus

EUAs have bounced back by 11% after a 25% rally in natural gas. Speculators are steadily reducing EUA exposure. However, brightening economic signals are leading some to say higher prices are on the way.

EUA and Gas Prices Rally

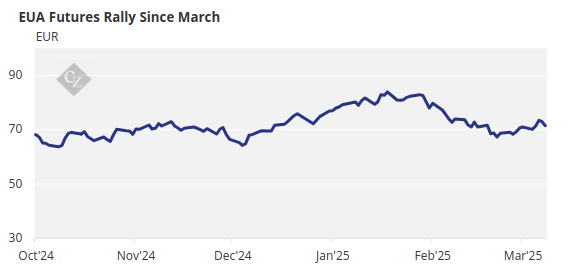

European carbon permit prices have recovered from their recent three-month lows amid a rally in natural gas prices and aggressive hedging by options traders eyeing the expiry of the March options contract this week.

The December 2025 EUA futures contract reached a three-month low of EUR 66.78 on March 7, but since then has rallied by more than 11% to a high of more than EUR 74.00.

Source: ICE

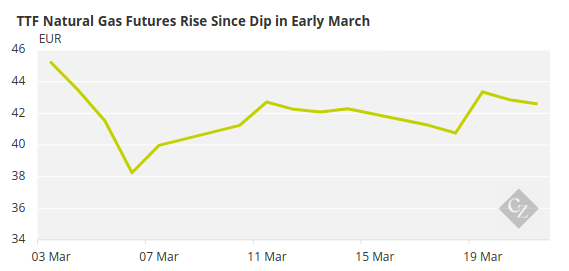

Over the same period the front-month TTF natural gas market has soared by as much as 25%.

Source: ICE

Once again, the close correlation between gas and carbon has been the main factor in the recovery, with gas prices ebbing and flowing according to the progress talks between Russia and the US over a ceasefire agreement in Ukraine.

The generally received wisdom among gas traders appears to be that a ceasefire increases the chances that gas may start to flow again through pipelines from Russia to Europe, though analysts are far less sanguine.

For a start, there remain numerous legal cases that were brought against Russia’s Gazprom for non-delivery of gas after Russia unilaterally ceased deliveries of fuel to Germany in 2022. These cases will need to be resolved before any further action is possible.

Secondly, there is the question of political will in Europe to resume gas supply. Latterly, Slovakia has been the main voice in favour of resuming flows through Ukraine, but its position has not had much backing. With these and other challenges standing in the way of gas deliveries from Russia, it remains very doubtful whether traders’ optimism is well-founded.

Yet, gas and carbon prices remain closely intertwined, and as the gas market goes, so carbon does most of the time. The correlation between the two has stretched at times, and has even briefly broken down completely, but so far it invariably reasserts itself, and this means that there is little that EUA fundamentals seem to be able to do to drive the market.

Nonetheless, the cycle of speculative bullishness may be coming towards an end for the time being.

Options trading in EUAs has become a considerable factor in the market, and the preponderance of open interest in March options at stroke prices between EUR 70 and EUR 80 suggest that the market is likely to remain around these mid EUR-70 levels for at least a few more days. As for the outlook after that, opinions are divided.

Speculators Cut Long EUA Positions

Speculative investors have been cutting their long positions in EUAs for the last five weeks, however. Net length reported by the two main EUA exchanges has dropped from 60.5 million EUAs to 31 million since the start of February.

Underlying this shift is a noticeable drop – 21% – in total long positions, while total shorts have grown by 17%. With the March options contract expiring on March 26, and most open interest in these contracts at between EUR 70/tonne and EUR 80/tonne, the closure of the front options contract may be the trigger for a further adjustment of positions.

The market will also get its first important dataset of the year on April 4, when the European Commission publishes verified emissions data for the 2024 calendar year. Most analysts are expecting yet another modest decrease in emissions, particularly from the power sector, and the size and scale of this anticipated decrease could be another trigger. But in some quarters, there is talk of a more bullish overall outlook for EUA demand.

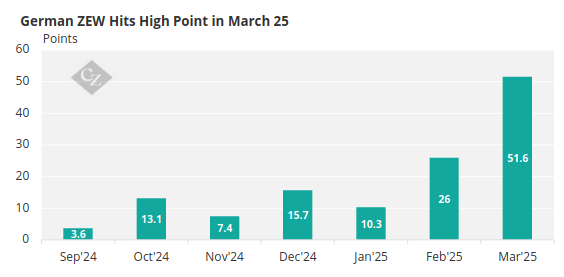

For example, the German ZEW Economic Sentiment index rose to its highest level since 2022 in March, and the EU’s equivalent measure was also at a two-year high this month. Industrial output in the Eurozone rebounded by 0.8% in January, compared to December 2024.

Source: Trading Economics

These signals are being taken by some participants to suggest the start of an upward trend in demand for EUAs and indeed, some bullish traders are saying that the market’s run of prices below EUR 70 may even be a thing of the past.

However, it may take more time for fundamental EUA demand to reassert itself to the point that carbon prices disconnect from gyrations in the natural gas market and revert to their own drivers. The European Commission is still selling additional allowances – over and above the original schedule – to fund the bloc’s weaning off of Russian fuels.

These sales are scheduled to end in just under 18 months, at which point the market could shift into deficits. However, 18 months ago, EUA prices were in the mid EUR 80s, and much can happen before August 2026.