Insight Focus

All grains rose despite the escalating trade war. The EU delayed tariff implementation to mid-April. The focus shifts to the USDA stock report, which is expected to be supportive despite potential pressure from favourable rains.

EU Delays Tariffs Until Mid-April

The EU is now considering delaying tariff implementation to mid-April, although they were initially planned for April 1, following the US announcement of new tariffs on April 2. The trade war appears to be escalating, with agricultural products at the centre of it. Despite this, all grains were up last week.

The market is attempting to define its direction amid conflicting factors. On one hand, the risk of tariffs with Canada, Mexico and the EU remains, threatening global trade and consumption. On the other hand, the USDA quarterly stock report next Monday could be supportive for corn, given that ethanol production and corn exports are running above the last WASDE estimates.

If there is no tariff-related news this week, attention will shift to the USDA stock report as we approach the end of the week and trade expectations are released. Favourable rainfall expected in the US, Brazil and Europe—except for the Black Sea region—could put some downward pressure on prices. However, we anticipate the stock report to be supportive.

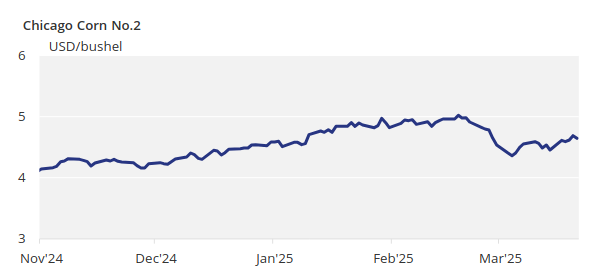

There is no change to our forecast for Chicago corn for the 2024/25 crop (September/August), which is expected to average USD 4.55/bushel. The average price since September 1 is running at USD 4.4/bushel.

Corn Gains Above 1%

Corn in Chicago traded sideways during the first half of last week before rallying on Thursday. Despite a negative Friday, weekly gains were above 1%, similar to the gains of Euronext corn.

US export inspections fell week-on-week but remained within expectations, making the impact on the market relatively neutral.

Spring planting has started in Ukraine, but corn has yet to be planted, with an estimated 3% growth in area.

In Brazil, Safrinha planting was 89.6% complete, compared to 92.3% last year. The summer corn harvest was 40.1% complete, up from 37% last year. In Argentina, 13.6% of the corn harvest is complete. BAGE maintained its estimate at 49 million tonnes, compared to BCR’s 44.5 million tonnes and 50 million tonnes in the March WASDE Report.

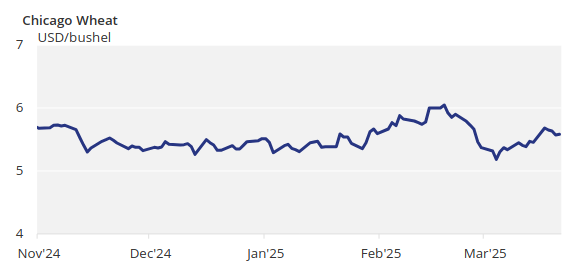

Weather Drives Wheat Direction

Euronext wheat rallied over 1%, supported by a midweek rally, but Chicago lost almost all its early-week gains and closed the week unchanged. The early-week rally in Chicago was driven by warm and dry weather threatening wheat yields, but stormy conditions by midweek and expected rainfall this week eased concerns about worsening conditions, causing the market to fall.

French wheat conditions remained 74% good or excellent for the third consecutive week, compared to 66% last year.

The US Midwest experienced blizzard conditions by midweek, and stormy conditions are expected to continue, bringing much-needed rainfall but also high winds. Brazil is expected to receive rain in the Centre-South region after a dry first half of March, while Argentina is expected to remain dry this week. Europe will likely receive rain in the North and Southwest, whereas the Black Sea region is expected to stay dry.