This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Sugar sales for 2025-26 remained slow but steady. Beet processors struggled to sell current-year supplies, and forward sales lagged, though interest may rise after the March 31 USDA report. Beet sugar prices may have bottomed out, but delivery concerns and potential tariffs on sugar and corn sweeteners add market uncertainty.

Sugar Sales Hold Steady, Forward Market Lags

Sugar sales for 2025-26 progressed at a slow but steady pace during the week ending March 21, with prices unchanged. Some large bulk sugar users remained uncovered for next year, while others added partial coverage. Meanwhile, most beet processors were still trying to sell sugar for the current year, with supplies ranging from adequate to ample and deliveries remaining weak.

Forward sales for the date lagged the past couple of years, yet beet processors indicated they were near expectations, with most anticipating that sales would be a slog rather than a rush. Interest in buying (or selling) may increase once beet acreage becomes clearer following the March 31 Prospective Plantings Report from the USDA.

To that end, the Michigan Sugar Co. will lose about 33% of its acres in Canada after grower-owners there sold back 3,582 acres under a share-redemption program. This acreage accounts for approximately 2.3% of Michigan Sugar’s total. Other cooperatives are expected to maintain 2025 acreage even to slightly below 2024 levels.

As of March 16, the condition ratings for Louisiana’s sugar cane crop had improved from a week earlier but remained the lowest for that date since 2018, according to the USDA.

Market Assesses Tariff Risks, Price Uncertainty

Bulk refined beet sugar for 2025-26 continued to sell mostly in the upper 30c/lb to lower 40c/lb range FOB Midwest. At least one processor was reportedly selling aggressively below 40c/lb, while others appeared to be holding firm at or above 40c/lb, as that level is considered breakeven for cooperative grower-owners.

While risks remain—including the potential for tariffs on sugar imports from Mexico—waiting too long to secure next year’s coverage does not yet appear to be an overwhelming concern for buyers.

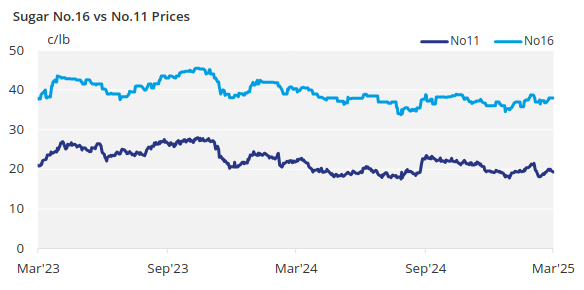

At the same time, some in the trade believe beet sugar prices for next year may have reached their bottom, given the possibility of lower planted acreage and the wide discount compared to refined cane sugar prices. Some sense that cane sugar has more downside potential than beet sugar. While this does not necessarily mean beet sugar has significant upside potential, it may be enough to prevent prices from falling further. The current price gap is as much as 10c/lb, compared to the traditional 2c/lb, though maintaining that spread may no longer be practical due to the non-GMO advantage for cane sugar.

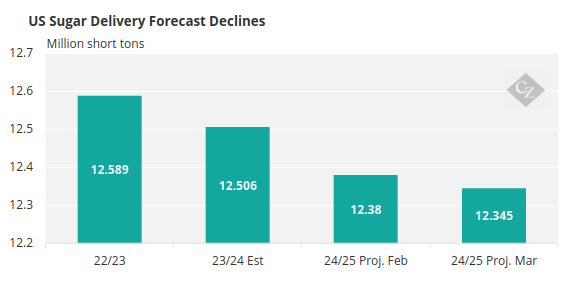

A persistent issue in both the spot and forward markets has been deliveries. More than one source noted some improvement in the past month, some of which may be seasonal. While most expect an improvement from the 4.1% year over year decline in October-January deliveries reported in the USDA’s Sweetener Market Data report, they also anticipate that full-year deliveries will decline by more than the 1.3% projected in the March WASDE Report.

Source: USDA

Corn sweetener markets remained quiet amid concerns about potential retaliatory tariffs on US corn sweetener exports to Mexico if US tariffs take effect on April 2.