Insight Focus

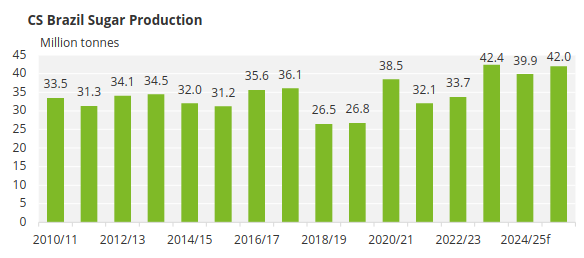

We have reduced our forecast for CS Brazil 2025/26 sugar production. It has gone from 43.6 million tonnes to 42 million tonnes. This recognises the adverse effect of recent dry weather on cane development. However, this new production figure would still be the second largest sugar output on record.

Crop Estimates for 2025/26

We estimate cane crushing at 612 million tonnes, almost unchanged year on year. A small decline in the cane area following last year’s drought and fires should be compensated by higher agricultural yields.

We are reducing our 2025/26 sugar production estimate for Centre-South Brazil by 1.6m tonnes, to 42m tonnes.

This reduction recognizes the possible effect of recent dry weather on cane development. However, we advise caution in interpreting what the weather data means for the crop. It’s hard to model such a vast region as CS Brazil using discrete data for rainfall across several locations.

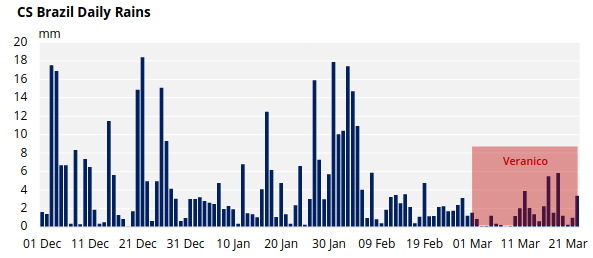

Nevertheless, our weather data shows that rainfall has been normal between October and December in CS Brazil.

In the 2025 Q1, below-average rainfall was recorded in CS Brazil, although it is still raining better than in the 2024/25 crop. From the middle of February until the beginning of March, almost no rain fell in the region due to a veranico, which loosely translates as an ‘Indian Summer’, a period of hot dry weather. It has now begun raining in cane regions once more and the forecast is wet.

Source: Tempo Ok; CTPEC.

Given the renewed arrival of rains, we think there is a chance that some of the more pessimistic sugar production forecasts from the sugar trade may need to be revised higher in the coming weeks. But we will only know the quality of the cane once it is crushed.

Because of the doubt over the quality of the cane, we’ve adjusted our sugar mix forecast slightly lower, to 51%. However, we believe there is capacity to achieve over 52% given the right conditions.

Sugar Mix Potential

In the 2024/25 crop, we believe that the cane industry made significant investments in crystallization, adding nearly 3 million tonnes of capacity.

Even so, various factors worked against the sugar mix reaching its potential. A higher-than-expected bis cane volume led to a prolonged harvest, lower cane quality, and delayed factory deliveries. Sugar output was also hit by a high proportion of reducing sugars due to dry weather. We don’t expect these factors to repeat in the 2025/26 crop season.

To read more about the CS Brazil 2025/26 crop click here.