Insight Focus

Urea prices rose this week due to new US tariffs. Processed phosphate prices climbed amid tight supply and strong demand. Potash prices increased in Brazil and Southeast Asia, while Canadian potash remains duty-free to the US. Ammonia markets remained dormant, with prices expected to soften both east and west of the Suez.

Urea Trade Shifts on New Tariffs

The Trump administration is set to implement a 10% baseline tariff on all imported goods starting April 5, which would include urea and other nitrogen products. Higher reciprocal tariff rates will apply to certain countries, but several major urea exporters to the US—such as Russia, Qatar, Saudi Arabia, Oman and Bahrain—were not given individual rates and are expected to be subject to the 10% blanket tariff. Some Russian producers believe they may even get away with no levy at all.

In contrast, imports from Algeria and Nigeria will face tariffs of 30% and 14%, respectively. Canadian urea will continue to enter the US duty-free, provided it complies with the US-Mexico-Canada Agreement (USMCA).

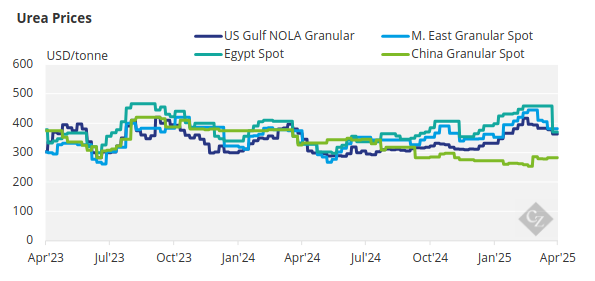

Tariffs on urea from overseas will raise the cost for traders importing vessels and push up urea barge prices at NOLA, as well as elevate urea prices across much of the US. Prices in NOLA have already reacted swiftly, with April barges trading at USD 410/short ton (USD 451/tonne) FOB—an increase of USD 40/short ton from Wednesday. This is the highest FOB barge price at NOLA since September 2023.

In other regions, urea prices have also climbed. In Egypt, prilled urea is trading at USD 385/tonne FOB, while granular urea is at USD 400/tonne FOB, up USD 10/tonne in 24 hours and USD 25/tonne from last week. The Middle East reported a sale at USD 390/tonne FOB, compared to earlier prices below USD 370/tonne FOB.

The overall sentiment is that trade flows will shift. Brazil appears to be benefiting, with more cargoes arriving from Nigeria and Algeria. A trading firm reportedly sold a cargo to southern Brazil at USD 390/tonne CFR, up roughly USD 5–10/tonne from recent trades. Meanwhile, Iran is producing urea at full capacity, with the latest reported sale at USD 345/tonne FOB.

On another note, the Russian government has extended and expanded its export quotas for certain finished fertilizers. The new quota totals approximately 20 million tonnes, including 12.3 million tonnes for nitrogen fertilizers. This quota, which began on December 1, 2024, will now expire on November 30, 2025, rather than the original May 31.

Forecasting the L1 urea price in India’s upcoming tender is now particularly challenging since we have yet to see the full fallout from the tariffs and reciprocal tariffs introduced by the US government.

Phosphate Tariff Confusion Lingers

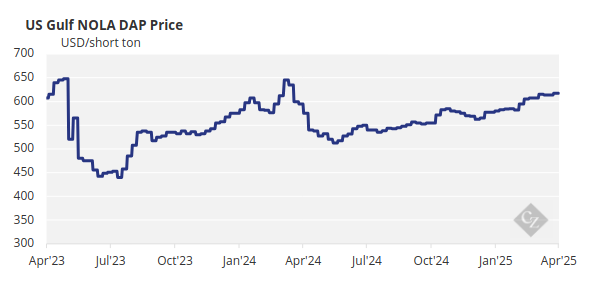

There is also confusion regarding whether Russia will be subject to the baseline tariffs on processed phosphate sales to the US. The latest countervailing duty on Russian phosphate fertilizers, set in November 2024 for the 2022 calendar year, includes an 18.21% rate on products from Phosagro. Morocco falls under the new 10% baseline tariff group, and the executive order specifies that this 10% is in addition to any other duties, taxes or charges.

As a result, without any further exemptions, Moroccan DAP, DAP, TSP, and NP face the current prevailing countervailing duty of 16.60% plus the baseline 10%, for a total of 26.60%.

China has long exited the US phosphate import market after previously facing a 25% duty. China now faces an additional 34% tariff, bringing the total to 59%.

In other markets, MAP prices in Brazil have increased to USD 660–670/tonne CFR, up from a flat USD 660—the highest level since October 2022. India’s DAP price assessment has also risen, despite limited trading activity, reaching USD 648–650/tonne CFR, the highest since February 2023. China remains absent from the export market and is expected to stay out until at least June.

The outlook for processed phosphate prices remains bullish.

Potash Prices Climb in Key Markets

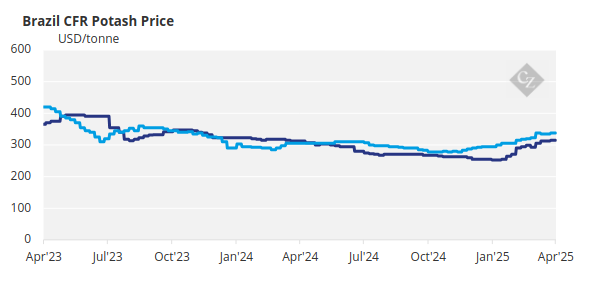

Potash prices have risen in Brazil and Southeast Asia, supported by limited May volumes, while potash in the US remained unaffected by the recent tariff wave. The US took centre stage this week as the market braced for President Trump’s “liberation day” tariffs. Potash from all locations was exempt. Despite this, market activity slowed in response. With recent price surges in anticipation of the tariffs, a slight correction may follow. NOLA prices firmed to USD 320/short ton FOB this week, up USD 5/short ton.

In Brazil, granular MOP prices rose by USD 10/tonne to USD 345–350/tonne CFR for May loading, as the market strengthened after a period of resistance. Producers are increasing price offers, with distributors now taking long positions. Prices are likely to rise further as demand increases for the soybean season.

In Southeast Asia, sMOP rose by USD 5/tonne and gMOP by USD 10/tonne, as producers push for higher prices. Market activity remains somewhat subdued outside of the current tender, with Indonesia and Malaysia concluding Eid celebrations. Prices are expected to climb in the coming weeks, with speculation of USD 330–340/tonne CFR for April loading.

A wave of tenders is expected to support the market until Pupuk Indonesia issues its major tender in the coming weeks. Producers continue to press for higher prices amid progress on the 2025 Chinese potash settlement.

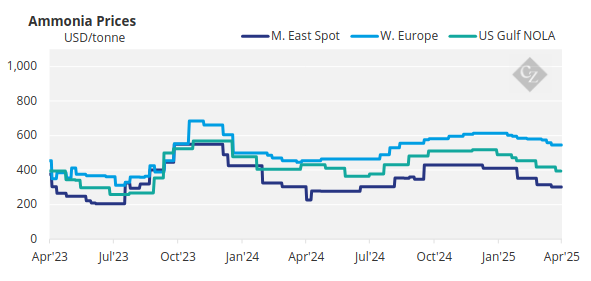

Ammonia Sees Limited Upside

Ammonia markets, meanwhile, show limited upside. Supply remains healthy and demand muted both east and west of Suez. All eyes were fixed on the US this week as President Trump announced wide-ranging import tariffs on products coming into the country, including a 10% levy on imports from Trinidad, which supplied 42% of the US’s total 2.07 million tonnes of ammonia import requirements in 2024. This should facilitate a knock-on impact on domestic prices, though it is likely suppliers will pass these costs onto end users in the form of finished products.

Supply from the US Gulf remains strong, although there are reports of further production issues at the 1.3 million tonne/year Gulf Coast Ammonia (GCA) facility in Texas, which finally loaded its first export cargo last week after years of delay.

The upside for global pricing remains limited, though tariffs on US imports of Trinidadian ammonia could generate some support for inland values in North America.