Insight Focus

EUAs dropped by as much as 11% after the US imposed 20% tariffs on imports from EU. A widespread “risk-off” move covered all energy markets. EU emissions data for 2024 shows a 5% drop, led by power sector.

Carbon Prices Plunge Following US Tariff Announcement

European carbon allowance prices plunged in response to President Trump’s announcement of blanket tariffs on imports into the US last week, joining a widespread sell-off that came close to panic selling.

The sell-off eclipsed the publication on Friday of annual verified emissions data by the European Commission that showed industrial plants had emitted around 5% fewer greenhouse gases in 2024 than in the previous year.

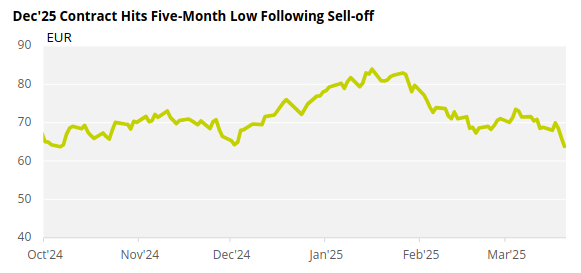

The benchmark December 2025 EUA futures contract fell by as much as 11% during the week, and reached a five-month low of EUR 62.69/tonne on Friday amidst some of the heaviest trading volume the market has yet seen.

Source: ICE

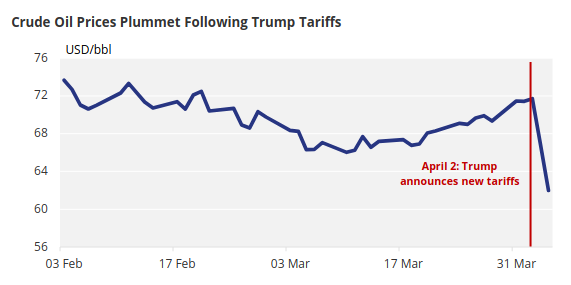

The fall in EUA prices reflected a widespread “risk-off” response to the tariff announcement, with natural gas (-5.1%), power (-4.3%), coal (-1.7%) and especially crude oil (-11%) prices all dropping over the week. Equity indices also plummeted.

Source: Trading Economics

Tariffs Jeopardise EU Growth

It’s not yet clear whether the 20% reciprocal tariff on European imports to the US will be imposed over and above existing tariffs. Analysts at ING estimated the new levy could cut 0.3 percentage points from Eurozone GDP growth over the next two years, but they added the tariffs would also have a secondary effect of reducing consumption and investment in the region.

ING reduced its forecasts for Eurozone GDP growth 0.6% from 0.7% for 2025, and to 1% from 1.4% for 2026, and many economists have suggested interest rates may be cut to as low as 2% by year’s end to offset the effect of tariffs.

Carbon’s price reaction to the news reflected not just a “risk-off” adjustment to portfolios, but also to the prospect of an economic downturn – if not recession – cutting into regional industrial output.

The verified emissions data for 2024 showed that many industrial sectors were starting to recover from the extended impacts of high energy costs. Overall industrial emissions were broadly stable in 2024, with sectors like fertilisers reporting substantial increases in emissions, and others – in particular cement – reporting decreases.

The power sector accounted for most of the overall decrease, returning a 12% drop in 2024 emissions due mainly to big increases in solar and hydropower generation.

However, the market had little opportunity to analyse and digest the data when it was published on Friday, and it’s likely that a more nuanced view will emerge in the coming weeks, after the initial reaction to the tariffs has calmed.

Compliance Buyers Capitalise on Low EUA Prices

The sharp fall in EUA prices appeared to trigger some buying from compliance-oriented participants last week. Industrial buyers often follow a strategy of buying at below the rolling average price for EUAs, and with the average EUA futures settlement price this year at EUR 74.68/tonne, prices in the low to mid EUR 60s/tonne were enough to persuade many to dip their toes into the market late last week.

The compliance deadline for 2024 emissions – when installations must surrender EUAs matching last year’s emissions – falls at the end of September, but the swelling uncertainty triggered by the US tariffs and the prospect of a global trade war mean that compliance companies will need to watch EUA prices very slowly.

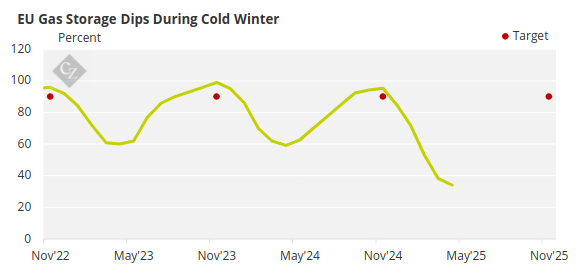

Despite the volatility brought on by last week’s events, Europe is still very short of natural gas and the summer is likely to see considerable swings in gas – and therefore carbon – prices as traders work to refill storages ahead of next winter.

Source: AGSI

The macroeconomic uncertainty is compounded by a struggle within the EU over how to mitigate the impact of high gas prices. Some member states are pushing for the existing November 1 storage mandate – at which time gas stocks should be 90% full – to be relaxed, to reduce the upward pressure on prices.

The storage deadline was due to expire after this year’s deadline, but the Commission is said to intend proposing an extension for another 12 months.

There have been proposals to relax some intermediate targets to give countries more flexibility in filling storages, particularly in light of summer season gas prices, which are presently more expensive than next winter.

With EUAs and TTF natural gas futures prices showing a very high positive correlation, any spike in gas prices is likely to lead to a similar jump in carbon, highlighting the importance of close monitoring of carbon prices in the run-up to 2024 compliance.