Insight Focus

Urea prices rose last week amid US tariff uncertainty. Processed phosphate prices surge due to high demand and tight supply. Potash remains stable, but price hikes are expected in Brazil and Southeast Asia as supply shortages persist. Ammonia prices face downward pressure with supply exceeding demand.

Urea Shifts Amid Tariff Revisions

“Based on the fact that more than 75 Countries have called Representatives of the US… to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non-Monetary Tariffs, and that these Countries have not, at my strong suggestion, retaliated in any way, shape, or form against the US.”

The above statement reduced the reciprocal tariffs to zero and then reinstated the standard 10% import tariff on all goods entering the US, with a 90-day grace period — except for China, whose tariff was raised to 125%. Urea trade flows began shifting, with Nigerian producers (facing 14% tariffs) and Algerian producers (30%) starting to look for alternative destinations beyond the short-haul US route. Russian producers, exempt from tariffs, were aiming to increase their exports to the US.

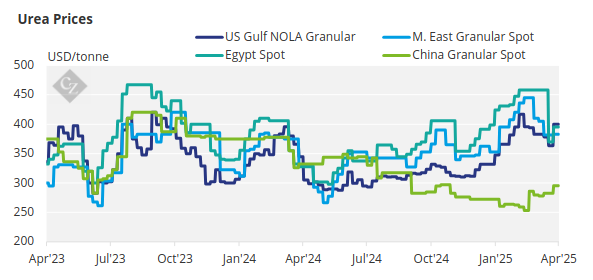

Prices for urea began climbing, with Middle East FOB levels approaching the USD 400/tonne mark. Us/NOLA prices reached USD 425/short ton (USD 468.5/tonne) FOB for first-half April, while first-half May traded between USD 410–415/short ton FOB.

Rumours also circulated that Southeast Asian producers were receiving offers above USD 390/tonne FOB for May shipments to Australia, where water shortages in the south continue to delay early demand.

Iranian producers tried selling granular urea at USD 360/tonne FOB, but bids came in around USD 350/tonne FOB, resulting in no reported sales.

India’s latest tender saw offers totalling 3.5 million tonnes, with West Coast India L1 at USD 385/tonne CFR and East Coast at USD 398.24/tonne CFR. India invited suppliers representing about 1.8 million tonnes to match these prices.

However, with global urea prices trending higher, it’s uncertain whether enough sellers will accept India’s target of 1.5 million tonnes. Estimated netbacks to the Middle East from the tender range between USD 470–380/tonne FOB — lower than current spot values. As of this writing, India has only secured 400,000 tonnes.

EABC of Ethiopia has announced a urea purchase tender of 676,000 tonnes, closing April 23, split into 12 lots of 52,000 tonnes, each for shipment to Djibouti. This is expected to add further upward pressure on prices. However, India’s final position remains a key factor — should it retender, it may temporarily cap the price rally.

Phosphate Prices Climb on Shortage

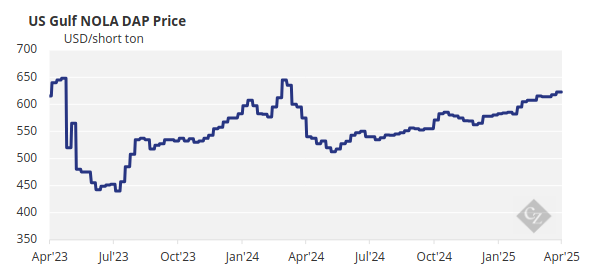

In the phosphate market, Chinese processed material remains absent, driving prices up at a relentless pace. Despite Brazil seeing the worst MAP affordability ratio since April 2022 (when prices hit USD 1,118/tonne CFR), demand remains firm. The latest MAP price is reported at USD 695/tonne CFR — up from USD 660–670 just two weeks prior.

Indian DAP buyers have also had to adjust, with current CFR levels surpassing USD 690, up from the last confirmed business at USD 640/tonne CFR. India remains in a tight position and continues to seek DAP.

In the US, price support comes from tariff expectations and broader uncertainty. DAP and MAP barge prices in New Orleans climbed further this week. While prices are trending higher, they may soon face resistance due to affordability concerns.

EABC of Ethiopia issued another DAP tender this week, closing April 23, which could add more pressure to prices, especially with Chinese exports still restricted by government policy.

Processed phosphate prices are expected to keep climbing, as demand continues to outstrip supply.

Potash Demand Builds

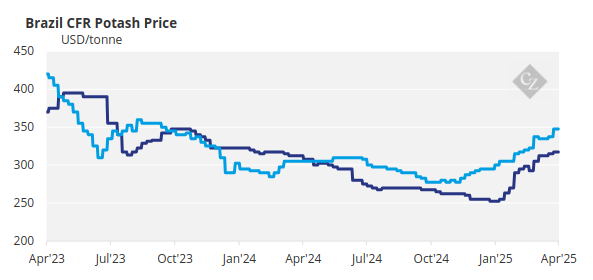

Potash prices remained mostly stable outside China and Southeast Asia, though Pupuk Indonesia’s new standard MOP tender is expected to create fresh momentum in Southeast Asia. Limited availability continues to support a bullish tone.

The US market was quiet this week, with Canadian potash still exempt from tariffs. In Brazil, granular MOP prices are assessed at USD 347.50/tonne CFR for May arrivals, while June onward is being offered in the USD 350–370/tonne CFR range, though no confirmed deals have been done yet.

The potash outlook remains bullish, driven by strong emerging demand.

Ammonia Prices Slide on Oversupply

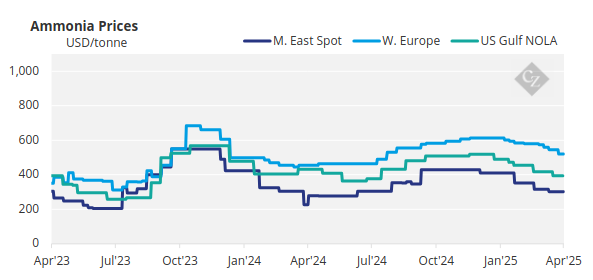

Ammonia prices, both east and west of Suez, remain under pressure, with supply continuing to outweigh demand. Sellers are struggling to place excess tonnage, and prices are expected to come under more pressure through the second half of April. However, it remains to be seen how much further values in Asia can fall before producers begin cutting output.

On the flip side, there are still questions as to what impact the 10% import tariff on Trinidad ammonia will have on next month’s Tampa settlement.