Insight Focus

The Second Trade War has officially begun. Shipping faces early strain as tariffs rise and blanked sailings increase. The US is targeting Chinese maritime dominance with shipbuilding revival plans and port fees.

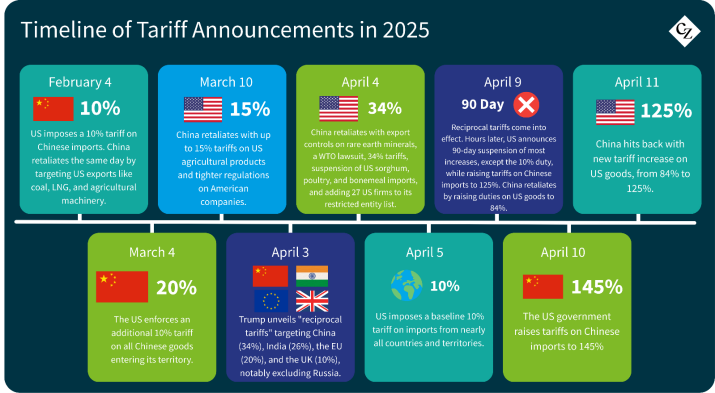

The Second Trade War is officially underway, with global markets teetering on a tightrope as they brace for the next volley of tariff announcements. On April 2 — dubbed “Liberation Day” — US President Donald Trump pulled the trigger, unveiling sweeping “reciprocal tariffs” targeting countries across the globe.

The shipping industry, inherently intertwined with global trade flows, stands among the most vulnerable sectors. With the US and China — two of the world’s most powerful maritime and trading nations — now locked in an escalating economic conflict, the ripple effects on shipping are expected to be both immediate and far-reaching.

Implications for Shipping

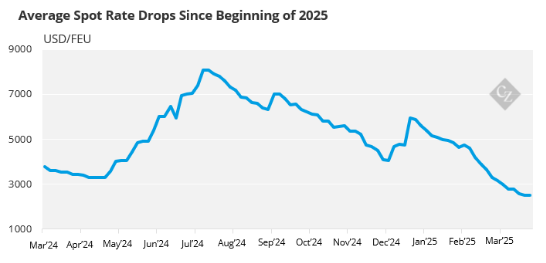

The container shipping industry has enjoyed a highly profitable five-year stretch, but this period of growth could soon face challenges — although not immediately. The ongoing crisis in the Red Sea and the rerouting of vessels around the Cape of Good Hope have helped mitigate, for the time being, the tariff shock to the market.

Despite these challenges, analysts are cautiously optimistic. Although the market is expected to weaken in the near term, it begins from a strong position, and it may take time before it reaches pre-Red Sea disruption levels.

However, signs of early disruptions to supply chains are already apparent. According to Xeneta, a freight rate analytics platform, freight rates have declined by 50% since January, while shipping consultancy firm Drewry reports a significant rise in blanked sailings — from 135 in the first two months of 2024 to 198 during the same period in 2025, across the three major trades: Pacific, Atlantic, and Asia-Europe.

Source: Xeneta

As noted by Dynamar analyst Darron Wadey, “Carriers skip sailings in response to market extremes.” He continued, “Cancelling sailings is often the first step taken to manage an overcapacity situation. Though skipping sailings initially starts as a temporary or occasional measure, it can become a structural response when repeated.”

In light of these developments, container lines may resort to tactics like blank sailings, rate adjustments, capacity management and rescheduling to address the potential crisis. However, history shows that ocean carriers have demonstrated a remarkable ability to not only weather global crises but also turn them to their advantage.

The COVID-19 pandemic and the Red Sea crisis are prime – and relatively recent – examples, where despite widespread global challenges, ocean carriers found ways to remain financially unaffected and even achieved record-level revenues and earnings at certain periods. The question now is whether this trend will repeat amid the current global tensions.

Trump Announces New US Shipbuilding Plan

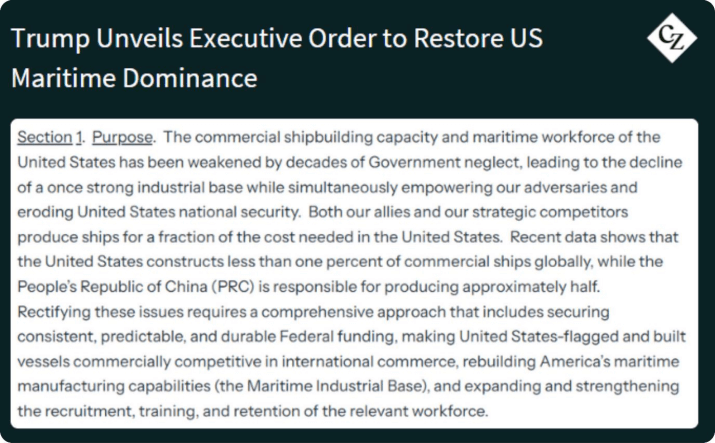

As part of his broader strategy to assert economic pressure on China and beyond, President Donald Trump has unveiled a plan to revitalise the US shipbuilding sector. His executive order seeks to provide financial incentives aimed at bolstering existing US shipbuilders and attracting new investors to the industry.

Titled “Restoring America’s Maritime Dominance,” the order outlines a comprehensive Maritime Action Plan focused on strengthening the nation’s maritime capabilities, with both commercial and military sectors at its core.

A central component of the strategy is the creation of a Maritime Security Trust Fund, which will serve as the financial backbone of the initiative. This fund, along with a financial incentives program, is designed to encourage private investment in US shipbuilding, fostering growth and innovation within the sector.

In addition to supporting domestic shipbuilding, the US administration has also outlined measures to directly target companies with vessels built in or flagged by China. These companies calling at US ports could face extraordinary fees of up to USD 1.5 million per call, depending on the number of Chinese-affiliated vessels in their fleet.

This move is part of Trump’s strategy to limit China’s influence over global shipping, yet analysts suggest that it could potentially have a more significant impact on the US economy than on Chinese shipping dominance. While this measure is not yet in effect, its potential could disrupt US ports and shipping networks, making it a pivotal point in the broader trade war with China.