Insight Focus

If Poland gets hit with FMD, it will be hard to ignore. NZ milk growth is well-timed, with EU bio-risks and US trade tensions driving global disruption. Chinese buyers may pivot whey demand, big options trades are being executed, and origin risk premiums are back in focus.

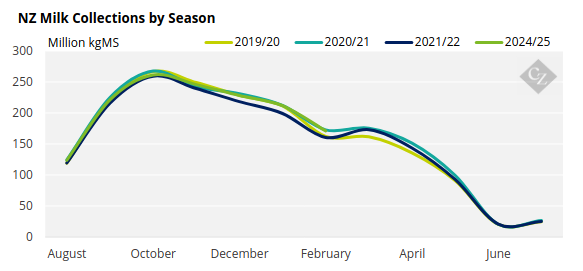

New Zealand Milk Production Up

New Zealand’s February milk collections rose 1.5% year-on-year to 171.2 million kgMS – closely in line with our forecast from last month. This now pushes the 2024/25 season into second place for year-to-date collections, just behind the 2021/22 record.

Nationally, the aggregate March to July milk collections over the past four seasons have all ranked among the highest ever recorded for that period – higher than any season prior to 2020/21.

If this season were to follow the average from those four seasons, then we would finish the FY with 1,932 million kgMS. It does seem very likely that New Zealand will print above 1,900 million kgMS for only the second time ever.

Rainfall in March was well above normal across the eastern South Island, but much of the North Island, including key dairy regions like Waikato and Taranaki, remained significantly drier, with parts of Northland, Bay of Plenty and Auckland receiving less than 20% of normal rainfall. Soil moisture was well below normal across most of the North Island, reinforcing concerns in the central/western dairying heartland.

Temperatures were above to well above average across much of the South Island and parts of the North Island. The national average was 0.5°C above normal, maintaining the warm trend that has supported strong milk flows where soil moisture hasn’t become limiting.

As we have been highlighting for several months now, Waikato remains the major weather risk region in New Zealand for milk production. Recently, Taranaki has seen enough rain to begin turning the region green on NIWA’s soil moisture anomaly chart, leaving only Waikato in shades of red amongst the key dairying regions (meaning much drier than usual).

We are now predicting around +1.7% for March for about 174 million kgMS. If Fonterra’s current season projection of 1,510 million kgMS holds true, then this implies that the non-Fonterra group will see a rare year over year decline for March collections.

While we think it is possible that the non-Fonterra group see a small decline in March YoY collections, we do not think that they will be 5% down, which is required for Fonterra to hit its own projection. We note that the non-Fonterra bloc also missed its market share projection for February, with actual 21.8% being 0.2% below forecast. This was the first time it missed this metric since July 2024.

EU Dairy Faces New Uncertainty from FMD and BTV-3 Outbreaks

FMD and BTV-3 are re-emerging as serious biosecurity threats to the European dairy sector, creating new uncertainty for both intra-EU trade and global exports.

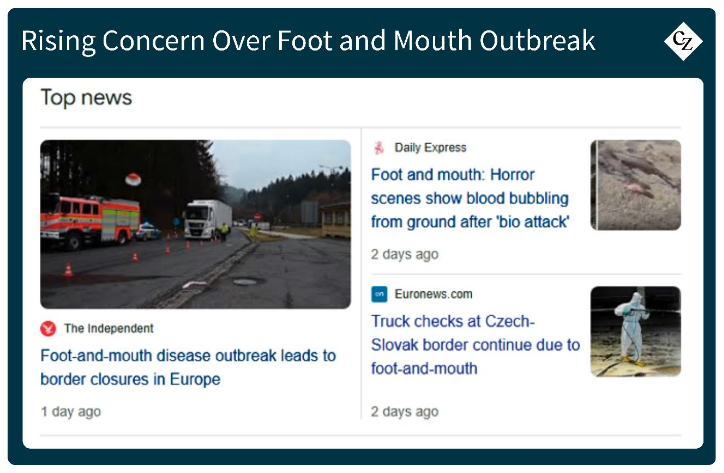

Foot-and-Mouth Disease (FMD)

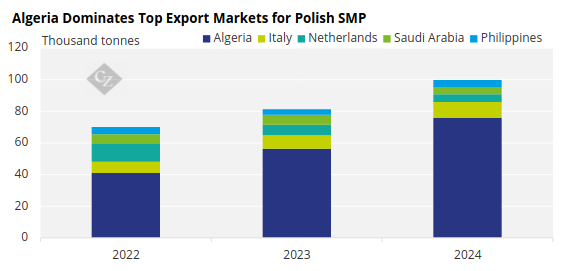

The current FMD outbreak in Central Europe has now also been confirmed in Hungary and Slovakia. While the newly infected countries are relatively minor in dairy export volumes with less than 30,000 tonnes exported collectively outside the EU in 2023. The real concern is Poland, which has so far avoided infection. As one of the fastest-growing EU dairy exporters, any disruption to its milk supply or export capacity would ripple through global supply chains. So far, Poland remains unaffected – but proximity matters.

Poland plays a critical role in supplying tender markets like Algeria, and any export suspension could force buyers to look elsewhere – creating upside for NZ, US or even Latin American origin.

Source: CLAL

The situation is fluid. The political noise alone has already prompted border closures and animal movement bans, and the UK has pre-emptively tightened import controls from the EU. For example, Austria closed 24 border crossings with Hungary and Slovakia to prevent the spread of the disease. The UK has then imposed bans on Austrian dairy imports, despite Austria not reporting any FMD cases, highlighting the broader trade implications. These moves underscore the severity of the situation and the lengths to which countries are going to protect their livestock industries.

These are exactly the kinds of restrictions that multinational buyers are likely to overreact to, rebalancing volume toward lower risk origins. Origin risk premiums are most likely to be paid in general by buyers in high-compliance regions such as Japan, South Korea or the GCC. Buyers who have long term supply agreements with the ability to flex volume upward from suppliers in origins such as New Zealand are highly likely to do so, tensioning Oceania pricing relative to EU.

Laboratory analysis indicates this strain of FMD is closely related to variants previously identified in Pakistan between 2017 and 2018. The virus’s ability to travel via wind and survive on surfaces for extended periods complicates containment and tracing efforts. Some countries, such as Hungary, are even investigating potential biological sabotage as a source of infection, though this is speculative.

The outbreak has led to the culling of over 9,000 cattle in Hungary and Slovakia. Strict biosecurity protocols, including border closures and disinfection measures, have been implemented to prevent further spread.

Germany’s shift from cheese production to Skim Milk Powder (SMP) and butter, with domestic consumption absorbing the butter, could lead to increased SMP stocks, potentially influencing global dairy markets.

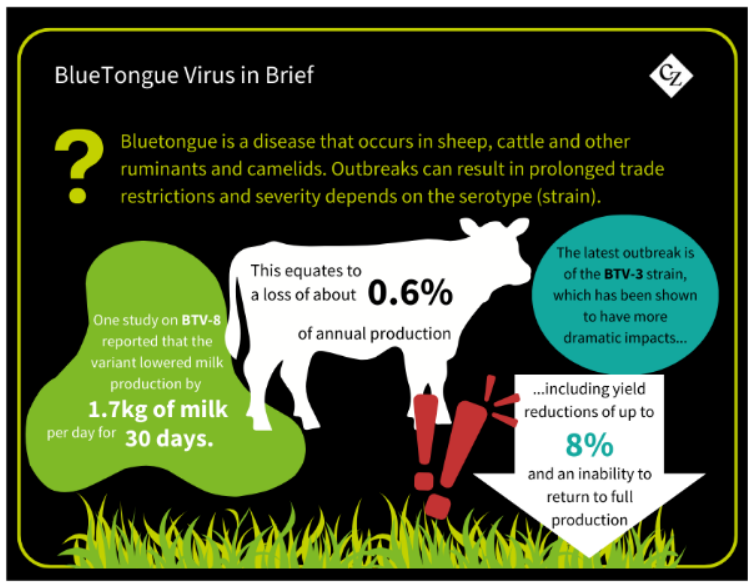

Bluetongue Virus (BTV-3)

Bluetongue risk is set to intensifying with the approaching warming months. Vaccination rollouts are underway, but vectors (biting midges) activity increases in heat. Expect more downward pressure in France and Belgium and watch for spillover into western Germany and the Netherlands if mid-summer heat persists.

Campaigns have been launched to encourage vaccination against BTV-3. However, the available vaccines are suppressive rather than preventive, meaning they reduce clinical signs but do not prevent infection or transmission.

As previously noted, infected cattle can experience reduced milk yields and fertility issues, leading to potential supply constraints in affected regions. France’s earlier struggles with BTV (and ongoing depressed collections) point to the real production downside this virus can cause.

As BTV spreads, dairy producers may face movement restrictions, impacting the distribution and availability of dairy products. All of which could lead to regional supply imbalances and price volatility. For example:

- Seasonal relocation of live cattle to higher-yielding or better-grazing regions (common in cross-border EU farming practices) might not be possible.

- Milk tankers may be unable (or processors unwilling to send them) to collect milk from affected farms if movement zones are locked down or access is delayed by biosecurity controls. This could lead to dumping.

- If similar moves to those being taken in FMD begin to be seen in BTV, then some processors who can switch product mix away from fresh dairy production might move more towards storable commodities like SMP or butter, echoing the current German trend.

What to Watch

If FMD were to spread across the EU, then the fallout would be uneven.

A mass culling scenario could spike EU prices locally while simultaneously removing any export demand for the origin – but it is hard to say which prevails intra-EU. Outside of Europe, all other origin pricing would be expected to spike.

SMP divergence risk.

If FMD is managed away, then Germany’s growing SMP stockpile could become a drag on EU SMP pricing – even if milk flows remain tight. This contrasts with strong Asian demand for Oceania-origin powder.

Under-discussed risk.

The reputational risk of “buying EU” is quietly growing. For multinationals with brand and food safety at the core of their value proposition, this is likely already a factor in internal sourcing decisions. Other buyers may too begin pricing in origin risk, especially for long-haul, multi-month contracts. NZ and South American exporters could benefit from this dynamic.

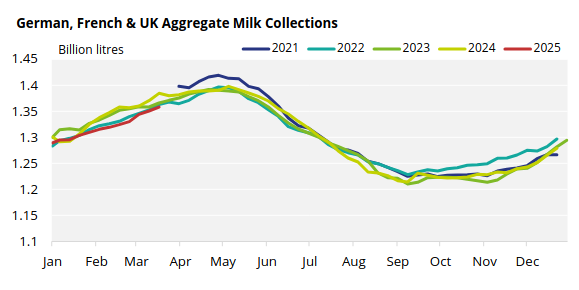

Aggregate Milk Collections Across Europe’s “Big Three”

On aggregate, the UK, Germany and France are tracking the collections seen in 2022 quite closely.

Tariff Tensions Reshape Global Dairy Trade Flows

Last month, we released an article on the potential impacts that a tariff war could have on dairy, so we are not going to do a complete re-review here yet.

The US has implemented a universal 10% tariff on imports, with China facing a significant increase to 125% on its exports to the US.

In response, the EU has initiated retaliatory tariffs of up to 25% on various US goods, including agricultural products. Notably, the EU has excluded dairy products from its initial tariff list, likely to protect its own agri-food sectors from further market volatility.

China’s imports of US dairy products, particularly whey, are expected to decline due to the heightened tariffs. This shift may lead Chinese importers to seek alternative suppliers, namely leaning more toward the EU, which is a larger player in the whey space than New Zealand, to fulfill their dairy protein needs. Other previously discussed infection risk points aside! Read more about whey and whey protein dynamics HERE.

Australian dairy farmers are already facing challenges from cheap US cheese imports. Australia is generally considered a low tariff trading nation. However, considering the US’s own tariff policies of late, this flow could be an interesting one for Australian leaders to focus any retaliation on if a defensive stance were taken (it would likely be popular locally too).

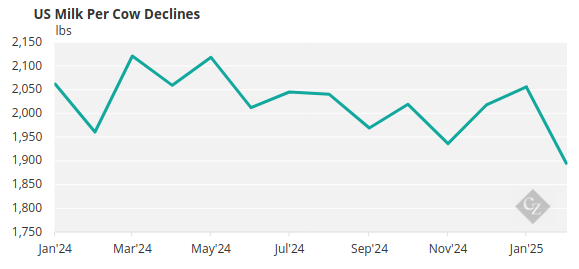

US milk production per cow has declined for three consecutive months, indicating potential supply constraints in the domestic dairy industry.

Source: USDA

Other Snippets

Two huge options trades occurred on the SGX-NZX.

Both were iron condor structures where the buyer was looking to get long volatility buy buying both call spreads and put spreads. They achieved this with 1,000 tonnes/month in WMP across seven months, and 500 tonnes/month in SMP across six months.

Each month required four times that volume of options to be executed (e.g. long 1,000 tonne call vs. short 1,000 tonne call plus long 1,000 tonne put vs. short 1,000 tonne put in each month for WMP). The buyer was so eager to enter these trades that they bought volatility on the near strikes 4% higher than they sold it on the wings, contra to the concept of a “volatility smile”. This trade will be amazing for liquidity, as it is likely that the vol seller will now delta hedge their positions to lock in the profit from vol-spread that they managed to execute.

Arla and DMK are applying to merge, making Europe’s largest dairy farming cooperative if approved.

While it is obvious that exporters should start exploring emerging markets and strengthening a wider basket of trade relationships to offset potential losses in traditional markets, importers should also be doing the same.

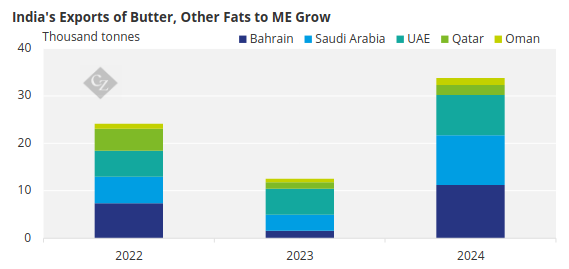

The rise of Indian butter flows to nearby countries.

This is an interesting example that has come from the recent dairy backdrop of extremely high butter and AMF prices from traditional origins.

Source: CLAL