Insight Focus

US shipping tariffs spark concern in the biofuels sector. Experts warn the rules could raise costs and disrupt ethanol and agricultural exports. China may turn to other suppliers, deepening the impact on US trade.

The global trade war ignited by the initial implementation of US tariffs on goods imported from China will surely have negative economic impacts on the shipping industry and everything it transports, including biofuels such as ethanol.

At the centre of the struggle between the world’s two largest economies is the question of which country will dominate the high seas.

Container volumes to the US have already taken a hit because of uncertainty over the tariffs, according to Neils Rasmussen, chief shipping analyst for the Baltic and International Maritime Council (BIMCO).

Bookings are reportedly down by two-thirds since April 5. Container ships and car carriers are also feeling the pain as US tariffs come into force. Liner operators continue to rein in capacity to the US amid fears of further declines in volumes and freight rates, according to maritime watchers.

Biofuel Sector Pushes Back on Proposed Shipping Rules

The US ethanol industry and other biofuels business interests are increasingly concerned about the impact of tariffs on shipping. Recently proposed rules, aimed at countering China’s efforts to dominate global shipping, have raised alarm across the sector.

In April 2024, the US Trade Representative (USTR) began an investigation into China’s practices in the maritime, logistics and shipbuilding sectors. USTR ultimately found that China’s efforts to maintain a competitive advantage in these three sectors were “unreasonable” and that they “burden or restrict US commerce.”

In response, the USTR proposed new fees that would increase the cost of shipping US goods using Chinese vessels. Additionally, the proposal includes new restrictions that would effectively mandate all US exports to be shipped on US flagged, US-built vessels, with only limited exceptions.

“The noted fees and costs of compliance with the proposed requirements to use US-flagged and operated vessels will be significant and result in higher, less competitive prices and decreased demand for US exports while also increasing the price of imported inputs for ethanol’s production,” said Growth Energy Senior Vice President of Regulatory Affairs Chris Bliley in submitted comments. “This will upend domestic supply chains while increasing port consolidation, port congestion, costs, other compliance requirements, and clearance time by customs that will add to the burden and cost of producing and exporting US ethanol.”

“Some of our members are already experiencing reluctance from shippers to enter future transactions without shouldering the risk associated with this proposal,” Bliley said. At the same time, other countries are taking actions to ease the cost of trade and expand their ethanol exports. Most notably, Brazil is currently seeking a trade agreement with the EU that would give its ethanol industry greater, easier access to that market.”

Trade Restrictions Could Disrupt US-China Export Flow

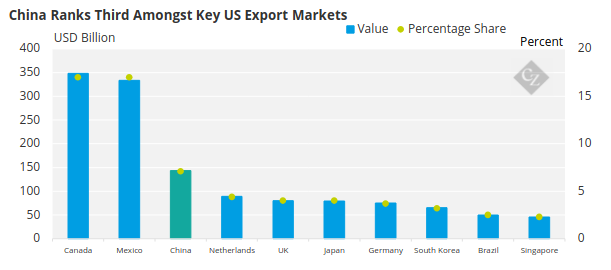

Rasmussen of BIMCO said that in 2024, China was the third-largest recipient of US exports, accounting for 7% of the total in terms of value. He explained that chemicals, computer and electronic products, agricultural products, transportation equipment, and oil and gas made up 67% of the value of these exports to China.

He also pointed out that these trade dynamics could be negatively impacted by US tariffs, which would harm both economies and potentially slow economic growth. Specifically, he noted that the US agricultural sector would be significantly affected, as it exported USD 18.2 billion worth of goods to China, representing 23% of US agricultural exports.

Rasmussen also predicted that the dry bulk market, particularly the Panamax and Supramax segments, would face a negative impact from tariffs. He said that in terms of volume, grains, coal, and petcoke were the largest exported commodities.

As these cargoes became more expensive due to the tariffs, he expects China to increase imports from other countries such as Brazil, Ukraine, Indonesia, Russia, Australia, and Mongolia. He added that US exporters might seek alternative markets for their goods as a result.

Regarding the tanker trade, Rasmussen suggested that it might not be greatly affected by the tariff increases. He noted that China could turn to OPEC and Brazil to replace the oil it had been purchasing from the US, while the US should also be able to find other buyers for its oil exports.

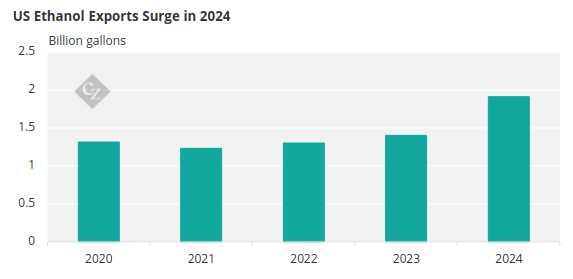

Exports of US ethanol set a record in 2024, shipping 1.9 billion gallons worth USD 4.3 billion. During the same period, the US ethanol industry maintained a USD 3.9 billion trade surplus.

Source: RFA

“As a result of the potential harm to the US ethanol industry, we asked the USTR to remove the proposed fees and restrictions on services,” Bliley said. “These new requirements would cause a significant upheaval that American producers can ill afford.