This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

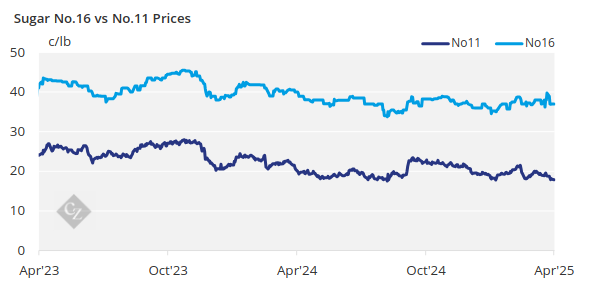

US sugar prices were lower last week amid slow deliveries and trading. Refined sugar stocks were the second highest on record at the end of February, supported by strong high-tier imports forecast in the April WASDE report.

Bulk spot beet and refined cane sugar prices were lower in the week ending April 17, with forward beet sugar prices also weaker. Trading was sluggish and deliveries were slow.

Spot beet sugar prices were 1c/lb to 3c/lb lower FOB Midwest. Prices had been unchanged for several weeks based on the lack of volume sales. But as the marketing year progresses, the nearby market will begin to converge with forward prices. Refined cane sugar prices for 2025 were lowered by 1c/lb in all regions.

Initial 2026 cane sugar offers were indicated at 52c/lb Northeast and West Coast and 50c/lb Southeast and Gulf, all 1c/lb below 2025 levels.

Prices for bulk refined beet sugar for 2025-26 were lowered for the second consecutive week, now quoted at 38c/lb to 41c/lb FOB Midwest. Even at lower prices, buyers aren’t rushing in, with most seeing limited upside price potential. Forecasts of higher sugar beet plantings in 2025, weak deliveries in the current year and economic uncertainty support buyers’ bearish outlook for the 2025-26 marketing year.

Few buyers need additional sugar in 2025, but most beet processors still have sugar to sell. The weakness in 2025 beet sugar prices appears to stem from weak deliveries and from some processors seeking to clear burdensome stocks that at the end of February were up by around 13% from a year ago.

Some in the trade noted that even lower prices may not generate new sales if users don’t need the sugar. There were some indications that buyers were honoring contracts and putting excess sugar into warehouses.

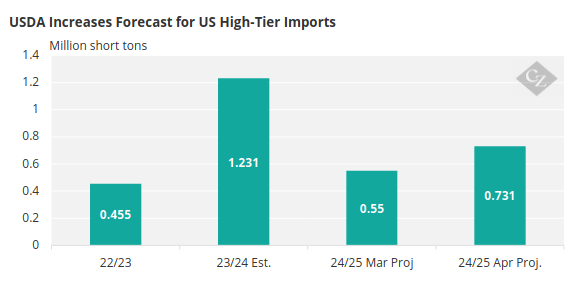

Strong High Tier Imports Support High Stocks

Refined sugar stocks at the end of February were the second highest on record (after fiscal 2013), and raw cane sugar stocks were the highest on record.

Adding to supplies are strong high-tier imports, which the USDA forecast at 731,000 short tons (663,152 tonnes) for 2024-25 in the latest WASDE report. This is up 181,000 short tons from March and second only to last year’s record-high 1.23 million short tons.

In the latest WASDE report, the USDA left its delivery of sugar for food forecast unchanged from March at 12.24 million short tons, which most in the industry deem significantly too high. The estimate is down 1.5% from 2023-24, but actual October-February deliveries reported in the USDA’s Sweetener Market Data report were down 3.6% from the same period a year ago. Some suggest the USDA’s WASDE delivery forecast may be 100,000 short tons too high.

Meanwhile, sugar beet planting progressed, with 11% of the crop in the four largest states planted as of April 13, mostly in Idaho at 59%, according to the USDA.

Global 10% tariffs are in place on all sugar imports except those from Mexico, which is significant, and Canada, which is minor. Many feel the 10% tariffs may slightly boost sugar prices, but the overall impact will be minimal.

Corn sweetener markets remained quiet.