Insight Focus

TiL is set to grow through a major acquisition. It operates over 70 terminals worldwide, supporting MSC’s global reach. If finalized, the USD 22.8 billion Hutchison deal would make TiL the largest terminal operator in the world.

Blockbuster Port Deal

One deal that has sent shockwaves through the global shipping industry is the mega port agreement between a BlackRock/MSC consortium and CK Hutchison, involving the sale of nearly all of CK Hutchison’s port and terminal assets—excluding those in China and Hong Kong.

Valued at USD 22.8 billion, the deal remains under negotiation, as concerns from Chinese regulators and broader geopolitical implications—particularly the transfer of Panama port assets from a Hong Kong-based conglomerate to Western interests—have delayed its finalisation.

If completed, the deal would see MSC’s terminal arm, TiL, become the world’s largest port and terminal operator. It would catapult MSC to the top of the global rankings, significantly expanding its footprint across key regions in both Asia and Europe.

That would also mean that MSC would be the largest ocean carrier and the largest port and terminal operator in the world at the same time, in an unprecedented dual dominance in the shipping industry.

Operational Profile

So, what do MSC and TiL’s global operations look like?

Terminal Investment Limited (TiL) is a global port operator widely regarded as the port operating arm of Mediterranean Shipping Company (MSC). The Swiss-Italian container shipping giant holds a 70% majority stake in TiL, while the remaining shares are held by Global Infrastructure Partners (GIP), a part of BlackRock (20%), and GIC, the Government of Singapore Investment Corporation (10%).

Founded in 1970 by the Aponte family in Italy, MSC is headquartered in Geneva, Switzerland, and maintains strategic control over TiL, solidifying its role as the company’s dedicated port operations subsidiary.

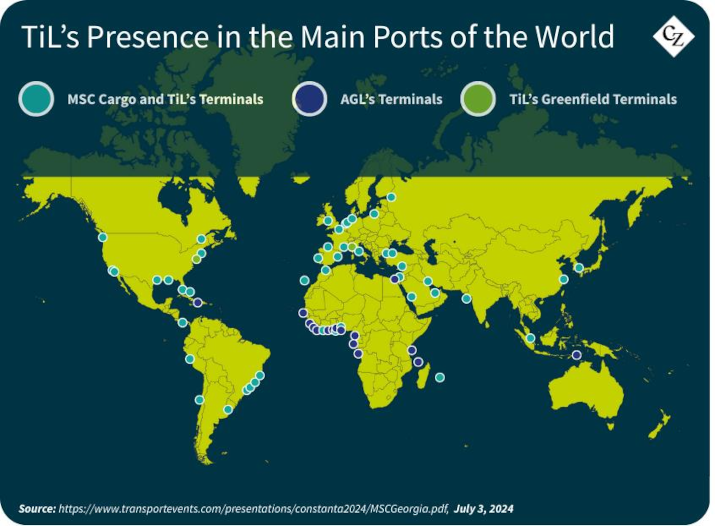

TiL operates a diverse network of container terminals strategically positioned along the world’s major shipping lanes, offering vital access to both established and emerging markets.

The company maintains a strong presence at several of the world’s busiest container ports, including Singapore, Ningbo and Busan in Asia, Los Angeles, Long Beach, and New York/New Jersey in North America, and Rotterdam, Antwerp and Valencia in Europe, ensuring connectivity across key trade corridors.

Overall, TiL operates in over 70 container terminals worldwide, including upcoming projects, spanning more than 30 countries across all five continents.

Key TiL Terminals

MSC PSA European Terminal (MPET) / Europe

With an annual throughput capacity of 9 million TEUs, MPET — a joint venture between TiL and Singapore-based operator PSA — is the largest container terminal in Europe, handling over half of the total container volume at the Port of Antwerp Bruges.

Port of Antwerp Bruges

TiL’s stake in MPET provides a strategic advantage to both TiL and its mother company, MSC, within the European shipping network.

Total Terminals International (TTI) / North America

As one of the largest box terminals in North America, TTI at the Port of Long Beach can handle three ultra-large container vessels (ULCVs) with up to 14 ship-to-shore cranes simultaneously.

Port of Long Beach

TTI secures a strategic position for MSC’s Transpacific sailings, ensuring, at the same time, the presence of the Italian shipping powerhouse at San Pedro Bay Ports, one of the world’s most critical port complexes.

MSC PSA Asia Terminal (MPAT) / Asia

Through another joint venture with PSA, TiL has a strong presence at Singapore, the world’s largest container port. MPAT, located at Singapore’s Pasir Panjang Terminals, is part of the largest transshipment hub globally and serves as a home for the largest container vessels ever built.

Pasir Panjang Container Terminal in Singapore

With a maximum capacity of 8.5 million TEUs and a terminal area spanning over 1 square kilometre, MPAT is capable of handling container ships with a capacity of up to 23,000 TEUs.

Lomé Container Terminal (LCT) / Africa

LCT is a greenfield project fully developed by TiL, which was awarded a 35-year concession by the Government of Togo to develop, finance, construct and operate a box terminal at the Port of Lomé. With an estimated handling capacity of 2.2 million TEUs per year, LCT has further expansion plans underway to support growing demand.

Port of Lomé

Strategically located on the Gulf of Guinea, LCT serves as a vital transshipment hub for the West African region, while it provides crucial connectivity to landlocked countries such as Mali, Niger and Burkina Faso, as well as northern Nigeria.

TiL’s Role in MSC’s Standalone Strategy

The world’s largest ocean carrier, MSC, has chosen not to join any of the newly formed container alliances—Gemini Cooperation, Ocean Alliance or Premium Alliance—opting instead for a standalone strategy. Leveraging its massive container ship fleet, MSC is focused on building its own global service network to ensure greater flexibility and independence.

“We want to be in charge of our own destiny, so that we can provide the speed, agility and decision-making to our clients that we want,” highlighted Søren Toft, CEO of MSC.

With MSC’s emphasis on a shipping network built around more direct services, two key factors are likely to determine the success of this approach: the adequacy of its fleet and the strength of its port and terminal infrastructure.

This is where TiL plays a critical role. MSC’s terminal operator, TiL, has a growing global portfolio that provides access to strategically located facilities, enabling efficient and reliable port services around the world—further reinforcing MSC’s independent strategy.

TiL’s expanding footprint may serve as a cornerstone of MSC’s standalone approach, potentially explaining the company’s increasing appetite for acquisitions, expansion projects and investment deals at ports and terminals worldwide.