Insight Focus

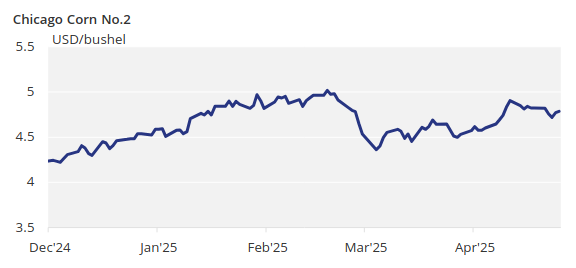

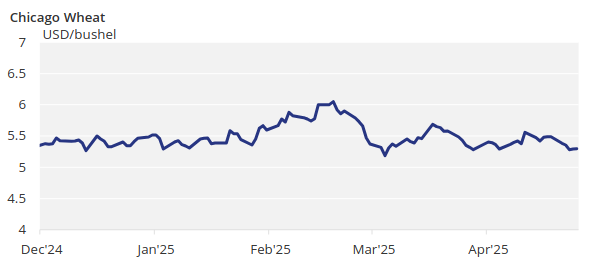

The grain markets fell due to strong planting and favourable weather. US corn and wheat prices dropped despite easing trade tensions. Weather risks persist, but the Chicago corn forecast remains at USD 4.55/bushel for 2024/25.

It was a negative week for all grains across all geographies due to good planting progress and favourable weather. We continue to be in a weather-driven market while corn planting in the northern hemisphere progresses.

We should expect good planting progress in the US as dry weather is expected, posing some downside risk. However, the market is pricing in 94.5 million acres, so any signal of a shortfall should be supportive. We also continue to expect the WASDE to increase corn demand for ethanol. Overall, there is more upside than downside risk.

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), which we expect to average USD 4.55/bushel, with some downside risk depending on the trade war. The average price since September 1 is running at USD 4.47/bushel.

Corn Prices Slip as Planting Progresses

US corn planting advanced more than expected, putting some downside pressure early last week, but the market rallied during the second half of the week on strong weekly US corn sales and signs that the US and China are deescalating the trade war. However, the gains were not enough, and the week ended negatively, with losses of less than 1%. Euronext corn experienced larger losses, mostly due to the impressive planting pace in France.

US corn is 12% planted, compared to 11% last year and the five-year average of 10%. In Brazil, the summer corn crop is 68.2% harvested versus 56.7% last year. The Safrinha corn is fully planted. In Argentina, corn harvesting is 29.7% complete, with 80% of the area in normal to good condition, up 2 points week-on-week.

French corn planting has reached 50%, compared to 24% last year and the five-year average of 42%. Corn planting in Ukraine is 18% complete versus 30% last year. Russian corn planting is 18.1% complete versus 35% last year.

US Wheat Drops Amid Dry Conditions

Wheat in the US mirrored corn, with a negative start to the week despite worsening conditions. However, strong planting progress for spring wheat was noted. Weekly losses exceeded 3%, significantly larger than the negative performance in Europe.

US wheat condition was rated 45% good or excellent, down 2 points on the week and compared to 50% last year. Spring wheat planting is 17% complete, compared to 14% last year and the five year average of 12%.

The French wheat condition was rated 74% good or excellent, unchanged week-on-week, compared to 63% last year. The April MARS bulletin from the EC raised its wheat yield estimate to 6.03 tonnes/ha, slightly above the previous estimate of 6 tonnes/ha.

On the weather front, the US is expected to experience dry conditions in some southern wheat areas, while northern areas will receive rains, albeit below average. Brazil is expected to continue experiencing a combination of rainy and dry weather across the centre-south, while Argentina is expected to stay mostly dry. Northwestern Europe is expected to have warmer-than-normal temperatures and dry weather, with rains only expected by the end of the week. Similar conditions are expected in the Black Sea region.