Insight Focus

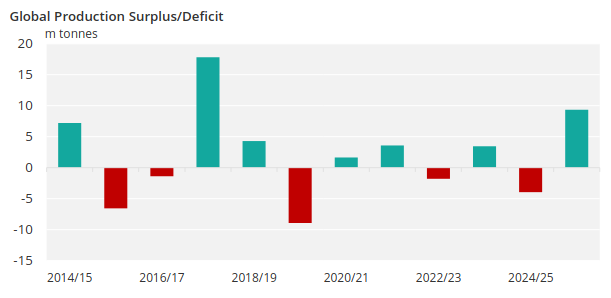

We think the world will make 9.3m tonnes more sugar than it consumes in 2025/26. Other analysts are showing deficits. We’ve been asked why there’s such a large difference in views.

We recently published our latest forecast of global sugar production and consumption. This showed the world will make 9.3m tonnes more sugar than it will consume in 2025/26.

We are aware that other analysts have published stats showing a more balanced market. In early February, Green Pool forecast a small 2.7m tonne surplus for 2025/26. At last week’s Geneva Sugar Conference S&P Global said they were working with a 1.6m tonne deficit.

We’ve been asked to explain the difference between our view and theirs. How is it possible that analysts can look at broadly the same data and come to such different conclusions?

Methodology

We hesitate to begin this discussion with a subject as dull as methodology. Some things are best debated by analysts in private!

We also cannot comment on other analysts’ work, other than to say that our competitors are competent and we hold their work in high regard. However, we rarely see the statistics which underpin their results.

Nevertheless, it’s fact that each analyst uses different methodology.

Some use a strict October to September year to assemble their production and consumption estimates. This has the unfortunate effect of splitting the cane harvest of Centre-South Brazil, the world’s largest sugar producer, across two seasons. We aggregate crop years for each sugar producer and compare against calendar year consumption. This means that different analysts’ statistics may not be directly comparable.

But this shouldn’t account for a 10m tonne difference in forecasts. Something else is going on.

Weather

We assume good weather until we have data indicating otherwise. In general, it is more common for non-normal weather to lead to crop degradation than above-average yields. This means that exceptional weather often leads us to downgrade our original crop forecasts.

We are aware that this bias exists in our statistics: it’s more common for our production estimates to decrease through time rather than increase. We prefer to know where our vulnerabilities lie and frame our market advice accordingly.

For 2025/26, much of the important weather for cane/beet maturity hasn’t happened yet. Any exceptional events could cause our production forecast to shrink.

Global Sugar Production in 2025/26

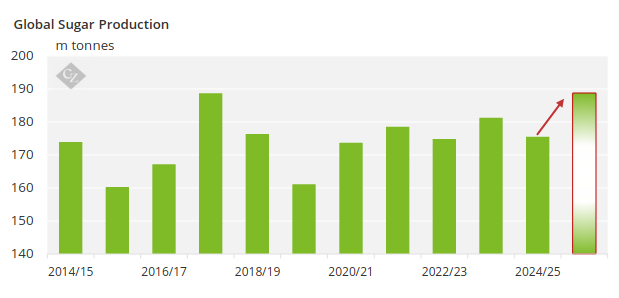

Looking specifically at our production forecast, we think 2025/26 could bring the second-highest global sugar production on record.

This will mostly be driven by the world’s largest sugar producers. We think:

- Centre-South Brazilian sugar production could rise from 39.9m tonnes last season to 42m tonnes this season.

- Indian sugar production could rise from just under 26m tonnes to 32m tonnes.

- Thai sugar production could rise from around 10m tonnes to 11.9m tonnes.

These three countries alone add around 10m tonnes of increased sugar production in 2025/26.

We believe the range of analyst estimates for CS Brazil in 2025/26 is 40-43m tonnes. We are near the top end of this range.

Equally, this year’s poor Indian crop performance could lead other analysts to be more defensive in their crop forecasting for next season. However, we are forecasting a ~23% increase in sugar output and India has achieved an increase on this scale five times in the past 20 seasons.

For Thailand we believe that ~12m tonnes is market consensus for the time being.

Sugar Consumption

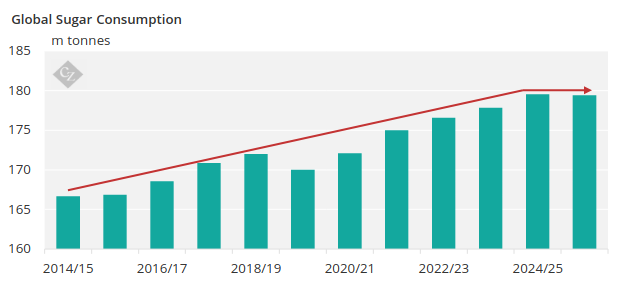

Finally, we suspect we diverge from everyone else in the market when it comes to sugar consumption forecasts. We think that sugar consumption will not grow at all in 2025/26, owing to food price inflation, increased awareness of sugar consumption and GLP-1 drugs.

Some of this analysis rests on our belief that GLP-1 receptor agonist drugs like Ozempic and Mounjaro are becoming mainstream in several countries around the world and they could lead to large changes in food consumption.

These effects are currently almost impossible to analyse sensibly, but we need to make some form of adjustment to account for their usage. Therefore, as a preliminary measure, we’ve started to taper sugar consumption in advanced economies, starting in the USA in 2024 and spreading to other wealthy countries in 2025. Semaglutide, the active ingredient in Ozempic, comes off-patent in India, China and Brazil in 2026, at which point availability will increase and prices should decrease.

We think this analysis is unique in the sugar market. We don’t pretend it is perfect; it’s an attempt at a first assessment of a rapidly emerging trend.

We suspect other analysts are disregarding these drugs for the time being, meaning they will be assuming 1-2% annual sugar consumption growth. This could account for another few million tonnes’ difference between our production/consumption forecasts.