This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

The US sugar market is still in a holding pattern as neither buyers nor sellers are in a rush to trade. The latest USDA acreage report showed net losses in both sugarcane and sugar beet planting and harvested areas for 2024.

Buyers and Sellers Face Off

The cash sugar market was quiet in the week ended June 28, typical of the summer and ahead of a holiday week. Sugar beet and cane crops were faring well, but most had room for improvement during the season.

Prices were unchanged from a week ago. Beet sugar for 2024-25 could be bought below 50¢/lb FOB Midwest but ranging up to 53¢/lb, and refined cane sugar was offered below 60¢/lb FOB Northeast and West Coast and slightly above the mid-50¢/lb area in the Gulf and Southeast. Spot beet and refined cane sugar values were modestly above forward prices and were also unchanged.

One beet processor remained out of the 2024-25 market, except for private label sugar, at least through September. There were indications that a second beet sugar seller also had withdrawn from the 2025 market. Other processors continued to sell at a steady pace for next year. Cane sugar sales also advanced, with some indicating a firmer tone was developing.

Buyers remained disciplined or even on the slow side to cover needs for 2024-25. The pace was more typical of the industry and was in sharp contrast to rapid sales in March-April 2023 for 2024-25. The upside price risk appears limited assuming weather cooperates with domestic beet and cane crops this year, and Mexico’s production and exports increase from this year as forecast. At the same time, there appears to be limited downside potential as beet processors tend to raise prices when they hit internal sales targets, and weather risks persist.

Deliveries in April, May and June remained near or above expectations, an improvement from weak deliveries in the first half of the marketing year (October-March). Some expect shipments to slow later in the summer and end the marketing year near or slightly below the USDA forecast. While sugar prices mostly are supply driven, the pace of new sales can be affected by deliveries as food manufacturers try to determine consumer demand for their products.

Weather Favourable but Acreage Down

Sugar beet crop condition ratings as of June 23 were up from a week earlier in five of the seven reporting states and down in two, according to USDA state office reports. The major concern for beet crops was heating degree days, with warm temperatures needed to produce sugar for deposit in roots. Most beet growing areas have been relatively cool this season, despite planting progress that was well ahead of last year.

Sugar cane crop conditions improved for a third consecutive week in Louisiana, with the good-to-excellent rating at 73% as of June 23, the highest in several weeks. Meanwhile, drought conditions that covered 100% of the cane crop in Florida two weeks ago were eliminated by recent heavy rains.

The USDA in its annual Acreage report estimated US sugar beet planted area at 1.11 million acres, down 19,000 acres, or 1.7%, from 1.129 million acres indicated in the March Prospective Plantings report and down 27,400 acres, or 2.4%, from 2023.

Source: Prospective Plantings, Acreage Report

The largest declines from a year ago were in the Red River Valley, with Minnesota down 19,000 acres, or 4.3%, and North Dakota down 8% or 18,000 acres. Planted area increased slightly from last year in all other states except California and Washington, which were unchanged. Sugar beet harvested area was forecast at 1.088 million acres, down 38,700 acres, or 3.4%, from 1.127 million acres in 2023.

Sugar cane area for harvest in 2024 was forecast at 909,000 acres, down 20,600 acres, or 2.2%, from 2023, with Florida at 394,000 acres, down 13,600 acres, or 3.3%, Louisiana at 515,000 acres, up 9,500 acres, or 1.9%, and Texas at zero, down 16,500 acres.

Source: Acreage Report

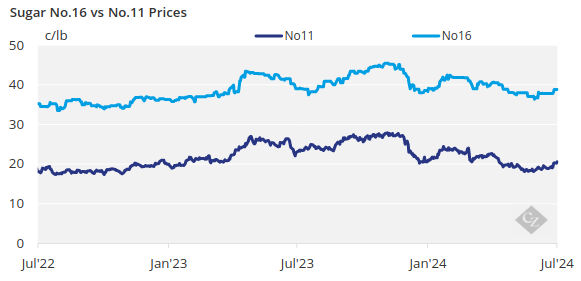

Sugar futures were well above recent lows and continued to rise amid concerns about global sugar supplies, mainly because of dry conditions in Brazil.

Corn sweetener markets were quiet.