This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

The sugar market was quiet last week. There was weak 2025 cane prices and slow 2025-26 contracting due to price gaps. Sellers held firm, while buyers awaited talks at the Sweetener Colloquium. Cane prices dipped slightly, beet trading was limited, and corn sweetener remained steady.

The cash sugar market was quiet in the week ending January 31. Refined cane sugar prices for calendar 2025 were weaker amid slow trade. Contracting for 2025-26 was in discovery mode, with most buyers and sellers still far apart on pricing.

Beet Sugar Pricing Holds Steady

Beet sugar sellers appear to be holding offers for 2025-26 at around 45¢/lb FOB Midwest, with the upper end around 48¢/lb, depending on location—about steady with 2024-25 traded prices. That was well above (in most cases) buyers’ bids in the lower 40¢/lb range, with some seeking prices in the upper 30 c/lb FOBs, which beet processors said would put sugar below the cost of production for sugar beet growers.

Buyers are viewing ample domestic and Mexican sugar supplies, at best steady demand, and raw sugar futures prices well below year-ago levels. Sellers maintain it’s too early to drop prices, as none of the 2025 crop has been planted. At least one grower cooperative said its planted area would be flat-to-lower from 2024.

The first widespread indication of 2025 sugar beet acreage will come in the USDA’s Prospective Plantings report at the end of March, although grower cooperatives will have determined planted areas before then.

While most alternative crop prices are lower this year—which would tend to discourage switching out of sugar beets—corn futures recently moved to a one-year high. Despite prices for other crops, growers’ commitments to plant enough beets to keep factories running limit significant movement out of sugar beet areas, just as processing capacity restrictions limit large acreage increases.

Buyers Await Colloquium

As a result, contracting for 2025-26 has been slow, with only a few sales noted. Many buyers were still in the price discovery mode, perhaps gathering intelligence for more meaningful negotiations on the sidelines of the International Sweetener Colloquium taking place February 23-26. While buyer-seller meetings will be busy, some doubt significant sales will occur at the Colloquium, with contracts inked a few weeks later.

Some spot beet sugar trading occurred at prices mostly steady with recently quoted values, although users’ 2025 sugar needs were mostly filled many months ago. Most beet processors have some sugar to sell from their 2024 crop after better-than-expected production, but most are also finding limited demand for excess supply. One processor remains out of the market.

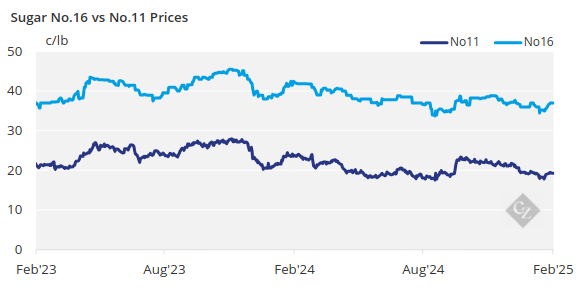

Refined cane sugar offered prices were steady to 2¢/lb lower across the country. The change may have been indicative of lacklustre demand, ample supplies, and/or earlier declines in raw sugar futures to five and a half month lows. Both domestic and world raw sugar futures prices have since rebounded, with the spot March No. 16 contract up sharply ahead of expiration on February 8.

As has been the case in recent weeks, sugar deliveries for 2025 contracted sugar remain a major concern. Processors indicated mixed results, with some noting an uptick in January deliveries but with shipments still somewhat below hoped-for levels, while others said users were drawing on contracts at expected levels.

The corn sweetener market was quiet after 2025 contracting concluded by year-end at prices that were steady-to-lower from 2024. Focus was on corn sweetener demand from Mexico, the primary US export destination, and the impact of potential tariffs on US-Mexico trade.