Insight Focus

- Ethanol prices have been below the cost of production since June.

- What will it take for prices to improve?

- We explain in only 5 charts the current ethanol environment and what to look for.

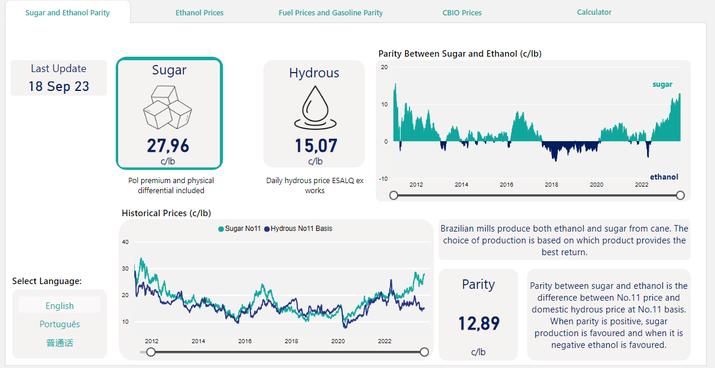

Centre-South Brazilian cane mills have pushed sugar production to its operational limit this season. The reason why is obvious when we look at the gap between sugar and ethanol prices.

So far in the 2023/24 season, sugar has been paying on average 10c/lb more than ethanol – this is 1000 points premium over the biofuel.

However, mills cannot produce only sugar. The estimated sugar mix for this season is around 48.5%, meaning that of the sucrose available, 48.5% will be allocated to sugar production and 51,5% for ethanol.

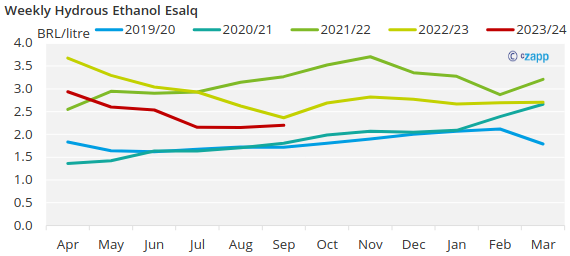

The problem is that ethanol prices have not only been below sugar, but have been the lowest in the past 2 seasons – currently being sold below cost of production.

What can producers expect from ethanol prices from now on? Below we have 5 charts that can help summarize the current environment and what to look for until the end of the season – in March 2024.

Gasoline Prices

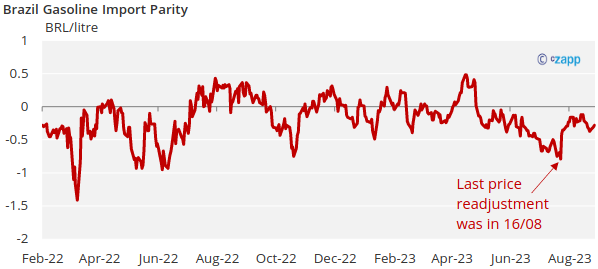

Source: Abicom

Gasoline prices (ex-refinery) have been below the international benchmark since May. While lower gasoline prices are an issue for fuel supply in Brazil, since only Petrobras is willing to import at negative margins, it can also cap ethanol prices.

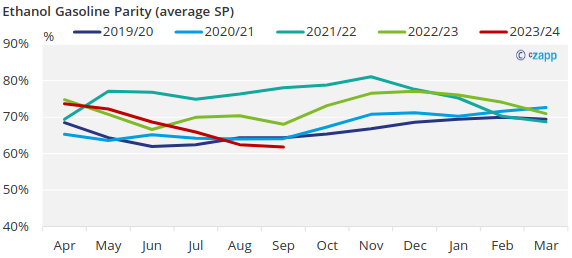

Ethanol needs to be 70% or lower than gasoline prices in order to be competitive and incentivize demand. If gasoline prices are kept low, then ethanol prices are unable to rise without breaking this rule.

Ethanol and Gasoline Parity

Source: ANP

Ethanol price parity fell below 70% in June, but demand failed to respond. While gasoline prices rose at the pumps due to tax changes, ethanol prices kept falling to try and trigger demand. Ethanol price parity fell down to 62% and only last month was there a demand reaction. This was the lowest parity since 2018.

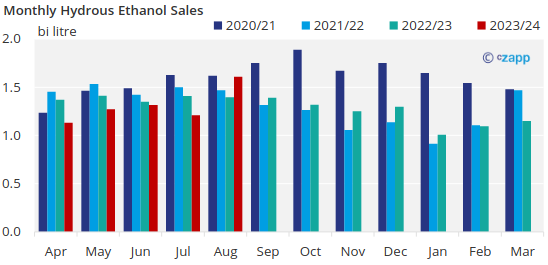

Ethanol Demand

Source: UNICA

At last, hydrous ethanol sales have reacted, with August volume reaching 1.6bi litres – the highest volume since 2020. We expect sales in September to remain above 1.5bi litres, as parity is still around 62%.

It is a tough game. If prices rise too fast then it might scare off any potential additional demand. This results in heavier carryover stocks. Lower prices might not be what mills want, but it can bring longer term demand and help reduce stocks for the offseason.

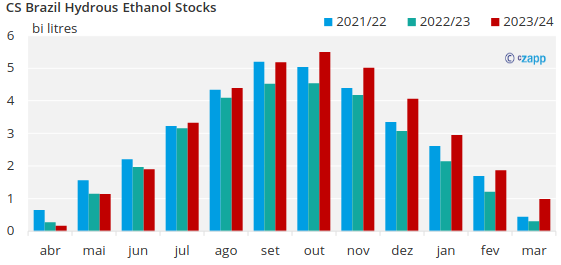

Ethanol Stocks

Carryover stocks could be one of the heaviest of the past seasons. Again, this could change depending on how demand reacts from now on. Sales need to increase to reduce stocks and improve the outlook of prices for the offseason.

The cost to carry from September until March 2024 is around 20cents/litre. This means ethanol prices would need to be at least BRL2.4/litre (net of taxes) by the end of the season for mills to want to carry ethanol. However, many players are not so confident prices could rise this much over the next 6 months. The alternative is to sell now rather than bet on values improving. This is a rather bleak outlook, since would mean the lowest off-season prices since 2021.

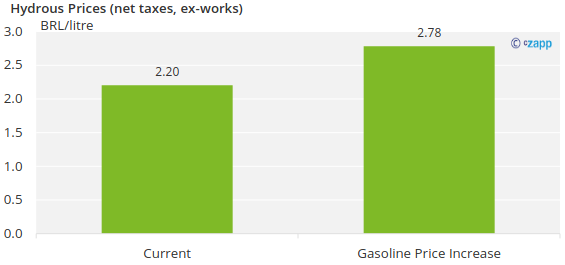

“Fair” Ethanol Prices

Currently, ethanol prices are around BRL2.2/litre (net of taxes, ex-works) – or 15c/lb on a No.11 basis. This in turn results in average prices at the gas station of BRL3.5/litre – and a parity of 62%.

The first chart of this article shows how gasoline prices in Brazil are below international benchmark, by around BRL0.28/litre. What if Petrobras readjusted gasoline prices to close this gap? What is the potential upside for ethanol?

Using 70% parity as the limit which ethanol prices could rise without affecting its competitiveness, then ethanol prices could rise up to BRL2.78/litre (18,5c/lb, No.11 basis). This is 26% higher than the present values and above carry cost.