Insight Focus

The container shipping industry experienced significant shifts in 2024. Geopolitical disruptions and supply chain challenges led to volatile freight rates and profitability changes. These developments signal a period of transformation and uncertainty for the sector.

The container shipping industry faced a turbulent year in 2024, characterised by significant geopolitical tensions, global port strikes, political shifts and strategic moves by market leaders. These factors, combined with fluctuations in global demand, created a challenging environment for ocean carriers, shippers and port operators. As they navigated this complex landscape, key players sought to optimise operations and adapt to evolving market conditions.

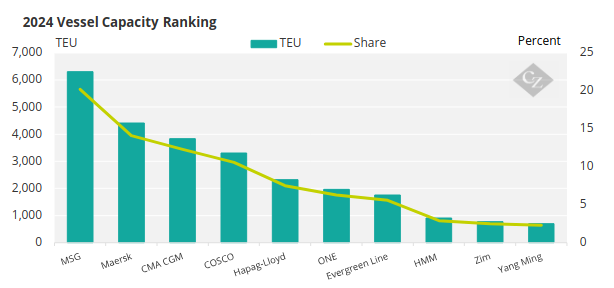

1. Container Lines Capacity Ranking

Vessel capacity remains a crucial indicator of market dominance, and 2024 saw Mediterranean Shipping Company (MSC) lead the container shipping industry in terms of TEU capacity. This trend is expected to persist in the coming years, bolstered by MSC’s impressive newbuild orderbook, which stands as the largest among container shipping companies.

Source: Alphaliner

The Danish shipping giant Maersk followed in second place, with French CMA CGM, Chinese COSCO and German Hapag-Lloyd completing the top five. These companies continue to play a central role in shaping the global shipping landscape and define the rules of the game.

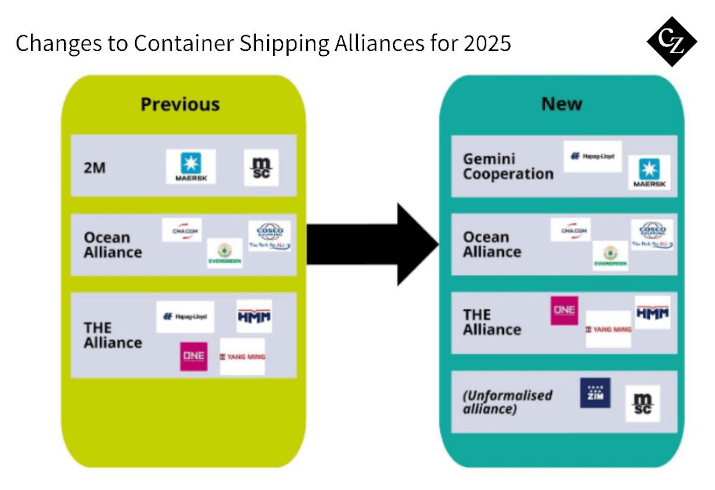

2. Shifts in Shipping Alliances

2024 marked the final year of the current structure of major shipping alliances, which has remained unchanged since April 2017. From February 2025, ocean carriers will form new alliances, which are expected to significantly reshape service networks.

MSC made the notable decision to remain independent, opting not to join any new alliance. Although it has established slot and vessel-sharing agreements with other carriers, the company aims to maintain full control over its giant fleet. This strategy places MSC in direct competition with the newly formed alliances, a development that will be closely monitored in the coming years with a great interest.

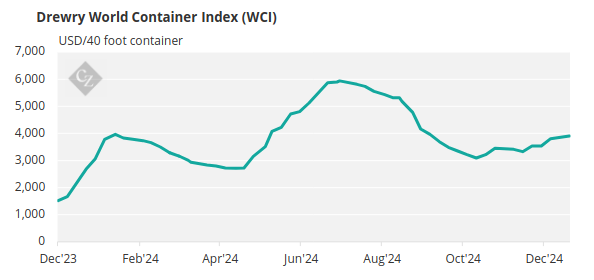

3. Freight Rate Fluctuations

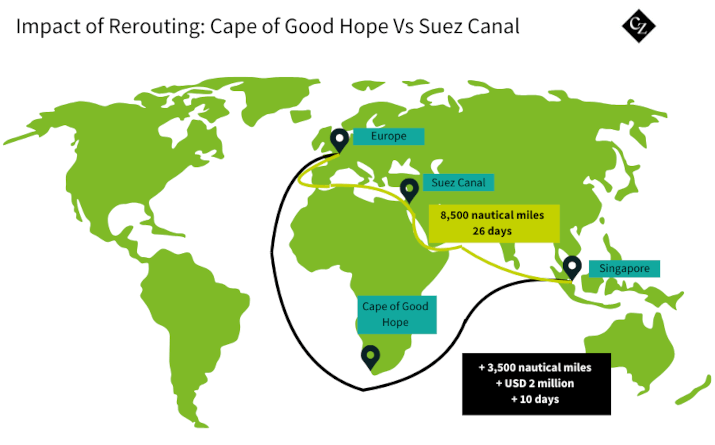

Container freight rates saw significant volatility in 2024, driven by geopolitical events, supply chain disruptions and changing global demand. The year began with the Red Sea crisis, where Houthi attacks on commercial vessels disrupted trade, causing freight rates to spike. The conflict in Yemen further exacerbated supply chain challenges, keeping rates elevated.

As the year progressed, the container shipping market experienced demand growth roughly double that of capacity expansion. This shift was largely driven by shipping companies opting for rerouted paths around the Cape of Good Hope, bypassing the Red Sea and Suez Canal due to ongoing disruptions. The alternative African route became a preferred choice, significantly influencing the balance between demand and available shipping capacity.

In the first half of 2024, spot rates surged dramatically due to the Red Sea crisis. However, as the industry adjusted to these new conditions, rates gradually stabilised, with companies adapting to the “new normal”. Retailers, especially in the fashion sector, faced mounting challenges from higher shipping costs and delays. To manage this volatility, some retailers accelerated their shipping schedules and locked in long-term contracts to avoid the unpredictable spot market.

Source: Drewry

In summary, 2024 was marked by significant volatility in freight rates, with geopolitical tensions, supply chain disruptions and shifting demand playing a central role. While many shipping companies benefited from higher rates, boosting their revenues, retailers and consumers struggled with the increased costs and delays.

4. Financial Results

The surge in freight rates, driven significantly by rerouting around the Cape of Good Hope, led to impressive financial results for ocean carriers.

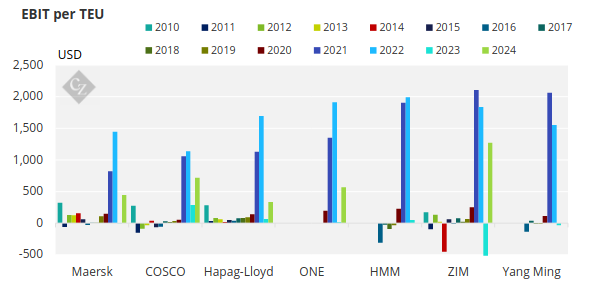

According to Danish maritime data analysis firm Sea-Intelligence, major carriers reported a combined Earnings Before Interest and Taxes (EBIT) of USD 17.06 billion in the third quarter of 2024, a staggering 600% increase from the previous year. Excluding Israeli container line ZIM, which reported a non-cash impairment loss, eight of the nine carriers reported EBIT over USD 1 billion, with three surpassing USD 2 billion.

Source: Sea-Intelligence

COSCO led the pack with the highest EBIT of USD 4.71 billion. Despite this, COSCO’s EBIT per TEU, at USD 716, was surpassed by ZIM’s impressive USD 1,273 per TEU. COSCO was followed by ONE (USD 567 per TEU) and Maersk (USD 446 per TEU).

While this level of profitability is below the heights seen during the pandemic, it is also higher than any “normal” Q3, according to Sea-Intelligence’s analysts. The current supply chain disruptions have injected volatility into the market, driving up freight rates and carrier profitability to levels not seen in the decade, except the pandemic period.

5. Global Port Strikes

Throughout 2024, several port workers strikes and warnings emerged globally, but the global focus was on the US East Coast terminal operators, who struggled to reach an agreement with the International Longshoremen’s Association (ILA). The main concern remained the port and terminal automation.

The ILA has expressed concerns that increasing automation and technological innovations could lead to significant job losses for port workers. Meanwhile, USMX wants to move forward with automation to enhance efficiency at port facilities.

ILA staged a strike from October 1 to October 3, before reaching a tentative agreement with USMX. This temporary agreement allowed both sides more time for continued negotiations. However, as the January 15 deadline approaches, and with no progress in discussions, there are growing concerns about the possibility of further strike actions in the early weeks of 2025.