Insight Focus

The price of cocoa has been especially volatile in the past year, for several reasons. A closer look at these issues could provide an indication of future price direction. We provide a list of the main factors set to influence cocoa prices in the short to medium term.

Cocoa is a tropical crop with around 75% of global production coming from West Africa and 65% coming from Ivory Coast and Ghana alone. Over 95% is grown on smallholder farms by farmers who are significantly challenged by high poverty levels, human rights issues such as child labour and major levels of deforestation.

Both Ivory Coast and Ghana are government-run systems with farm gate prices set by the authorities at the beginning of each season. The prices are established by selling the crop forward during the year prior to the harvest period. The remaining origins are free markets.

The market has had a sensational year with a huge price rally to all-time highs followed by a significant reversal with unprecedented daily volatility.

Trading Becomes More Volatile

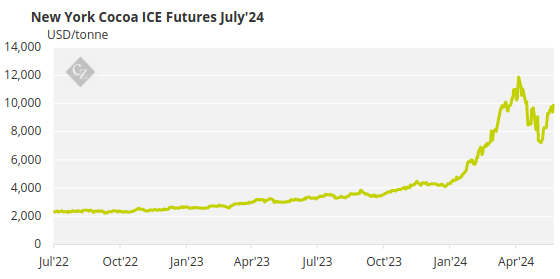

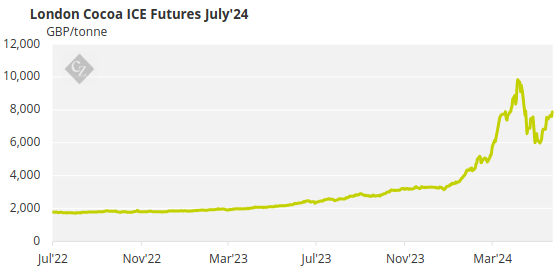

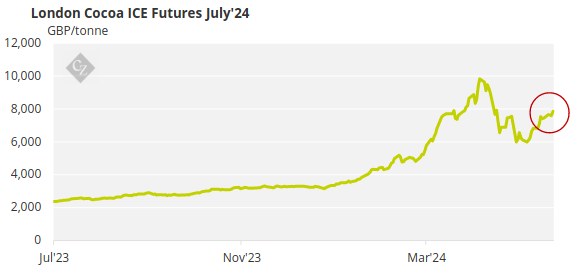

The ICE cocoa London July’24 contract started the year at GBP 3,300 and New York started at USD 4,180. Both contracts then hit record highs in late April at GBP 9,980 in London and USD 11,722 in New York, before falling back to close at GBP 7,444 and USD 9,331, respectively.

It is not just the scale of the rise and fall. It is also the movement in the structure, with London July’24/July’25 trading from GBP 400 at the beginning of the year to over GBP 3,900. In New York, the July’24/July’25 contracts saw a similar movement from USD 475 to over USD 3,900.

The structure of the market has also followed the drop, with the July’24/July’25 contracts having retreated to levels of GBP 2,500 in London and USD 3,000 in New York.

During this period of volatility, one single day’s trading range was GBP 1,730. This has made the futures market almost impossible for the physical trade to use as a hedging tool. The initial margins have risen to such levels that a lot of industry are struggling to maintain their hedges. People are now stepping back, resulting very light volumes and, as result, very big moves in the market.

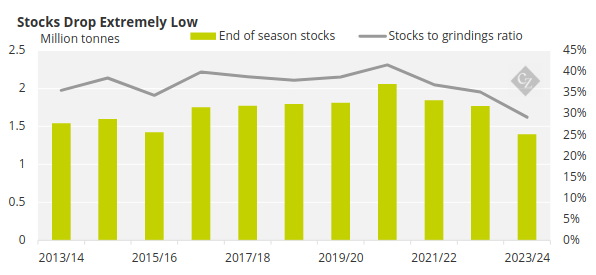

The market moved to the highs with an ICCO predicted deficit of 374,000 tonnes pushing the stock to consumption ratio to around 25%. This deficit was caused by collapse in the crops of Ivory Coast and Ghana.

Source: ICCO

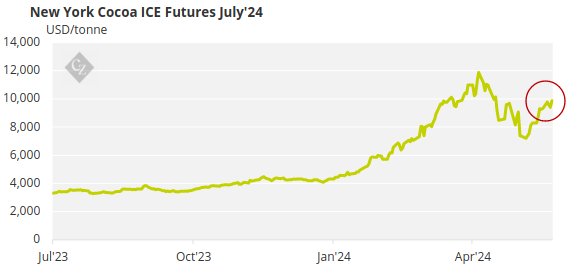

The prices seen in April are the highest prices recorded, with the previous high being in 1977 at USD 5,000. The market appeared over cooked and fell back to around GBP 6,000 in London and USD 7,000 in New York on very thin volumes. The direction of the market was driven by algorithms rather than fundamentals.

More recently the ICCO has upped its deficit number to 439,000 tonnes based on surprisingly good grind numbers in the importing countries. This has supported the market back up to over GBP 7,800 in London and nearly USD 10,000 in New York.

Cocoa Stocks Dwindle

The initial price hike came because of the collapse in the West African crops because of weather conditions, disease (Cocoa Swollen Shoot Virus), illegal gold mining in Ghana and tree age in West Africa.

El Nino was also impacting the Ecuador crop, with cocoa users extending cover and desperately trying to keep pace with the surging market. The mid crops in Ivory Coast and Ghana have not been as productive as many had hoped.

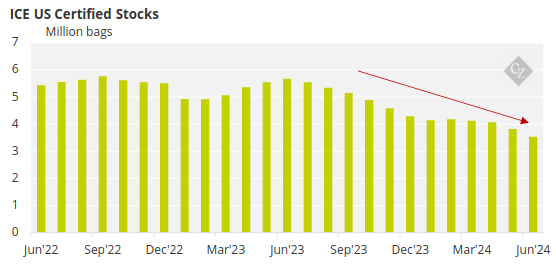

Global stocks have dwindled with a good indicator being that ICE monitored cocoa inventories held in US have fallen to three-year lows.

Source: ICE

Five Influencing Factors

In the short term the whole sector is in a unique environment of extreme volatility with high initial margins, making physical trade very challenging exactly at the time when cocoa users need and want to contract physical volumes.

A series of indicators will be crucial to monitor for an indication of price direction. In our upcoming articles, we will explore these issues in greater detail. They include:

1. EUDR

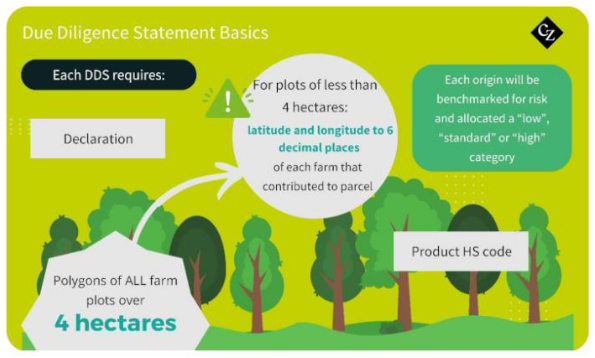

The exhausted cocoa industry is grappling with the European Union Deforestation Regulation (EUDR), which are set to enter into application on December 30, 2024 (barring any delays). This will require any cocoa crossing the EU customs border to be traceable to farm plot and compliant to the criteria of the regulation.

Read our article What EUDR Means for Cocoa to find out more.

2. Smuggling Activity

A clear understanding of the level of smuggling from Ivory Coast and Ghana during the 2023/24 crop is essential to understand the tree crop versus the arrivals at port/exports which might lead a correction in the assessed supply deficit. Next month, we’ll explore this issue in greater depth

3. Weather

The industry is watching the weather, particularly in West Africa, and its impact on the crop development for the 2024/25 crop. Another material deficit during the next crop would undoubtedly stimulate more buying.

4. Farm Gate Prices

The Ivory Coast and Ghana farm gate price announcement in early October will also influence participants’ thoughts on the direction of the market. Ivory Coast and Ghana have had to roll significant level of sales from the 2023/24 crop to the 2024/25 crop at low levels fixed before the price rally. Any 2024/25 sales were made a year forward — well before the highs on a backwardated market. This leads us to believe that a big farm gate price increase will be challenging.

The price was increased in both origins from around USD 1,550 for the main crop to USD 2,450 for the mid-crop. This level should at least be maintained for the 2024/25 main crop. This is less than half what the free-market origin farmers are receiving.

5. Grind Figures

The second quarter grind figures are also keenly awaited to see if demand is slowing. The complexity will be to assess whether the grind is affected by lower demand or lack of access to beans to grind.

These criteria include no risk of deforestation or illegal growing according to the land of production. This can encompass a range of issues, from land rights to labour rights, human rights, indigenous people, tax and corruption.

There are question marks over whether the supply chain will be able to prove compliance to EUDR for the entire volume required for Europe in time bearing in mind the due diligence needs to have been completed by the 2024/25 main crop in October.

It would be very risky to assume that there will be a delay in the regulation start date. Even if the regulation is pushed back, this won’t be announced until September/October, at which point it would be too late to start due diligence activities if it is not delayed.

So, the final big question to confront the industry is, what influence will EUDR have on price over and above the existing sensational market?