Insight Focus

- Several trade houses have been positioning aggressively in soybean oil futures.

- Soybean oil spreads remain firm.

- The trade may have divergent views on oil demand.

“When the elephants fight the ants suffer.” African proverb.

Quick update on the elephant battle in the CME’s soybean oil pit (virtual) and the implications for soybean oil spreads and flat price.

Cargill Inc. returned to the market to merchandise oil via the CME two days in a row this week, never a good sign for demand or the value of physical soybean oil (“values must be trading below delivery equivalent,” observers – and more importantly consumers – will say, “otherwise Cargill would not be so aggressive in filling the delivery window with receipts.”). I know I as a domestic vegetable oil trader would NOT pay Cargill above delivery equivalent given their actions; that is an easy negotiating position.

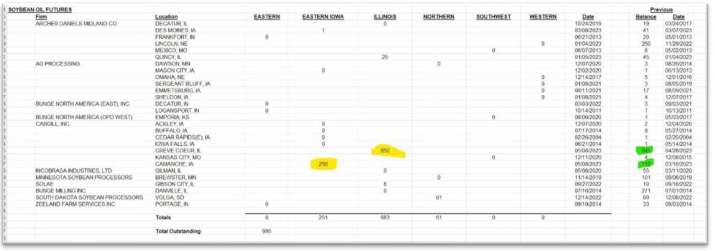

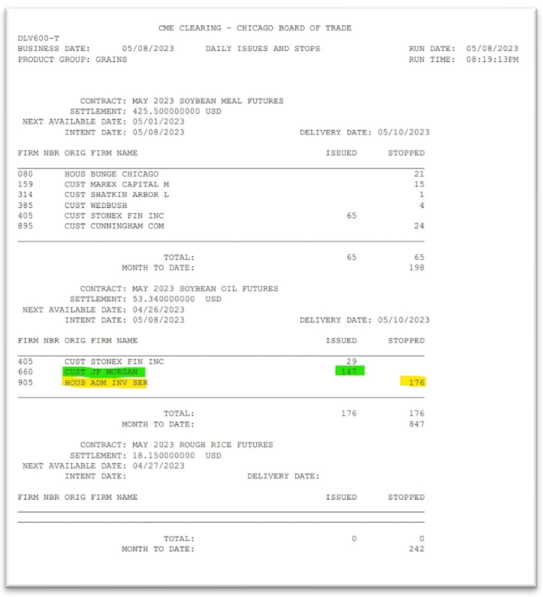

Two nights ago it was this, yellow highlight (prior outstanding receipts in far right hand green highlight):

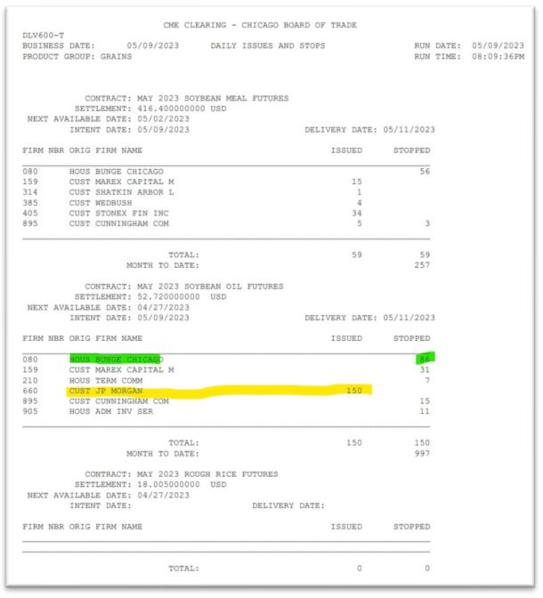

Last night it was this (prior outstanding receipts in far right hand green highlight):

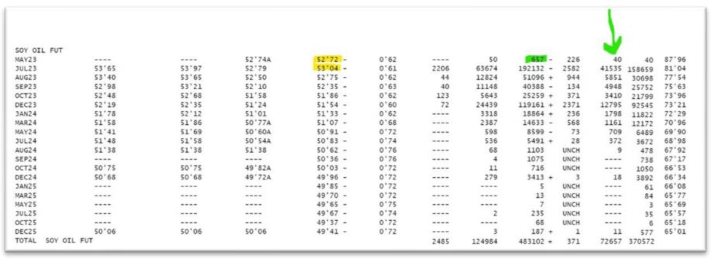

So Cargill is saying it loud and proud: the physical market (and our customers) does not want this soybean oil so we will give it to the exchange and let them deliver it to their customers! I am head scratching here in Omaha and not getting the strategy especially when Cargill, for my purposes, is breaking one of the cardinal rules of “delivery” commodity trading: do not give your competitors control over your delivery facility and inventory unless you get paid to do that. And Cargill is not getting paid to do that as they are delivering into a carrying charge market (yellow highlights, contango for you Houstonians) so the stopper of these receipts and holder of these receipts will get paid to do what they do, i.e. buy May at a discount to July, earn the carry, and have a fairly cheap embedded call on any upside in basis as a function of demand (plus the ability to twist the knife with Cargill’s traders).

And there are 657 May futures contracts still to be reconciled (green highlight) where last year there were only 40 contracts still to be reconciled (green arrow) so there is likely more Cargill delivery action ahead.

I think the soybean oil trade desk at ADM disagrees with Cargill’s view of markets as they appear happy to take the Cargill inventory. Two nights ago they took the full complement of Cargill’s strategy:

Then last night the Bunge soybean oil trade desk joined the ADM team and took some of the Cargill inventory as well (Louis Dreyfus showed up for a few cars as well):

Cargill’s activity should discourage the bulls and the bullspreaders. To repeat myself, expanding inventory in the delivery window is never good for the bulls nor the bull spreads. Why? Is there any reason to buy a commodity in the physical or futures market when you can see plenty of it sitting in the delivery window? In a word, “No”!

So the nearby spreads should weaken in recognition of that new information, but they have not. See the charts on the next slide: Chart A, July 2023 v December 2023 and Chart B, December 2023 v July 2024.

Chart A should feature a complete breakdown as all the longs in the July contract are 20-40 days away from having to either liquidate that position or face a near guarantee of taking delivery of receipts (given all of Cargill’s delivery actions here against the May contract). It is this chart (strong seasonality) that most investors who need high liquidity (open interest) watch if they are to trade spreads. Commercials as well. It is not breaking down today, but let’s keep watching. If it begins to rally sharply this close to July delivery something is up and ADM (and now Bunge and to a certain extent Louis Dreyfus) sees it.

Chart B is a spread that reflects the reality of new crop US soybean oil supply in the second half of the year the versus the new crop position for Brazilian and Argentine supply in 2024. Like the spread in Chart A, it is not breaking down; unlike the spread in Chart A, the spread is rallying and now trading above the important 50% level (green arrows) of the spread’s high and low (I am not a technical trader, at all, but as regular readers know I like to apply the Fibonacci analysis against calendar spreads).

Chart A

Source: Refinitiv Eikon

Chart B

Source: Refinitiv Eikon

The bullish factors for this spread include the following (in order of importance):

- The ceo of ADM waxed eloquent about second half 2023 demand for vegetable oil feed stock during his earnings call two weeks ago

- The ceo of Bunge waxed eloquent (ADM * 2) about developments in their forward sales of soybean oil to the RD industry over the last two weeks in his call one week ago

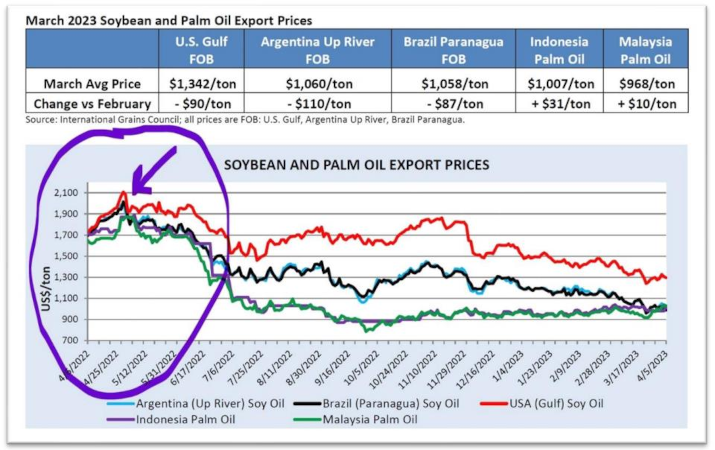

- Palm has bottomed and the wide carries have disappeared (see chart below)

- There is (are) a strong commercial for Cargill’s deliveries

- There is a war in Europe near significant rapeseed and sunflower production

Demand markets are the best bull markets; we are in a demand market from the “US-renewable-diesel-industry-needing-feedstock” perspective. To repeat myself, what shifts sentiment that is currently bearish for vegetables oils, meals, and grains due excellent US planting and emergence weather, an above average planting pace for US corn and soybeans, Brazilian production of soybeans and corn swamping domestic logistical and warehousing capacity that necessarily forces their production on world markets at any price, and a declining CRB index due declining energy prices: the RD industry on the verge of overwhelming the feedstock supply and the beginning phases of RD 2.0. Cargill does not see it; maybe ADM (BG too) does.

Remember where we were a year ago at peak RD 1.0: