Insight Focus

- Sugar prices have been high for all of 2023.

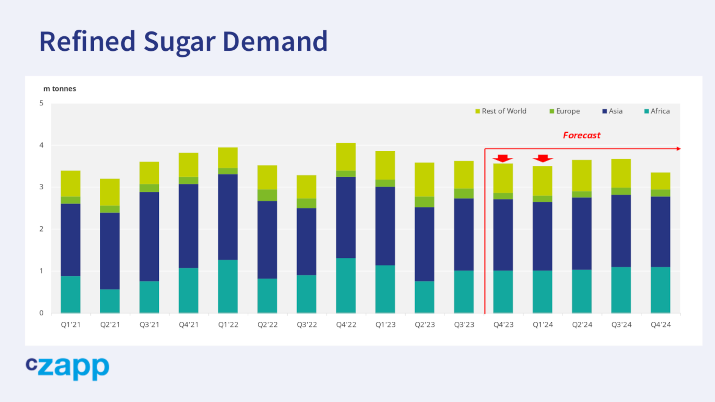

- We are yet to see reduced sugar demand in the face of high prices.

- Demand destruction might come from Brazil’s inability to export fast enough.

Click here for the full video!

Hi, it’s Stephen from Czapp and welcome to another video update on the state of the sugar market. I know it says October, I know it’s the middle of November. Sorry for being late.

I’m also working on building CZ’s new consulting business alongside my usual analysis work, which is keeping me busy.

Speaking of which, if you’d like help understanding new commodity markets or supply chains, or diversifying your revenues by expanding into new products, or if you’re interested in understanding how you can decarbonize in a cost-effective way, please message me for a chat on how our consulting team can help.

Enough of that. Onto sugar.

Prices have been in the news recently, with world market futures hitting 12-year highs just in time for Halloween, which is a journalist’s dream. Welcome to the party, guys. Better late than never.

Yet in many countries, even if the sugar price is high, people will buy it anyway. It’s wrong to look at the price of sugar in isolation. Very few people buy foods to eat one at a time.

They buy meals, which is to say that they buy combinations of foods.

When all food prices are increasing, as they have in 2023, then this means they make relative decisions, not absolute decisions.

Here’s how it looks on Google Trends.

Lots to unpack here.

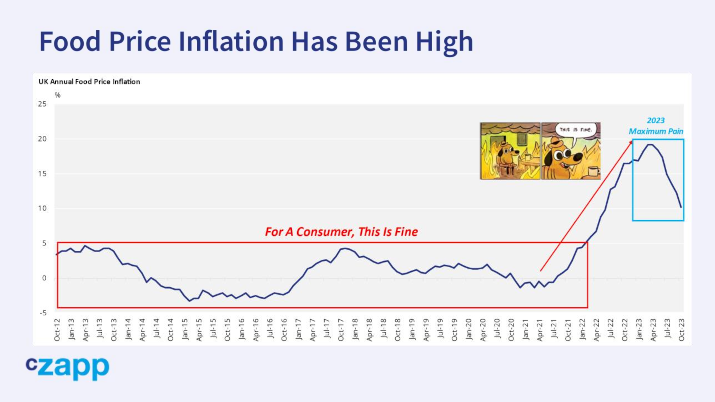

These are worldwide Google searches for the last 20 years. They show food cost in blue, which peaked in April 2022, which was when in the UK anyway food price inflation broke out of its multi-year sideways range, and has remained high ever since.

It also shows sugar cost in red, and the number of searches relative to each other. Searches for food cost outstrip those for sugar by 8 to 1.

We all fixate on sugar prices because we’re interested in sugar. But for the average consumer, it’s not terribly important; it’s the cost of the basket that matters. This probably means that in 2023 many people around the world have eaten slightly less expensive foods like meat and might have increased consumption of cheaper carbohydrates despite the high price.

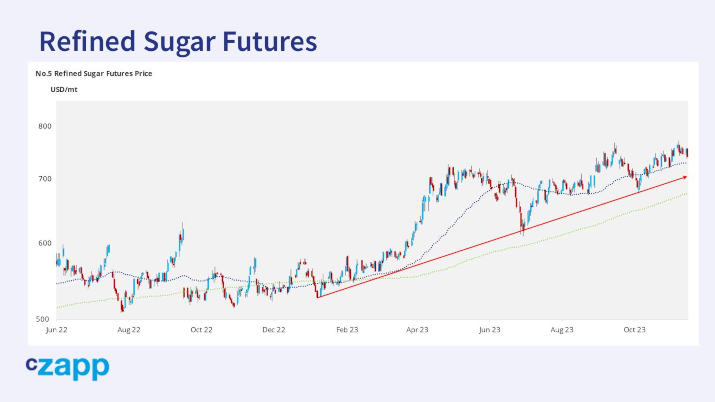

Certainly we’ve not yet seen signs of sugar demand destruction in the market. The raw sugar and white sugar futures have both been strong in recent weeks and the charge has been led by refined sugar futures.

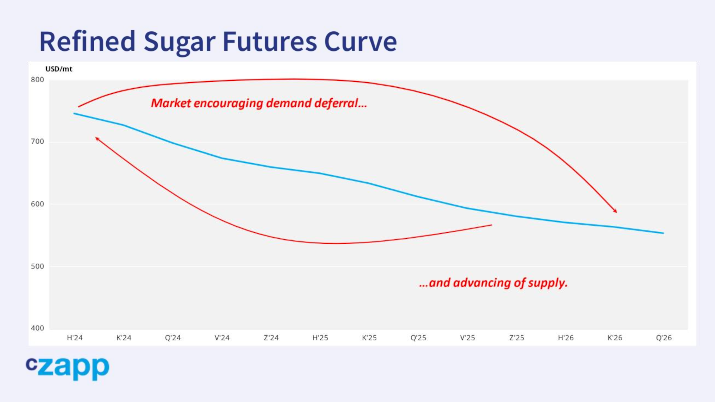

We know there’s a problem with sugar supply in the coming months. There’s not enough sugar to go around so someone somewhere will have to go without. The market is trying to trade to a price where this happens. It’s just that no-one seems very keen on going without sugar.

This means prices remain high, not just the flat price, but the white sugar spreads too. The futures curve for 2024 is aggressively backwardated. This is a bull market. But we need to be careful.

We know that previous bull markets often have rapid declines; this has been the longest sustained rally I can recall without a major price dip. The biggest drawdown so far has been 17%, not including expiry gaps.

We also need to watch the amount of time we’ve spent near the highs. Everyone fixates on price, especially journalists. But time spent at a high price is equally important. If prices spike higher momentarily, this is irrelevant for most people. If high prices are sustained for months, people are unable to ignore them. They run down their stocks but then have to come to market.

Refined sugar futures have only been above $600/mt twice in the past 40 years; once in the 2009-11 bull market and very briefly in the 2015 bull market. They’ve now been above this level for most of 2023. Perhaps the fact that prices have been high for months means that demand destruction is quietly happening in the background.

We won’t know ahead of time. Analyzing sugar consumption is extremely difficult and no-one does it well, to my knowledge. Major white sugar buyers to watch include China, Sudan and Ethiopia.

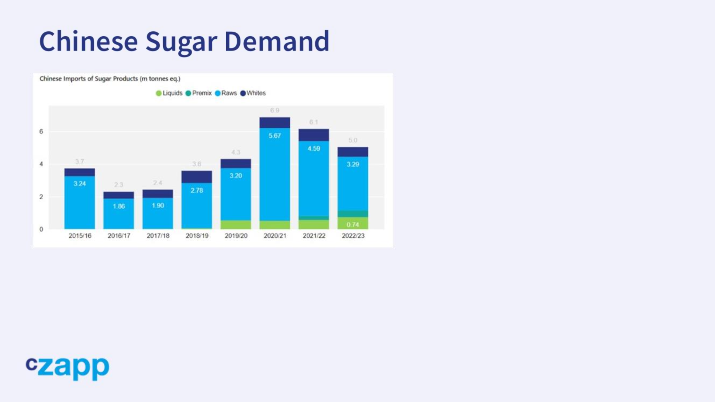

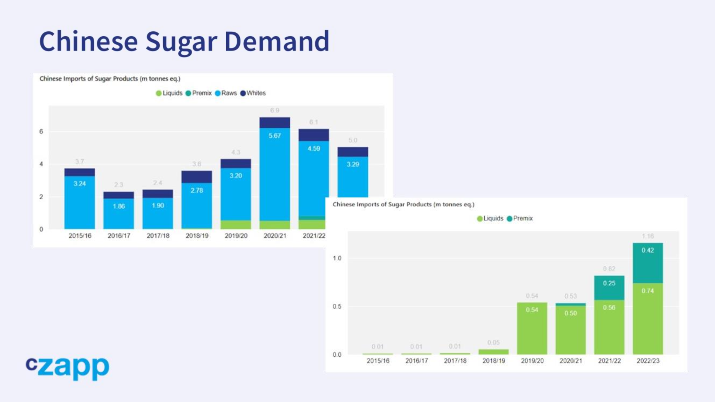

China is one of the largest sugar importers in the world.

It normally imports raw sugar, but this year has been taking a lot of Thai and Indian white sugar to make into liquid sugar or premix powders in recent years.

These pay a lower duty rate and so are cheaper than imported raw sugar or white sugar for consumption.

But Thailand and India both face poor cane crops this year, meaning they won’t have so much white sugar to supply to China. Does this flow stop, or can Chinese importers find other sources of white sugar in sufficient volumes? Will raw sugar prices above 28c or white sugar prices above $750/mt be enough to stop this flow?

Meanwhile, will Sudan and Ethiopia be able to continue to import sugar on a large scale given conflict and US dollar shortages? We’ll only find out in a few months. Until then, watch how the futures markets behave very closely.

If the white sugar market sounds messy, wait until I tell you about the raw sugar market.

If you just look at the futures, it all looks quite orderly. The market is still just about in its 2023 range – which has been pretty wide between 28c and 22c. In recent weeks it’s held the 50-day moving average nicely, and has been making a succession of higher lows, perhaps indicating that consumer buying targets have been slowly rising.

We’ve just seen how this has happened in China. The government has paid up for food security, and this payment has flowed through to the sugar futures market. It’s an echo of the consumption conundrum in the whites – who will pay up next? Or is there anyone out there who won’t pay 28c and so goes without?

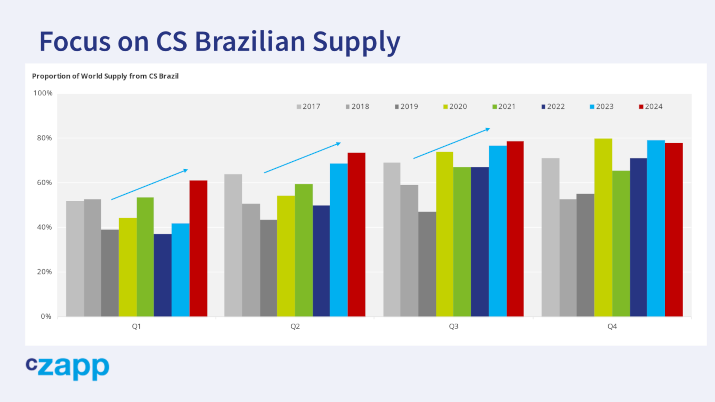

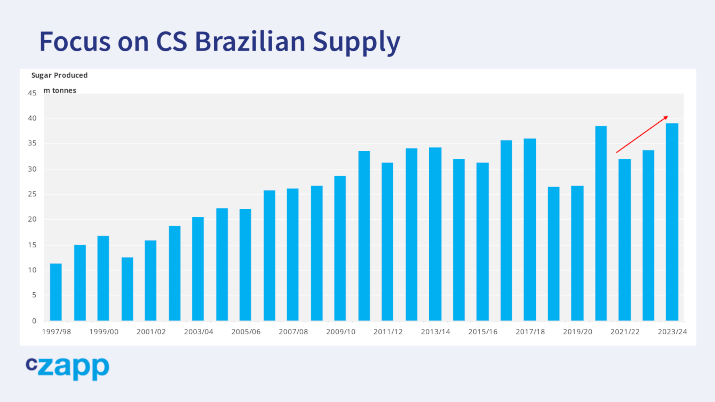

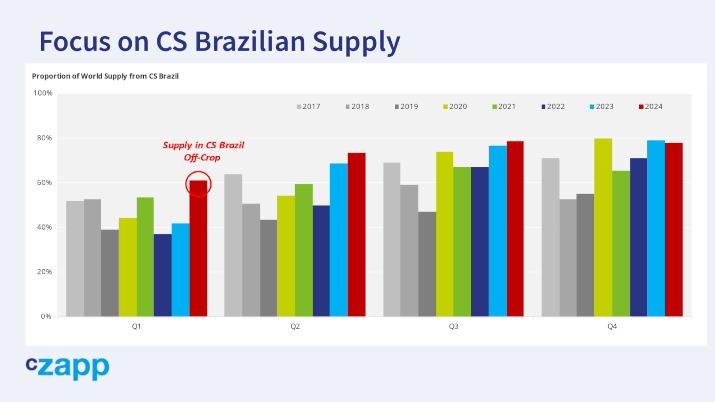

If we’re thinking about raws then we need to think about Centre-South Brazil, and this is where the market is messy. I’ve mentioned in the past how utterly dependent the world is on Brazil for sugar.

This dependence has been getting worse as many countries around the world struggle with adverse weather, which has hit cane and beet crops.

Not so in Brazil, it’s the opposite problem. The cane industry here will probably make a record amount of sugar in the season that’s just finishing; close to 40m tonnes.

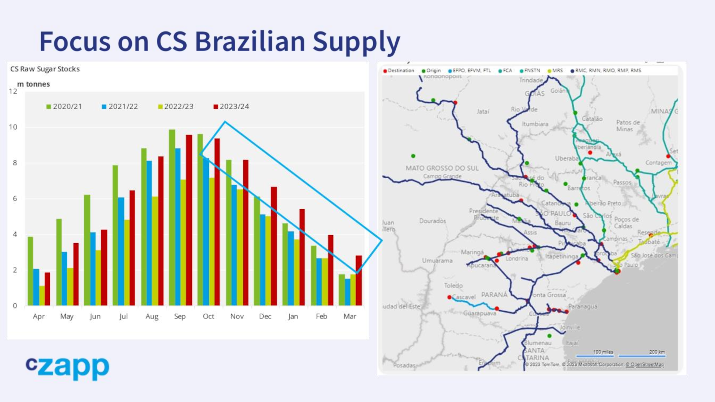

The major problem is getting this sugar from inland, where the cane is grown and the sugar is made, to the ports so it can be exported.

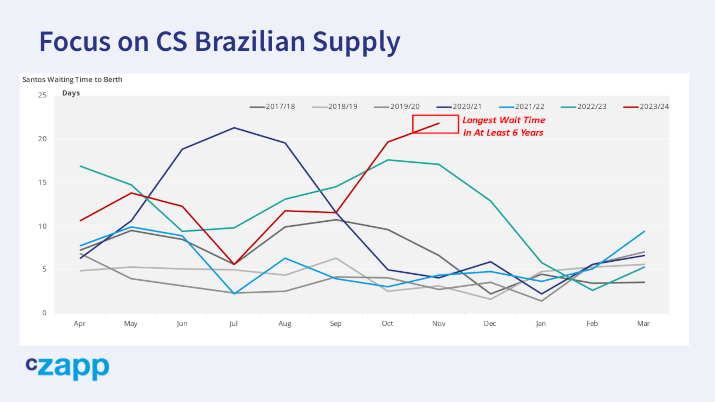

Recent rains at the ports have delayed ship loading, there are long vessel queues. Port warehouses are full and the sugar backlog has flowed back up-country. Mill warehouses are also full, yet no-one wants to make less sugar given the high prices, and low prices for ethanol.

So mills are aggressively discounting their prices for anyone who can move the sugar from their warehouses to the port. The problem is no-one has port capacity so there are few inland buyers. This means Centre-South Brazil will still be looking to export huge amounts of sugar during the traditional off-crop period in December to April.

Old crop sugar will be carried into the new crop because there isn’t the logistics capacity to get the stuff out of the country. And don’t forget Brazil’s huge corn and soy harvests will begin early next year, meaning sugar loadings at the port will be squeezed further.

It’s a bit of a mess – sugar prices are high, no-one wants to forgo sugar consumption yet the world’s largest sugar supplier can’t get the stuff out fast enough, to the extent that it’s choking on its own supply. In other words, if sugar prices can’t force demand destruction somewhere, Brazil’s inability to export sugar quickly might do the job instead.

Until we get that demand destruction, prices will remain high. And given low global sugar stocks, any further problems that materialize will probably push prices higher. The big unknown is whether we are already getting demand destruction at 2023’s high prices. We’ll only get a clue from the price action itself – watch how futures prices and traded volumes evolve towards year-end. It’ll set the tone for 2024.

We’re approaching the point where raw sugar will either have to break above 28c and make a push for 30c, which looks like the most likely outcome…

… or break below the 50-day moving average, leaving the path open to the 200-day moving average at 25c, which would be a pretty big clue that demand destruction has happened and the sugar shortage has resolved for the time being

No matter what price risk you’re trying to manage in the market, I wish you well.

Thanks for watching and we’ll speak next time.