Insight Focus

Trade disputes are ways for governments to influence the trade of goods. We have entered a period of huge geopolitical uncertainty and volatility. Agricultural commodities will ride the storms, even if trade flows have to change.

The downturn of financial markets following US President Trump’s tariff announcement on April 2, combined with the political scrambling to resolve them by world leaders, demonstrates the real fear of long-term implications for manufactured goods. This fear should not impact agricultural commodities to the same degree.

As we have previously discussed, political disruption is not likely to change the long-term outlook for prices. Trade flows, on the other hand, could change, while a global economic slowdown could lead to some demand erosion.

Tariffs and Trade Wars

A tariff is simply a tax or duty to be paid on a particular class of imports or exports. The idea is that it either raises revenue in tax receipts or disrupts the trade of relevant products to the economic advantage of the government imposing the tariffs.

The new President of the US, Donald Trump, is using these very tools to tax imports with a view to rebalancing the trade flows into the US, to the advantage of the US economy.

However, where agricultural commodities and products are concerned, the US is a major exporter, not a big importer.

The largest importer of agricultural commodities and products is China, with whom the US appears to be initiating a full-scale trade war.

There are many other significant buyers of US agricultural commodities and products so far in 2024/25 who are equally very dissatisfied with the US Trade War also directed towards them:

Billions of dollars have since been wiped from global financial markets and, as a result, the US dollar has also been weakening.

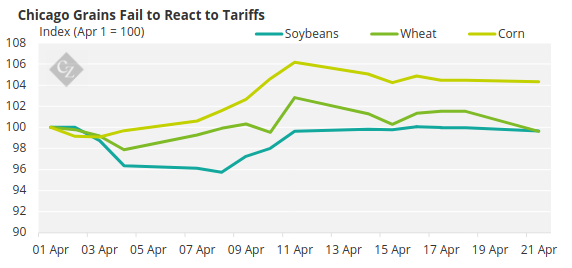

Agricultural commodity prices have fallen, but have weathered the storm better, although they continue to hang on every tariff-related news report.

The US vs China

Trump’s trade war has specifically targeted China, and in the case of soybeans, we can observe a clear example of the potential consequences. Interestingly, this is detrimental to the US farmer in the short term.

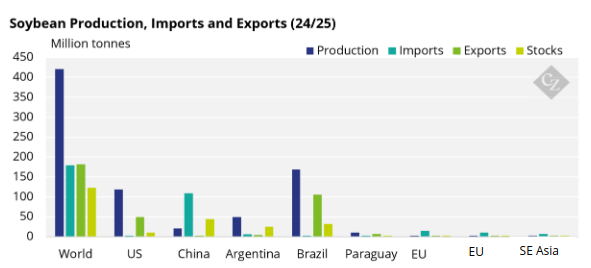

Using figures from the latest USDA WASDE report below, China is the largest importer by some margin. While the US is the second largest producer and exporter, behind Brazil.

The complication here is that China has imposed reciprocal tariffs on the US, which means that both tariff rates, now exceeding 100%, effectively create trade barriers. These high taxes have reached prohibitive levels, resulting in no trade unless exemptions are eventually granted.

China demands respect and seems unwilling to seek negotiations with the Trump administration. It remains uncertain who will back down first.

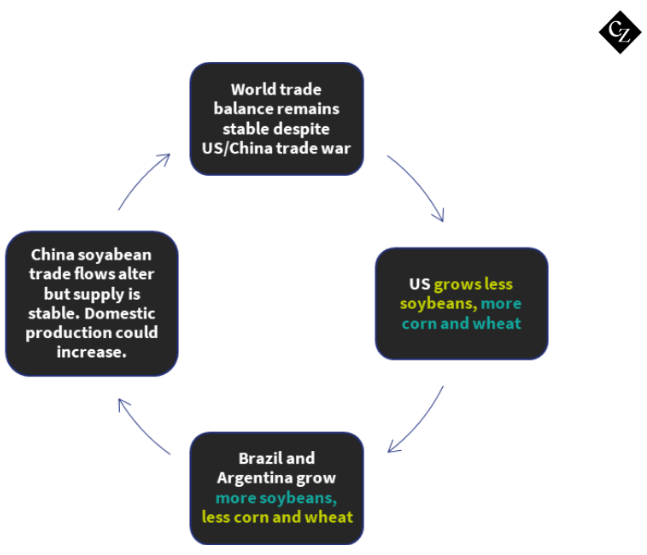

For soybeans, the following scenario is possible, particularly if the trade war persists for an extended period, or even years:

- China stops buying US soybeans as the taxes make them prohibitively expensive.

- China increases buying from Brazil and others.

- There is potential for China to draw down on domestic stocks but not for any length of time, as it will affect its key food security strategy.

- China could encourage greater domestic production, currently a mere 20 million tonnes.

- The US will look to increase sales to other markets, such as the EU or Southeast Asia.

- The Trump administration is considering an increase in the use of biofuels. This would use US soyabeans, domestically reducing the need for the export market.

- A price differential could lead to US sales to Brazil and Argentina, which in turn could either export more of their own soyabeans to China or up their crushing for export.

Given the small number of materially significant players in the global soybean market (China, the US, Brazil and Argentina), a total collapse in trade long-term between the US and China could cause interesting market adaptations.

This would be a development over years not months, due to the lengthy planning and growing timescales.

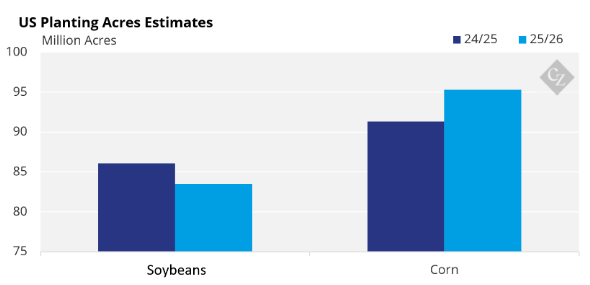

However, the most recent USDA planting figures do already point to this scenario:

Source: USDA

The Simple World of Commodities

- In essence, agricultural commodities feed people, while agriculture is the primary industry of the world. Without it we do not survive, so it will continue.

- Trade wars can take whatever route the politicians wish, but ultimately no politician will knowingly starve their own people, so the market will adapt.

- Trade flows and relationships may change with the global political map, but farmers will grow crops that people need to buy and provide the best margin.

- The world of agriculture always finds a way to prevail at affordable levels, regardless of politics and trade wars.