- Molasses demand has been quite robust in recent months.

- The beet molasses market has eyes fixed on the EU and Russia, with slicing commencing soon.

- For cane molasses, it’s the off season in the Northern Hemisphere, meaning Indonesia and Australia are under pressure to provide.

Breathing Room

We’re at a crossover point in the cane and beet molasses markets, meaning both are somewhat quiet at the moment.

The beet molasses market has all eyes fixed on the new crops in the EU and Russia, with their slicing seasons commencing in late August and September respectively.

EU crop yields should be aligned with the five-year average at 73.6 mt/ha. Cold weather in France and Belgium in April meant some beet had to be replanted. Yields should remain unaffected though, even if the planted area is slightly below expectations.

The Egyptian beet market has continued to sell large quantities for export, with around 270k tonnes now committed. Its total availability should be over 300k tonnes, meaning the majority’s now been committed and priced for export.

For cane molasses, it’s the off crop in the Northern Hemisphere, meaning the main supply is now concentrated in Indonesia and Australia. We should therefore have a quiet summer and will need to wait a few more months before we can make any predictions for the new cane crops.

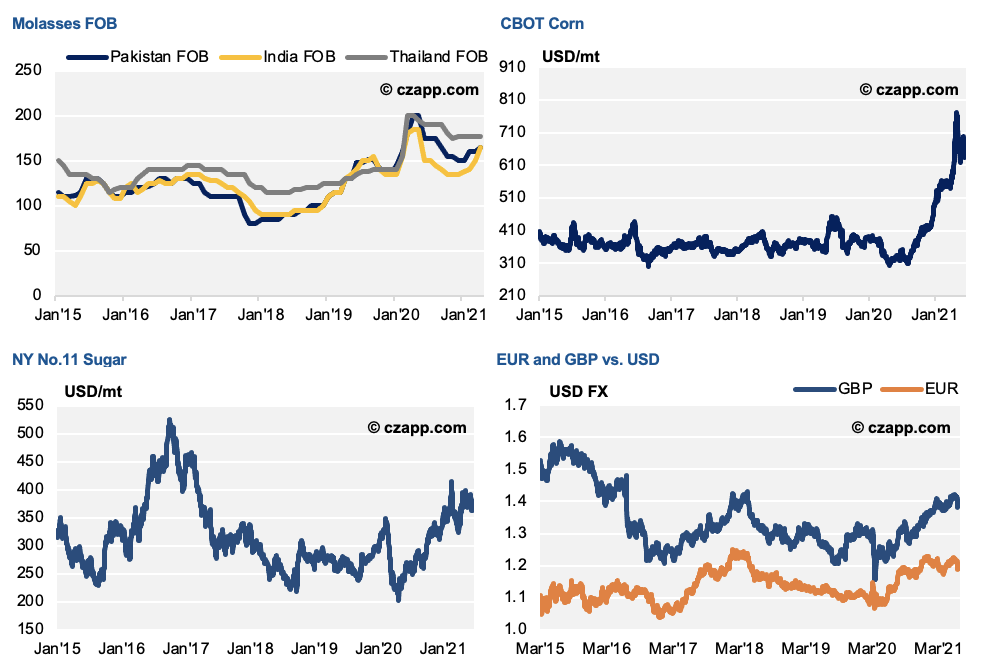

Demand for molasses has been quite robust in recent months, reflecting the higher prices for the main competing commodities; in feed markets, higher corn/wheat/barley prices, and in fermentation markets, the raw sugar price is hovering around 17c/lb (374 USD/mt). In recent years, molasses prices have been more of an outlier, trading at higher equivalent levels.

Explainers You Might Be Interested In…

- Czapp Explains: Molasses