A Quick Recap

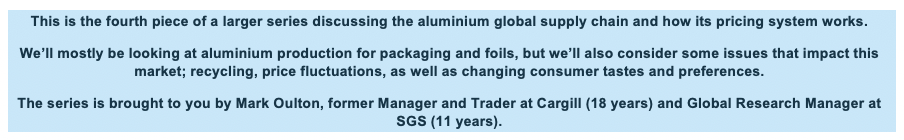

In our previous report, we described the history of the development of the aluminium beverage can and associated technology up to the point where the base part of a two-piece can had been manufactured. We showed how the base had a flange applied to the neck, ready to receive the lid. We also showed the evolution of the opening mechanism, which today has evolved into the almost universal ‘stay tab’.

Filling the Can

The unprepared lids, called ‘shells’, are stamped out from aluminium alloy coil and transferred to a conversion press that produces the prepared lids (also called ‘ends’). The press adds the integral rivet and scores the drinking opening before moving to form the tabs in a dye from a separate strip of aluminium. The two complete pieces (base and lids) are ready for the beverage manufacturer to add the liquid and seal (seam) the lid ready for shipping. The cans were already normally decorated during the base-making process (not shown in the diagram below), along with the addition of any required QR/Bar codes or other symbols such as ‘recyclable’.

As these reports are about the role of aluminium in beverages, we haven’t described the complex beverage filling process or, at this stage, discussed which beverages are popular now or will be in the future, although that will certainly affect the demand for different can sizes.

It’s fair to say that the technology is as dynamic and challenging as the manufacturing of the can. That’s without the art and science of choosing the most desirable beverages…

The most sophisticated canning lines can work up to 125,000 cans per hour (cph). Although the cans are already decorated at this stage, some companies have experimented with a further outer sleeve or jacket for additional promotion of the product. The craft brewing industry sometimes uses plain cans and the adds a sticker which gives greater flexibility for small batch runs.

Changing the Specifications

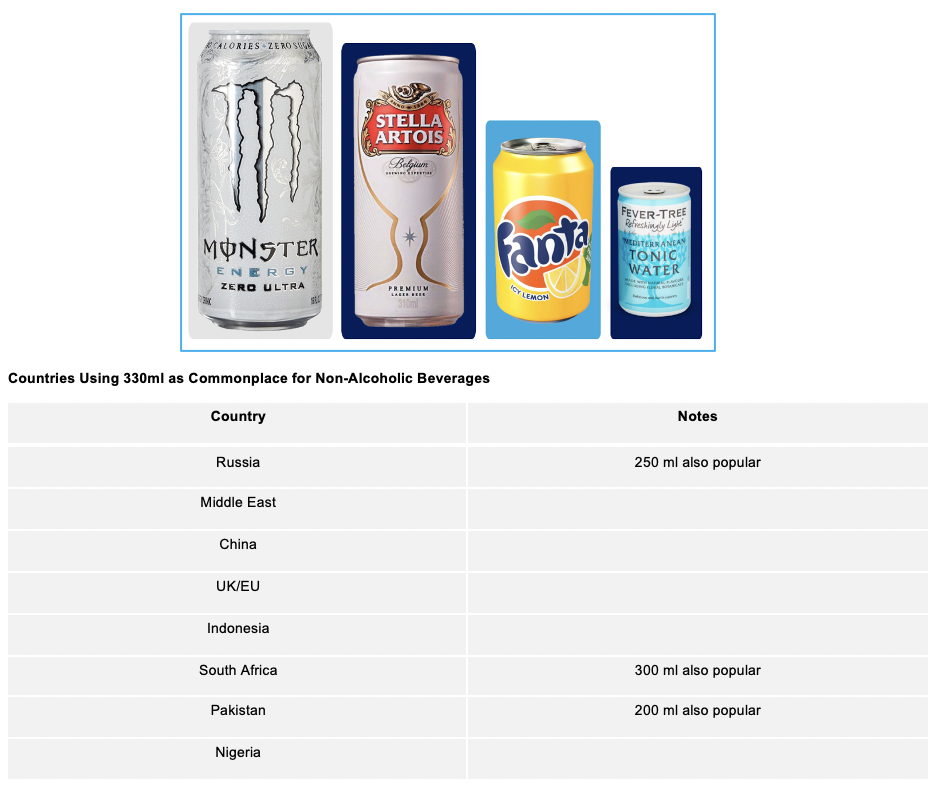

The standard beverage can size worldwide is 330ml. This is derived as the nearest rounded metric equivalent to the US 12 fluid ounce, 355 ml configuration.

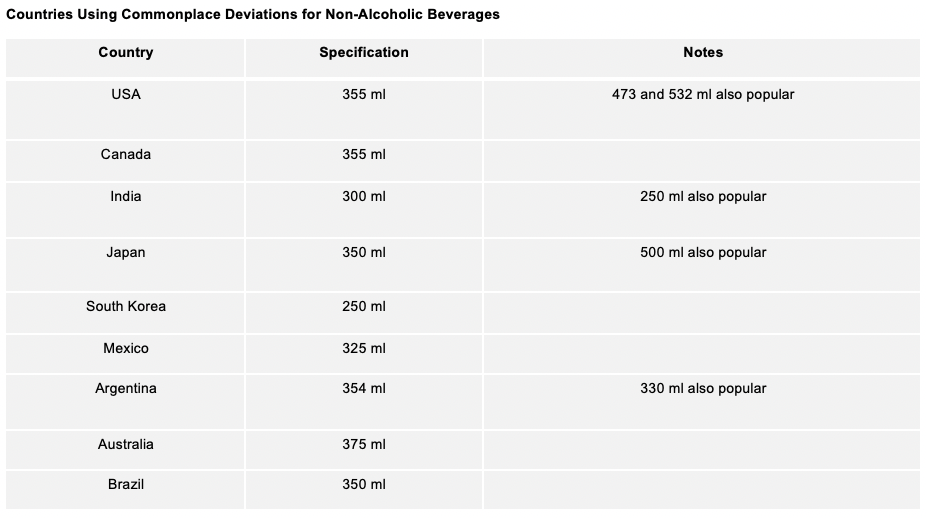

In today’s market, there have been significant deviations from this standard volume based on consumer research, market segmentation, the type of beverage and the desired height and diameter of the can.

There are some useful rules of thumb, however. Beer and cider tend to come in larger cans than soft drinks. Mixer drinks to be paired with alcohol tend to be smaller, as do canned wines. Energy drinks tend to come in 250ml or 500ml cans; the larger ones strive to look ‘stronger’ on the shelf display. It’s very important for marketers to know the current size preferences in a country and also to discover what could be tempting as a new size offer. This could sometimes be as important as the taste of the beverage.

The desired height and diameter of the can varies significantly giving rise to a range of terminology.

The variety of shapes and sizes for alcoholic beverages is also extensive, especially in respect of beer. Some of the sizes are shaped by history.

In the UK and the Republic of Ireland, 568ml cans of beer and cider are often used, as this is the equivalent to the traditional pint of ale (although 440ml is also used).

In Europe, 500ml of beer, and in some countries (e.g. Germany and Russia), a one litre ‘king’ has proven popular, as has its American cousin, the 32 fl oz (946 ml) ‘crowler’. The US also has 12 fl oz, (355 ml), 16 fl oz (473 ml) ‘tallboys’ or ‘pounders’, 18 fl oz (532 ml) and the slim 19.2 fl oz (568 ml) ‘stovepipe’.

The Role of Government

For marketers and production planners, it is very important to keep an eye on existing, and especially pending, legislation. The trend towards smaller can sizes is undoubtedly being driven by changes in consumer habits, but governments can also influence this. There has been an increase over the last ten years in sweetened beverage taxes (SBT). The intention is mostly to reduce the sugar content in the liquid, at whatever size of serving.

However, there have already been several cases where the beverage manufacturer has not been prepared to do this. Some are extremely sensitive to any changes in their proven, established or even secret formulas and know from many years of experience that changes to these can cause consumer switching or reduced sales. In this case, one possible strategy could be to maintain the sugar concentration but reduce the can size and try to maintain, or marginally increase, the price to offset the tax.

Similarly, returnable deposits may also have an impact on can sizes. If the refund is per can of any size, that favours miniaturisation. On the other hand, some countries pay a bigger refund on larger cans which weakens the incentive to go smaller. There will also be a hierarchy of which beverages are most suitable for can size reduction, depending on which beverages are included in the SBT, such as energy drinks or fruit juice with added sugar.

What’s Next?

Our next report will look at both manufacturing and consumer trends in detail, but here are a few clear ones:

Consumer

- The sports and energy drink market is growing rapidly.

- Consumers want smaller cans in order to reduce waste and increase convenience.

- The demand for mini cans is rising (150 ml).

- There is an increasing variety of beverages going into the cans, which may well require different can configurations such as tea, coffee and even water.

- Sleek cans are a big hit!

Manufacturer (with Consumer Research Where Applicable)

- The quest for a resealable aluminium top.

- Varying the colours on the tabs for easy identification.

- Improved aluminium bottles.

- Better information on recycling.

- Further efficiencies in the canning process from, for example, reduced thickness or reduction in trimming.

Other Opinions You May Be Interested In…

- NEW! Aluminium: The Basics You Need to Know

- Aluminium: A Closer Look at its Carbon Footprint

- Aluminium: The Anatomy of the Can