Recycling Rates

Total percentage recycling in the circular economy is likely to increase quickly in countries that have not extensively adapted to this technique but will slow down in countries that are already at high rates. The easiest part is recycling cans, tabs, foils from food containers, etc.

According to the European Aluminium Association, some countries have already achieved more than 95% can recyclability. This includes Belgium, Finland, Germany and Norway, with Malta and Romania below 40%. Other statistical sources suggest Japan is at 83%, the UK is at around 75% and the US is at 53%.

To reach higher rates for all aluminium in the food and beverage industry, further effort will be needed to extract from multi-layers of aluminium, plastic and adhesive, such as on retort pouches and coffee capsules. Although technically possible, the process is complex and expensive.

For this week’s quiz, there’s one country missing from the elite list with above 90% can recycling and it’s in joint first place with Germany. The answer is at the end and consider yourself an expert if you can answer this difficult question!

The Power of the Consumer

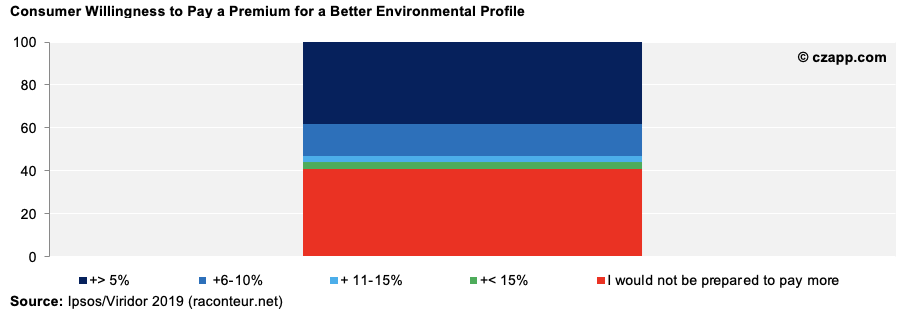

Consumers like the environmental aspects of aluminium and in general (for all packaging materials), 59% are willing to pay some sort of a premium for packaging better environmental and social credentials.

According to Fast-Moving Consumer Goods Guru (2020), 62% of consumers think packaging should be able to be recycled as many times as possible, which is good for the near infinite recycling capability of aluminium. Consumers also largely believe that it’s the responsibility of the packaging manufacturer and companies that sell the packaged good, followed by government and, lastly, the consumer themselves to make this happen.

Consumers also want better transparency, and, for this reason, we think there will be increased pressure for a labelling system that identifies ‘greener’ aluminium (i.e., using electricity in aluminium smelting from sources such as hydro, wind and solar, rather than oil-based systems which have a poor carbon footprint). Smelting companies are already gearing up to this transition, with Rusal’s ALLOW and Hydro’s Reduxa premium price brands serving as prime examples.

Aluminium Beverage Containers

Significant growth is likely in the overall soft beverage market, with aluminium benefiting by increased sales of canned water, milk, tea, coffee, wines, cocktails and fruit juice.

This will be offset by near stagnant growth in beer sales (beer cans tend to be larger), especially in western markets.

This dual effect will continue to see the percentage of the smaller can market (under 330ml, from 150ml to 250ml) increase because of their on-the-go convenience and healthier image. The sleek (tall and thin) configuration will also retain its newfound popularity. Bucking the trend will be the still large-sized energy and sports drinks.

We think the growth in resealable beverage containers will be as important to the industry as the invention of the non-detachable tab because of the reduced wastage of the product and the convenience.

Equally, the aluminium top/cap likely will gain from the plastic configuration to allow total recycling without separation. This development is still in its infancy, but in twenty years’ time, we may be asking ourselves why did didn’t always do it this way.

Aluminium Foils and Flexible Packaging

The future for aluminium foils is also bright, but perhaps less so than for cans.

On the plus side, the global growth in a convenience-based middle class wanting ready-to-heat and pre-prepared meals and takeaways favours the industry. Pouches and coffee capsules have become wildly popular too and will take market share from clunky old cans (steel or aluminium).

Although we remain very positive on this sector, there have been advances in alternatives made of paper and other materials (some of them compostable). It remains to be seen how much traction these new developments will achieve. The problems are not just in manufacturing this new packaging but also finding outlets for the discarded materials. The improvement in plastic recycling volumes always remains a threat in the background.

Technological Gains

Technology has an important role to play. Shaving a micron or two off aluminium wall thickness without compromising integrity is the holy grail for engineers. However, this is more difficult to do for sodas than beer as they are at higher pressure. For cans, there are still possibilities to improve design by better alloys, shapes, trimming, tab, and score line design, etc. It’s also likely that production speed both for beverages and pouches using better to fill technology are yet to be found.

Improvements are also likely in printing, with improved wet-on-wet processes and the introduction of fluorescent printing.

Aluminium Prices

In theory, lower aluminium ingot/billet prices should make cans (and foils) cheaper, but this wasn’t the case in 2020.

We’ve previously discussed the can shortages caused by both COVID-induced supply chain disruption and increased at-home consumption of canned beverages.

The ingot market has been in rapid decline since 2018 as a result of oversupply and sanctions. Post COVID-19, we should see a more direct relationship between the raw material ingots and beverage can prices. However, any can stock price increase should be modest because of new capacity coming online, such as Ball’s new Glendale and Pittston beverage can plants and Constellium’s recycling plant at Muscle Shoals. These are all based in the US and can produce sheets, tabs and coated end stock.

The World Internal Monetary Fund (IMF) thinks London Metal Exchange (LME) ingot prices will reach 2159 USD/mt by 2024 and the World Bank to 2200 USD/mt in the next ten years. That is something like stability after a wild ride.

In the recycling market, more material is also likely to come on-stream after the precipitous drop in 2020 of the benchmark UBC (Used Beverage Can) market, such as in the US from 75 c/lb to at one point around 50 c/lb making deliveries to the recycling companies uneconomical.

Conclusion

The future for the use of aluminium in the food and beverage industry is bright. With a metal that’s theoretically almost indefinitely recyclable, and with the improvement in green energy production of ingots, the environmental story is constantly improving.

Oh, and the answer to the quiz was Brazil. Brazil recycles over 98% of the beverage cans it consumes. They even have a National Aluminium Recycling Day, whereby thousands of volunteer litter pickers get involved to help clean the streets.

Other Opinions You May Be Interested In…